The conflicts in the Middle East are impacting global shipping lanes and putting renewed pressure on shipping freight rates. In Brazil, the main impact is expected to be felt from February, according to industry analysts. Market concerns that could affect the country include rising freight rates, delays in vessel arrivals, and a shortage of containers.

The crisis began in late 2023 when Houthi rebels from Yemen started attacking ships in the Red Sea in response to the conflict between Israel and Hamas in Gaza. The attacks have had a direct impact on access to the Suez Canal, causing shipping companies to divert ships bound for Europe and the United States to an alternative route through southern Africa—a longer and more expensive route.

On routes from Asia to Europe and the United States, prices have already skyrocketed since last December. In Brazil, the impact is still small. Import freight from China to Brazil is currently around $3,500 per container, according to market sources. This is higher than prices in 2023 but well below the peak recorded at the height of the pandemic, when freight rates from Asia exceeded $10,000 per container.

The market forecast is that the impact will be more pronounced in the coming weeks. The main impact will be on routes from Asia. Today, between 25% and 30% of Asian imports to Brazil go through Europe (and Suez), according to Mr. Dantas of Asia Shipping.

“This route will have an impact on the price because the freight from Asia to Europe has increased, today it’s $6,000 per container. And those who used to use the Asia-Europe route will want to switch to the direct route to Brazil, which will also increase the price,” he said. In addition, he foresees a delay in the arrival of ships because the alternative route to Suez via southern Africa takes longer. “The first effect Brazil will feel is the price, but there will still be operational problems. They are expected to arrive around February, March,” he said.

Another major concern is the shortage of containers, which are likely to be “stuck” on ships in transit for longer. “When there is a shortage of containers in the world, shipping companies prefer services from Europe and the U.S. Brazil will suffer the most,” said Mario Veraldo, president of logistics company MTM Logix. He also expects congestion in European ports, which could affect global logistics as a whole.

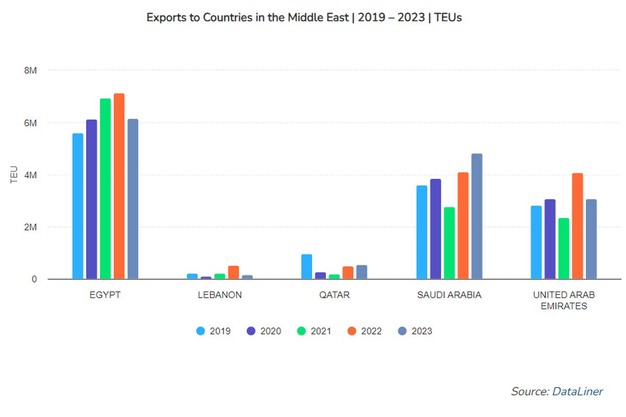

The chart above shows the progress of container exports to some of Brazil’s leading trading partners in the Middle East, the region most affected by the political havoc in the Red Sea.

For more information: datamarnews.com