The blueberry harvest season in Georgia has just begun, and the market is already showing signs of softening. Over the past week, procurement prices have dropped from €9.5 to €7 per kilogram, and most market analysts expect the downward trend to continue as volumes increase, as highlighted by EastFruit.

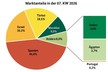

Despite this decline, prices in Georgia remain relatively high compared to competitors, especially Serbia, which has become a key supplier to the European Union in recent weeks. Serbian blueberries are currently more competitively priced, with strong quality and faster logistics to EU markets. However, Georgia benefits from a diversified export geography, with the Russian market playing a crucial role in absorbing early volumes and helping to support pricing.

Over the past few years, Georgian exporters have significantly expanded their presence in Russia, which now acts as a stabilizing outlet for early-season fruit. That said, many exporters still prefer to sell to the European Union whenever prices are comparable, due to the EU's greater market transparency, legal predictability, and lower risk of non-payment. In contrast, the Russian market remains volatile, with higher logistical risks, inconsistent customs procedures, and a lack of legal safeguards.

Meanwhile, in the EU market, buyers are already shifting away from Spanish blueberries, where quality issues are becoming more frequent late in the season. This has increased interest in Serbian fruit, and Georgia will need to remain price-sensitive to maintain competitiveness in the bloc.

As Georgia ramps up its harvest over the coming weeks, the growing supply will inevitably add pressure to prices, especially if exports to the EU remain sluggish. Some local wholesale platforms are already reporting signs of oversupply, which could trigger a sharper price correction unless new export channels open quickly.

In this environment, Georgian exporters must remain agile and responsive by closely tracking market trends and adapting logistics and pricing strategies accordingly. As past seasons have shown, the ability to shift flexibly between markets and maintain consistent product quality will be key to success in the highly competitive and fast-moving blueberry trade.

Source: EastFruit