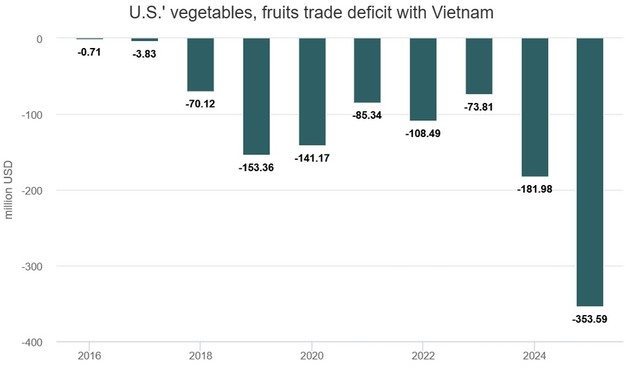

U.S. fruit and vegetable shipments to Vietnam rose sharply in 2025, while Vietnam's exports to the U.S. market continued to lag behind. According to Vietnam Customs data, Vietnam imported nearly US$900 million worth of fruits and vegetables from the U.S. in 2025, an increase of almost 67 per cent compared to the previous year. This represents a tenfold increase compared with imports from the U.S. a decade earlier. Key imported products included cherries, apples, grapes, and oranges.

In contrast, Vietnam's fruit and vegetable exports to the U.S. reached US$546 million in 2025, accounting for just 1.49 per cent of total U.S. imports in this category. The U.S. market is largely supplied by Mexico, Canada, and South American countries.

© Vietnam Customs

© Vietnam Customs

Dang Phuc Nguyen, general secretary of the Vietnam Fruit and Vegetable Association, said the U.S. is a large and attractive market, but also one with strict technical requirements and long transport distances for Vietnamese exporters. He noted that Vietnam currently ranks as the 13th largest fruit and vegetable supplier to the U.S., reflecting efforts made by export-oriented companies in recent years.

Vietnamese exporters have benefited from an expanding list of fruits approved for entry into the U.S. Permitted products now include pomelo, mango, dragon fruit, longan, lychee, star apple, rambutan, and, most recently, coconut. These approvals have widened market access but have not yet translated into proportional export growth.

U.S. consumer demand is shifting toward new fruit varieties, health-oriented products, and processed formats such as frozen fruit, dried fruit, and juice. Vietnamese products, including coconut, durian, and pomelo, are gaining visibility within these segments.

© Vietnam Customs

© Vietnam Customs

At the same time, exporters face increasing constraints. From this month, U.S. authorities have tightened requirements related to traceability and food safety, with a stronger focus on pesticide residue compliance. Inconsistent management of planting area codes and packing facilities in Vietnam poses a risk of warnings or temporary import suspensions.

Logistics costs remain a challenge due to the long distance to the U.S., limiting price competitiveness compared with suppliers located closer to the market, such as Mexico and Peru, as well as Thailand. In addition, U.S. trade policy aimed at protecting domestic agriculture has become less predictable under the current administration.

Supply chain requirements related to production practices, carbon emissions, and social responsibility are also becoming more prominent, adding further compliance demands for Vietnamese exporters targeting the U.S. market.

Source: VNExpress