Arrivals of Hass avocados on the European market have dropped to 3.6 million boxes. Moroccan volumes remain stable, as do those from Spain and Portugal, while arrivals from Israel are gradually declining. Volumes from Latin America are also theoretically decreasing, but due to many delayed shipments, some have arrived with quality issues, putting pressure on the market. As for summer origins, arrivals from Peru, Kenya, and Tanzania continue to increase, though they remain limited compared to overall available volumes. Matthijs Brokke of Dole Europe BV provides a seasonal update on mangoes and avocados and looks ahead to the coming season.

"Overall, more avocados are entering the market than needed, as demand is lower this week. This is mainly due to school holidays but also the relatively high supermarket prices, with promotional offers not doing enough to boost demand. Additionally, quality issues and rapidly ripening fruit, combined with lower demand, are putting pressure on the market across all size grades. However, mid-sized avocados seem to be holding their price better than small and large ones."

Double volumes due to sea freight delays

The importer expects arrivals to decline slightly further in week 9 before potentially stabilizing in week 10, depending on how Moroccan exports develop. "Volumes from Israel are expected to remain at the same level, while arrivals from Spain and Portugal will continue to increase. Latin American volumes should theoretically decrease, although some players are actually receiving double volumes due to delays."

"In addition, arrivals from Morocco are also expected to decline, as market pressure has led importers to take fewer positions. Moreover, with the start of Ramadan, the labor force may decrease slightly, potentially affecting the harvest. However, Morocco still appears to have fruit available for export. The key question is how this will impact dry matter content as the season progresses, but volumes will certainly be slightly lower in March and early April. The beginning of Ramadan in week 9 may stimulate demand somewhat. Additionally, several promotional campaigns are planned in the coming weeks, particularly for larger sizes, which gives hope that market pressure will ease as stocks quickly reduce."

Outlook Brazil / South Africa

"For other origins, the expectation for the new season is that Brazil will have very little volume available from the São Paulo region, where growers have suffered field losses of up to 90%. The focus will therefore be on Minas Gerais, which is expected to have good production this year due to its higher elevation. The first arrivals are expected in week 14. Due to heavy rainfall, the dry matter content has not developed as expected and is slightly below 20% on average."

"South Africa has also experienced continuous heavy rainfall over the past two weeks. In the Letaba production area, the first sunny days have now appeared, but dry matter development remains slow. As a result, the start of the season has been delayed by about two weeks. Currently, growers are packing the first volumes, which are expected to arrive on the market in week 14."

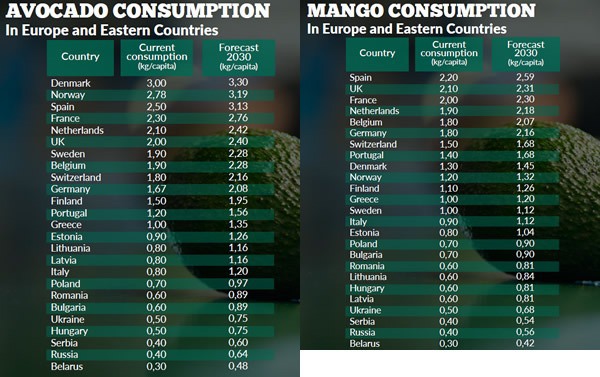

Avocado and mango consumption figures. Click on image to enlarge

Demand for organic avocados shifting

OTC Organics, the organic division of Dole Europe, reports that demand for organic avocados is currently shifting. "At OTC Organics, we started shipping from Peru three weeks ago. These shipments allow customers to transition from European and Moroccan products to Peruvian ones. Thanks to our knowledge and contacts in Peru, we are familiar with the size distribution and orchard scale across different regions, enabling us to plan the season effectively. We expect the season to last until week 37. In parallel, we aim to supply high-quality Kenyan avocados, ensuring that we meet various organic certification requirements while also providing diverse packaging solutions for our customers' shelves."

Mango market disrupted by delays

Shipping delays have also affected the mango market, disrupting supply to Europe this week and next. Supermarket suppliers, in particular, are facing challenges in meeting their commitments. Mango quality varies significantly, with some fruit overripe and showing discolored flesh. Additionally, certain Peruvian batches originate from the first harvest in Piura, which has a significantly reduced shelf life. Harvesting in the Motupe and Valle de San Lorenzo regions has been suspended due to the presence of fruit flies. Casma is the next scheduled harvest region.

If sea freight remains stable, shipments of Peruvian Kent mangoes to Europe should reach around 280 containers per week. Meanwhile, demand for mangoes in Brazil is rising again, particularly for the Palmer and Tommy Atkins varieties, with buying prices increasing this week. Brazilian mango supplies are growing slowly but steadily, primarily driven by Palmer, which is approaching the 100-container mark. Brazilian supply is also complemented by Keitt, which has seen moderated volumes this week, and small shipments of Tommy Atkins.

Large volumes from Ivory Coast expected in early season

For the upcoming mango season from Ivory Coast, Dole Europe says the focus is on early-season supply. "The weather has generally been quite cold since November, which has led to this early and abundant flowering. Much will depend on the Harmattan winds, which can always cause heavy fallout and a temperature rise, which will accelerate fruit growth and ripeness. The supply is likely to be quite aggressive at the start of the season because of the abundant initial flowering, but availability will be lower at the end of the season as most of the fruit will have been harvested by then. The first arrivals are expected in weeks 16-17. High season is expected to be advanced to arrival weeks 19-21 with rapid decline and extremely low availability in weeks 23-26."

OTC Organics notes a strong demand for organic mangoes. "We ensure a high-quality organic product year-round by working closely with professional growers. Recently, the market has been supplied with organic mangoes from Peru's Piura region. The next batch of quality mangoes will come from the Ancash region, followed by organic mangoes from Africa and Central America."

For more information

For more information

Matthijs Brokke

Dole Europe BV

Spectrumlaan 29

2665 NM Bleiswijk

Tel: +31 88 089 08 79

[email protected]

www.doleeuropebv.com