Port of Antwerp-Bruges closed in 2025 amid geopolitical tensions, economic uncertainty, and operational disruption. Total maritime throughput declined year on year but remained broadly in line with previous years, while container traffic was largely stable. The United States emerged as the port's largest trade partner, supported by higher LNG imports.

Geopolitical and economic pressure

Activity in 2025 was shaped by the war in Ukraine, trade tensions between the United States, Europe, and China, prolonged congestion at container terminals, and a high level of industrial action. Trade flows fluctuated during the year, partly due to the anticipation of import duties, followed by a slowdown from the second quarter. Higher U.S. tariffs weighed on exports such as iron, steel, and vehicles.

© Port of Antwerp-Bruges

© Port of Antwerp-Bruges

The United States accounted for 31.3 million tons of throughput. At the same time, container imports from China rose by 3.8 per cent, further widening the imbalance in container flows with the Far East. China remained the largest country of origin for containers and became the leading origin for cars in 2025.

In Zeebrugge, the European ban on the transshipment of Russian LNG to non-EU destinations reduced energy volumes. Expanded LNG production capacity in the United States and the Middle East may influence future flows.

Operationally, the logistics chain faced additional strain between January and July due to disrupted sailing schedules, rerouting, and the transition between container alliances. Around 25 days of industrial action affected all cargo segments, resulting in an estimated loss of 2.4 million tons, or about 1 per cent of annual throughput.

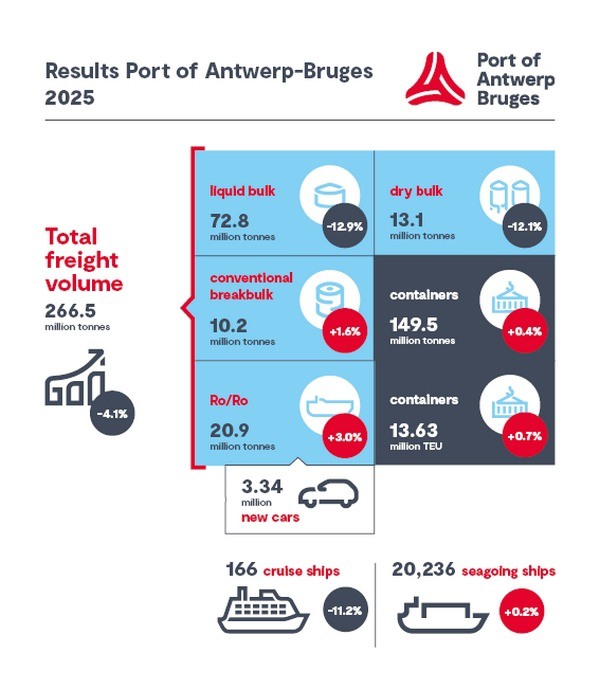

Lower throughput, stable containers

Total maritime throughput for 2025 reached 266.5 million tons, down 4.1 per cent from 2024. Most cargo segments reflected a higher share of imports. Container throughput increased slightly, up 0.4 per cent in tonnage and 0.7 per cent in TEU. Market share in the Hamburg–Le Havre range fell by 1.2 percentage points to 29.3 per cent in the first nine months, linked to congestion and reinforcing the need for additional capacity projects such as Extra Container Capacity Antwerp.

© Port of Antwerp-Bruges

© Port of Antwerp-Bruges

Liquid bulk declined sharply due to a 19 per cent drop in oil products, driven by lower gasoline exports to West Africa and reduced diesel imports. Conventional general cargo rose by 1.6 per cent, supported by stronger volumes late in the year, though iron and steel decreased by 1.7 per cent. RoRo increased by 3 per cent, while dry bulk fell by 12.1 per cent, mainly due to fertilizers, coal, and sand.

The port handled 20,236 seagoing vessel calls, up 0.2 per cent. Cruise calls declined to 166, carrying 466,089 passengers.

Priorities for 2026

For 2026, the port's focus remains on safety, transition, and infrastructure. Measures include investments in physical and digital security, cyber resilience, and anti-crime actions. Transition initiatives covering circularity, low-carbon molecules, and CO₂ infrastructure are expected to progress.

To view the full report, click here.

© Port of Antwerp-BrugesFor more information:

© Port of Antwerp-BrugesFor more information:

Port of Antwerp-Bruges

Tel: +32 492 15 41 39

Email: [email protected]

www.newsroom.portofantwerpbruges.com