Many sectors have not seen much pick-up in demand from the week previous. As retail markets work through remnants of Christmas stocks, there is hope some demand creation could be seen soon. Export trade has seen some level of disruptions from the additional checks, though trade is continuing to Ireland and the Canary Islands. Over the last few months, more fish and chip shops have signed up to popular takeaway websites in an attempt to capture additional footfall during the lockdown. Though demand is quiet in January, such steps could help businesses reach new customers.

Click here for this week’s Potato Weekly

Click here to download this week’s price tables

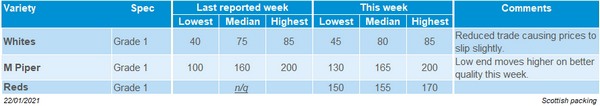

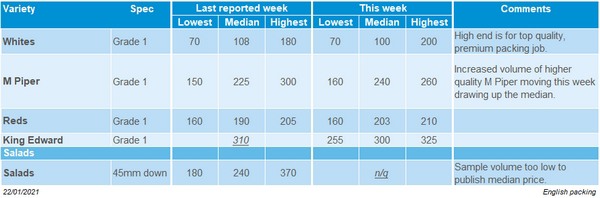

Packing

Retail packing markets have seen a steady level of demand, with some supermarkets still continuing on Christmas stock for some products. Supermarket demand has been strong during previous lockdowns, with the closure of food service outlets. Demand on the whole for packing whites has been mainly covered on a contracted basis. Maris Piper has traded well, with demand persisting especially for top quality material. Salad markets have seen quiet demand following a relatively busy run-up to Christmas. The next demand push could come once the weather warms and we move closer to Easter. Demand for Reds continues, with supply relatively hard to come by at present. This is also seen for King Edwards, which have been able to achieve a high premium because of low availability.

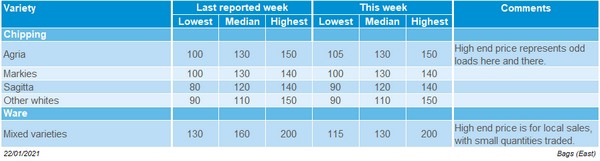

England

Click on images to enlarge them

Scotland

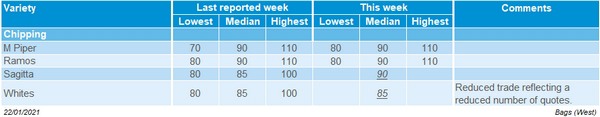

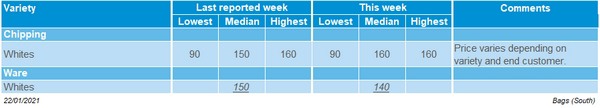

Bags

Prices have generally remained stable this week. Traded volumes are said to be fairly low though. Many fish and chip shops are opening for reduced hours due to lower footfall. January is a notoriously quiet month in the bag trade, and there is hope that trade will pick up in the coming weeks. Wholesale trade is also relatively slow, with most of the catering sector closed. Trade with farm shops is variable. Some reports suggested good footfall, others recording reduced sales with people less confident about being out of home.

East

West

South

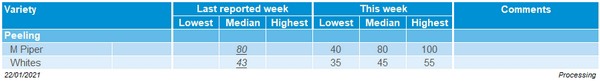

Processing

Processing markets have been affected by school closures, with demand only coming from top-up volumes for contracts. However, some colleges and universities are providing hot meals for key workers and students. Demand for Maris Piper continues, especially for ready meals and other processed products. There are reports of more material being available for markets.

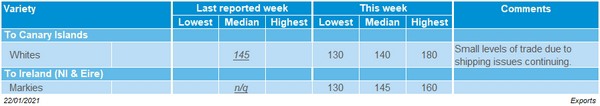

Exports

Export material to Ireland is beginning to increase, as ports and exporters get to grips with documentation. Exports to the Canary Islands continue, with the process better than the first week of January. However, shipping is proving troublesome with boats arriving simultaneously.

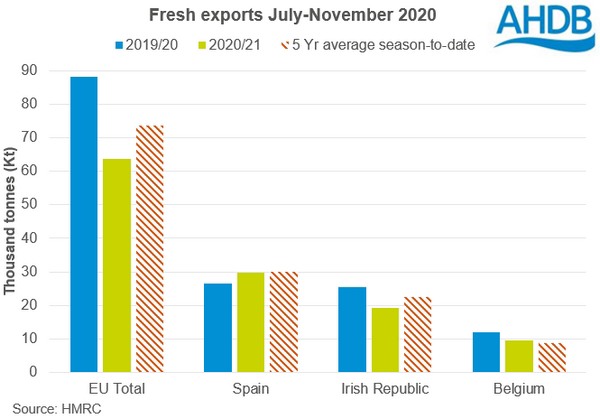

November trade round-up: Potatoes

Fresh exports down year-on-year this season, though seed exports are up Last week, HMRC released the November trade figures. These figures show quieter fresh exports than what may be expected coming up to the end of the EU transition period.

Though seed exports for both November, and season-to-date, exceeded both last year and the 5-year average (2015-2019). These strong exports are likely in anticipation of EU exit, in order to buy a little time to mitigate any immediate impacts of not being granted third country equivalence.

Exports

Overall exports for the 2020/21 marketing season (July-November) have fallen year-on-year. The main factor for this, is a drop in fresh exports. November exports were down 14% from 2019 and 12% to the 5-year average (2015-2019) to 14.9Kt. Season-to-date (July-November) fresh exports are notably down, totalling 64.9Kt: down 28% (24.9Kt) from 2019/20 and 12% (8.8Kt) from the 5-year average.

Season-to-date EU exports, the main destination for fresh exports, fell 24.6Kt year-on-year. Despite increasing exports to Spain versus 2019, significant losses were seen to exports to the Irish Republic, Belgium and Poland. Some of this will be driven by a lack of demand from the pandemic, but it may also be the calm before the storm in December, particularly for Ireland, which will be uncovered in next month’s figures.

In contrast, seed exporters have seen a different story altogether. In November 2020 alone, 44.0Kt of seed was exported: up 6% year-on-year. 35.2Kt was destined for Egypt. July-November, 57.1Kt of seed had been exported; this is 14% (7.2Kt) higher than the 5-year average (2015-2019).

In the processed sector, season-to-date canned exports were down 22% year-on-year to 10.9Kt*. Whereas crisped exports, so far this season, were up 14% year-on-year, to 11.7Kt*. Frozen exports were up too, climbing 11% year-on-year to 20.6Kt*; though this is still 10% (2.4Kt*) below the 5-year average.

Imports

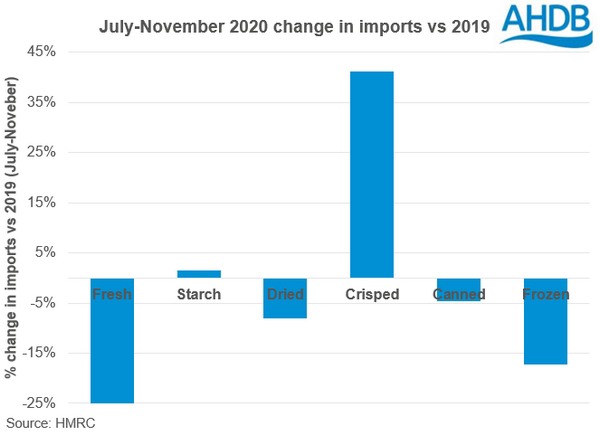

July to November ware imports (fresh and processed) were down 15% year-on-year and 4% against the 5-year average (2015-2019). With domestic demand lacking this season due to the ongoing impacts of the global pandemic, this is unsurprising.

Frozen imports have seen the largest fall year-on-year, season-to-date. The sector imported 17% (51.1Kt*) less than in 2019 and 8% (20.5Kt*) less than the 5-year average.

Fresh imports (July-November) have witnessed a smaller fall year-on-year to 41.5Kt, 25% (14.2Kt) less than 2019 but relatively in line with the 5-year average.

Collectively, other processed imports including starch, dried, crisped, and canned, remained relatively unchanged from last year. These imports totalled 71.9Kt* season-to-date. Individually, dried and canned imports saw a small dip season-to-date, though crisped imports were 41% (2.0Kt) higher year-on-year.

Source: AHDB