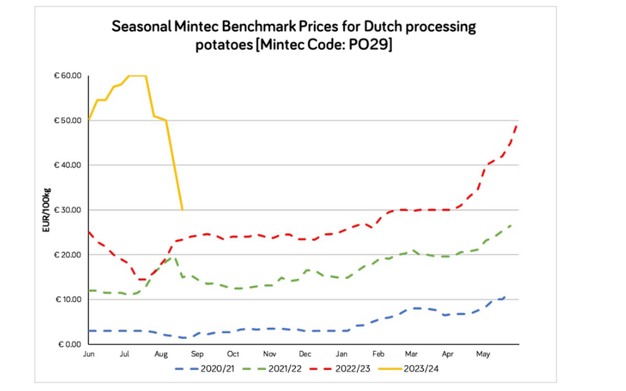

European processing potato prices continued to decline from the record highs seen in July as increasing volumes of new crop entered the market. The Mintec Benchmark Prices for Dutch processing potatoes [Mintec Code: PO29] were assessed at €30/100kg on 22nd August, down 50% from the record high of €60/100kg seen on 25th July.

The market has seen a shift away from the supply deficit seen at the tail end of the 2022/23 season towards an excess of non-contracted potatoes. According to Mintec market sources the majority of buyers are utilizing contracted volumes with minimal demand for free-buy supplies. This has led to growers having to sell at lower prices to incentivise purchases.

A seasonal decline in prices as harvest moves away from early varieties is typical for the potato market. However, due to the delays seen in crop development and a later harvest this downward price movement has occurred later than normal.

Looking further forward market sources disclosed to Mintec that they expected prices to continue to decline in the coming weeks as lifting continues and availability continues to increase.

At this stage, yields are expected by market players to be average at best. The August Mars report from the European Commission forecast EU potato yields at 34.4 t/ha, just a 1% elevation over the five-year average and unchanged from the July report. Significant potato-producing regions, including Poland, France, Belgium, and the Netherlands, are all forecasted to record yields below the five-year average.

For more information: mintecglobal.com