CMA CGM released their results for the fourth quarter of 2018. With a record revenue for 2018, the company has been able to invest and improve on several of its transportation lines. A major disturbance was the increased price of fuel.

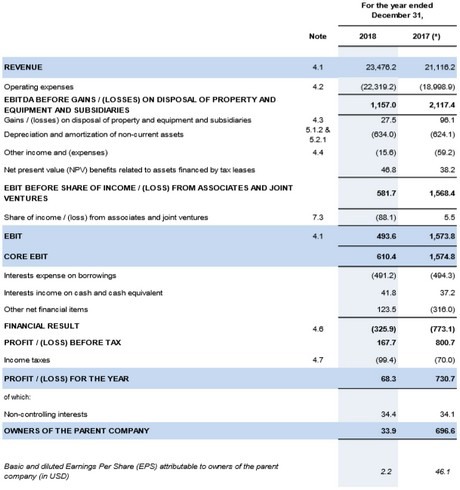

CMA-CGM was able to show record results in terms of revenue, which rose over two billion US Dollars, from 21,116 million USD in 2017 to 23,476 million USD in 2018.

In terms of volumes that carriers transported, the group exceeded 20m TEUs for the first time thanks to improvements to its Transpacific, India/Oceania and Africa lines. The new implementations of IFRS 16 comes with new interest and lease rates, which the group expects to have the following effect for the Full Year 2019 results:

- An increase of the lease liabilities in the range of USD 6.2-6.8 billion

- An increase of EBITDA in the range of USD 1.6 - 1.8 billion

- Additional depreciation expense of nearly USD 1.3 billion

- Additional interest expenses of nearly USD 0.5 billion.

CMA-CGM management estimates that the 2019 Profit and Loss could be negatively impacted by an amount of USD 0.1 to 0.3 billion, based on the lease portfolio as at December 31, 2018.

Another issue was the rising price of fuel, which increased by about 33 per cent.

Low Sulphur regulation

For the future the CMA CGM Group has decided to invest significantly by using LNG to power some of its future container ships, currently nine giant ships on order, resulting in a 99 per cent reduction in Sulphur emissions.

Investment in CEVA

On October 17,2018, the Group acquired additional shares increasing its stake by 7.88%, for a total of 32.87%. Later that month the group announced its intention to make a tender offer to the shareholders of CEVA Logistics. The main objective for the group is to offer door-to-door service to its customers, while reducing the costs through the pooled operations.

For the full results, check the complete report here.