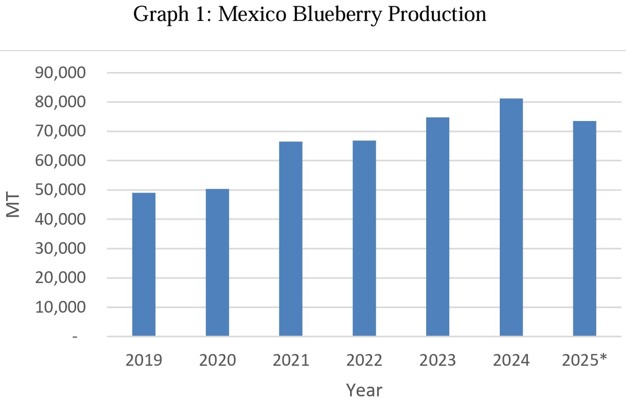

Mexico is a leading global producer of blueberries, ranking sixth worldwide. Production is forecast at 73,500 metric tons (MT) for calendar year (CY) 2025, representing a nine percent decrease from CY 2024 based on a shortened harvest period. Mexico's CY 2025 exports are forecast at 70,000 MT and imports at 20,000 MT. While still well below the annual per capita consumption levels of the United States and other leading global blueberry consumers, Mexico's consumption more than doubled from 2023 to 2024 with increasing consumer awareness of berries and related health benefits. The United States is expected to remain both Mexico's number one blueberry export market and its top supplier.

Mexico's blueberry sector benefits from favorable growing conditions, proximity to the United States, its top export market, and market access to parts of Europe, Asia, and the Middle East. Producers are focused on implementing advanced production technologies, including new varieties and new growing techniques, to manage climate challenges and enhance fruit quality and flavor. In response to competitive pressure from Peru and Chile, which offer comparable quality berries at a lower price, Mexican producers have strategically delayed the beginning of the harvest season.

Production

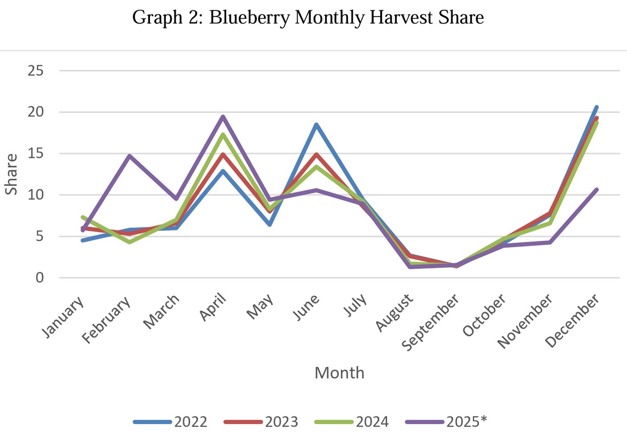

Mexico is the sixth blueberry producer globally. Calendar year (CY) 2025 production is at 73,500 metric tons (MT), representing a nine percent decrease from CY 2024 due to a shorter harvest period. Faced with competition from Peru and Chile, which supply comparable quality berries at a lower cost, many Mexican producers report having pushed the start of the harvest from October to February (see Graph 2), aligning with the slowdown in the South American harvest. By delaying the beginning of the harvest and thus shortening the total harvest period, growers aim to reduce labor costs (seasonal and day labor) and export their blueberries when their competitors' production is lower, offsetting lower overall production with increased revenue during the February-May period.

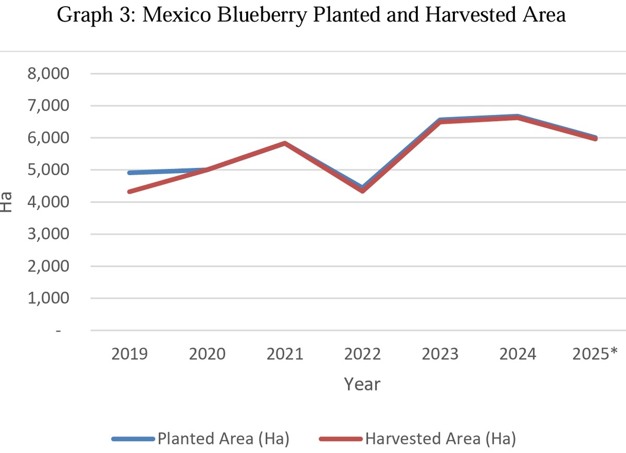

Mexico's blueberry production benefits from favorable growing conditions, readily available labor, and proximity to the U.S. market. Planted area is forecast to decrease slightly in 2025, as producers shift towards improved, higher-yielding proprietary varieties. Jalisco and Sinaloa (see Map 1) are expected to remain the top blueberry-producing states, with Sinaloa forecast to increase its production in CY 2025 based on favorable production conditions including adequate access to water.

Faced with ongoing water scarcity in recent years, Mexican producers are increasingly adopting drought-resistant varieties and technological innovations such as the use of substrate planting in pots rather than in-ground planting. Many growers are installing more efficient irrigation systems and private water reservoirs.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov