Amid ongoing immigration enforcement under the Trump administration, farmworkers across the U.S. are increasingly reluctant to show up for work, creating visible labor shortages in Washington state's cherry orchards. Growers, already grappling with years of workforce instability, now face acute challenges during the short June-August harvest season. Rosa Hernandez, a seasonal picker in Wenatchee Valley, noted that labor numbers are down significantly this year, largely due to fears of detention and deportation. Although no mass arrests have been reported in Washington, incidents in other states have spread fear among undocumented workers.

Carlos Torres, owner of PLM Orchards, says he's working with 35 pickers instead of the usual 60. Unable to harvest the full crop, Torres warns the financial strain could drive his business under. Meanwhile, Erik Zavala, director at Blue Bird, a co-op of 200 growers, confirmed that output has dropped across the board. Even their most productive workers are bringing in just a fraction of the usual volume. Despite rising costs, prices paid by major retailers like Costco and Walmart remain fixed, forcing growers to absorb losses. The H-2A visa program offers a legal route to seasonal labor, but housing and transport requirements make it prohibitively expensive for many.

Some growers blame fear-driven narratives for exacerbating the labor shortage. John Folden, another Blue Bird grower, disputes rumors of raids in Washington, calling them unfounded and harmful. Still, industry leaders agree on the need for reform, affordable, legal avenues to secure labor and keep farms operational.

Labor issues compound an already difficult year for cherry growers. Tom Gotelli of San Joaquin County, California, says unseasonably warm winter temperatures disrupted tree dormancy, cutting yields by up to 50%. While exports held up, more cherries stayed in the domestic market, and total volumes fell short of expectations.

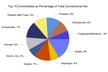

Trade tensions with China have also taken a toll. U.S. farmers lost an estimated $2 billion in exports due to retaliatory tariffs. From January to April, agricultural exports to China dropped by over $5 billion, or 55%, compared to the previous year. Modest gains to South Asia, the EU, and Central America, up 43%, 39%, and 24%, respectively, have not offset the shortfall.