"Five years ago, we already wondered when it would stop. But it's still rising, and I think, in another five years, it will still be growing," says Anton Filippo of the Dutch logistics service provider LBP about the unabated rise in blueberry sales.

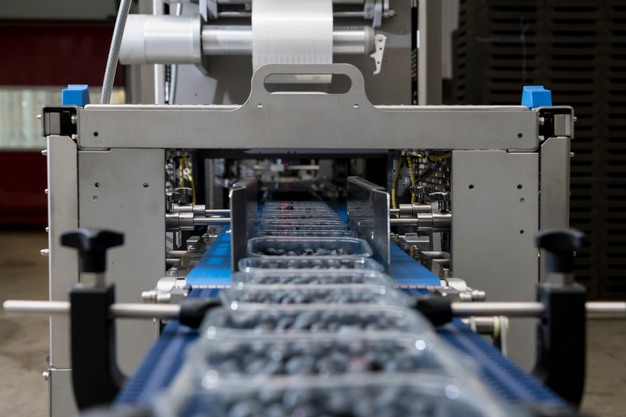

The market has changed considerably since the company began specializing in blueberry logistics 12 years ago. "We used to focus on bulk packing; now, it's mainly on top sealing and stickering of open punnets." Costs, especially increasing labor costs, primarily drive this shift, so packing at the origin has become the norm. Two years ago, LBP even discontinued its packaging lines to focus entirely on manual sorting and top sealing.

Changing countries of origin

Chile, Argentina, and Uruguay used to be the top blueberry supplies, but new regions are entering this market. "Peru is one of the biggest players, with more than 100 containers a week in season. But Eastern Europe and Morocco also show significant growth," Anton explains. Southern Africa is gaining ground, too. "There's plenty of investment in South Africa, Namibia, and Zambia. Those areas benefit from good timing in the season, and offer opportunities provided their quality and logistics are in order."

Despite this, the traditional South American countries remain relevant. "Peru continues growing and is investing heavily in new plantings. Chile, though, lags slightly. It's betting on new varieties. Argentina now focuses mainly on organic berries, of which Peru has fewer," Anton points out.

El Niño's impact

The influence of weather conditions like El Niño is a significant challenge for the blueberry sector. "Last year, we lost almost 40% of the volume from Peru due to bad weather. The season's start was delayed this year, but quality remains good. Thanks to strong varieties such as Sekoya and Ventura, the product can better withstand long transit times to Europe."

Consumption growth

Blueberry demand keeps rising, with especially the volume per pack increasing. "Before, 125 g packs were common; now, there are more and more 300 g punnets. People buy the same number of punnets but each with more fruit," says Filippo. He says though the market potential in Europe is not comparable to that in the US, he still sees room for growth.

Challenges and price developments

The ever-increasing planting and volumes bring challenges, especially regarding pricing. "Rising volumes affect prices and logistics costs. That's a key area of focus for us in the coming years."

After a long career in logistics, Anton handed over the baton at the end of 2024. He is now retired. "I proudly reflect on the blueberry sector developments. There are still plenty of challenges, but also plenty of opportunities," Anton concludes.

Anton FilippoL.B.P. Rotterdam BV

Honderdland 50

2676 LS Maasdijk

Tel: +31 174 530550

[email protected]

www.lbp.net