Mexico's blueberry industry is undergoing varietal replacement and a shift toward hydroponic production, targeting higher productivity, larger fruit size, and improved post-harvest performance for the U.S. market. Eduardo Betancourt Esparza, independent berry consultant and founder of BETABLUE, says the sector is consolidating its position based on proximity to the United States and adapted genetics.

Early plantings were dominated by Biloxi and Ventura. Today, these represent 20% to 25% of planted area, mainly in Michoacán at 2,000 meters above sea level, where cooler conditions and lower pest pressure have slowed replacement. In lower regions such as Sinaloa, Guanajuato, and Jalisco, replacement has progressed more rapidly over the past three years. In some advisory fields, only 15% of older varieties remain.

Current selection focuses on exceeding 20 tons per hectare and achieving at least 50% jumbo fruit above 19 mm. "Unlike Peru and Chile, we have the market very close; we can reach Texas in about 18 hours," he says, noting that post-harvest life is still monitored closely.

Sekoya Pop and AzraBlue from Fall Creek genetics are among the most planted replacements, alongside Planasa varieties such as Madeira, Manila, and Maldives. Adaptation depends on altitude, with Madeira performing above 1,800 meters.

The United States accounts for 95% of Mexican fresh blueberry exports. Mexico's primary supply window is February to April, while Peru ships from July. "The windows are narrowing," Betancourt says. When Mexico coincides with Peru, prices can fall to US$4 to US$5 per kilogram. In colder areas, productivity of 30 to 32 tons per hectare has been achieved, with improved firmness and Brix levels.

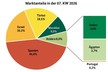

For 2026, around 70% of the planted area is concentrated in Jalisco and Guanajuato. Early yields from Sekoya Pop and AzraBlue are reported at 9 to 10 tons harvested, with peak volumes expected in February, March, and April.

Hydroponics is driving productivity gains. Of the 1,000 hectares Betancourt advises, only 30 hectares remain in soil. "We are doing everything hydroponically," he states. Container sizes have increased from 30 liters to 50 to 55 liters of coconut fiber substrate. Under hydroponics, planting in April can deliver 23 tons by November, compared to around 10 tons in soil. In colder areas such as Puebla, yields of up to 35 tons per hectare have been reported.

Source: Blueberries Consulting