Hass avocado has become a driving force for Colombian exports. Antioquia, Risaralda, and Valle del Cauca lead growth with exports to Europe and the United States, which have increased demand. However, U.S. President Donald Trump's decision to impose a 10% tariff on Colombian products has generated concern in the sector, especially since Mexico, the main competitor, is not subject to this levy.

Katheryn Mejía, executive director of Corpohass, stresses that replacing the U.S. market is not viable: "We have a logistical advantage that allows us to reach the East Coast, which has the greatest purchasing power, more quickly. We reach Miami in three days, and Philadelphia in four or five. In addition, Puerto Antioquia will soon be operational, saving us another four days in transport times and increasing our competitiveness."

It takes Colombian avocados three to five days to arrive in the United States. In contrast, the transit time to China lasts 25 days; a duration that the fruit does not resist.

To address the challenge of shipping avocados to Asia, the National Association of Foreign Trade (Analdex) suggests developing more resistant varieties or innovative technologies that maintain the avocado's good condition during transport. Alternatively, value could be added to the product by exporting oil, pulp, or frozen avocado.

To compete in the U.S. market, the Colombian avocado must strengthen its advantages: having competitive prices, sustainability with certifications of good agricultural practices, and making use of its favorable geographical location that allows for a reliable year-round supply. The port of Cartagena, which is well-connected in Latin America, also offers competitive transit times.

"I don't know how the 10% tariff that started to be applied in April will impact exports. We'll find out in our second quarterly report, which should be ready by the end of July or early August," stated Mejía.

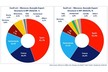

In 2024, Colombia exported more than 35,000 tons of Hass avocados. This year, the sector expects to export 70,000 tons. Antioquia is the largest exporter, followed by Cauca and Valle del Cauca. According to Analdex, 39.1% of exports went to the Netherlands, 23.4% to the United States, and 10% to China.

Source: elcolombiano.com