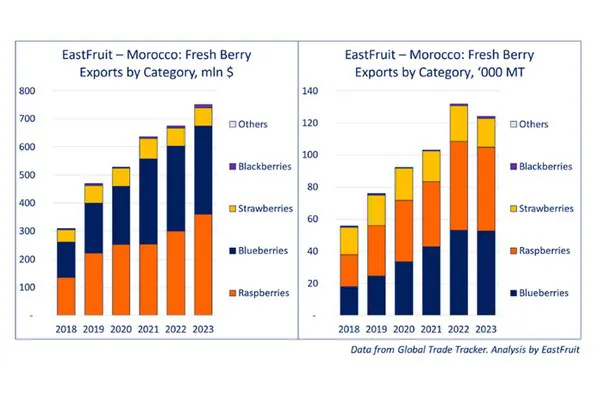

In 2023, Morocco demonstrated a robust increase in revenue from its fresh berry exports, overcoming adverse weather conditions and a dip in supply volumes. EastFruit's data reveals that Moroccan berry producers exported nearly 124,000 tons, generating $750 million in revenue.

"Berries have reaffirmed their role as a cornerstone of Morocco's agricultural exports. Only greenhouse tomatoes yielded more foreign earnings than frozen berries. And also an additional $83 million came from frozen strawberries, raspberries, and blackberries. Despite these gains, the year posed significant challenges for the sector," notes Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

The revenue from Morocco's fresh berry exports has seen a 2.4-fold increase since 2018, yet the actual volume of exports in 2023 saw a 6% decline from the previous year, totaling 124,000 tons. However, this figure still surpasses the five-year average by one-third.

A noteworthy development in 2023 was the 40% increase in fresh blackberry exports, reaching 1.4 thousand tons. Conversely, exports of other major berries either plateaued or diminished, with blueberries at 52.5 thousand tons, and raspberries and strawberries at 52 thousand tons and 17.7 thousand tons, respectively.

"The growth in revenue from berry exports is encouraging, but the reduction in tonnage signals potential concerns for the industry's future in Morocco. The sector's reliance on favorable weather and its heavy export focus on the EU and UK markets – regions that faced economic challenges in 2022-2023 – highlight its vulnerabilities," Yevhen Kuzin elaborates.

Approximately 90% of Morocco's berry exports in 2023 were destined for just five countries: Spain, the UK, the Netherlands, Germany, and France. These nations accounted for 88% of Morocco's foreign currency earnings from berries. However, each reduced their import volumes, with Germany's imports dropping by a third and France's by 20%, reflecting both a decreased supply from Morocco and a weakened demand due to the EU's economic difficulties.

Yevhen Kuzin reminds us, "The IMF reports that the EU's economy grew by a mere half percent in the crisis years of 2022-2023, with Germany experiencing a 0.3% contraction. This economic stagnation has inevitably impacted consumer demand. Consequently, diversifying export markets is a strategic priority for Morocco's berry industry, building on its existing successes."

In 2023, Morocco also saw growth in berry exports to emerging markets. Exports to the UAE increased by 29% to 2,000 tons, direct shipments to Poland surged over fivefold to 1,200 tons, deliveries to Canada rose nearly 6.5 times to 65 tons, and Saudi Arabia more than doubled its import volumes to 810 tons. Despite these advances, the volumes remain modest compared to the leading five importers.

For more information: east-fruit.com