Above-average claims but also above-average premium growth characterised the 2022 financial year of Gartenbau-Versicherung. At this year's meeting of member representatives in Kamp-Lintfort, the Board of Management again presented the most important developments on both sides of the balance sheet to the elected members of the insurance association. Current topics such as the subsidy for multi-peril insurance and an insight into ongoing future projects were also on the agenda.

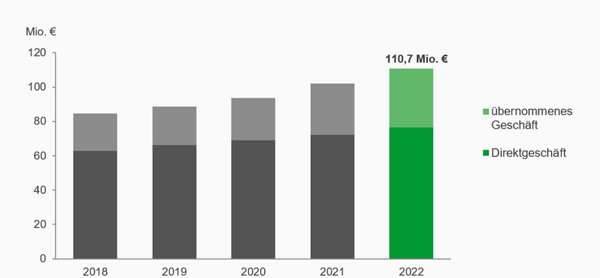

For the first time, Christian Senft and Dr Dietmar Kohlruss presented the review of the past business year as the newly formed Executive Board in pairs. Chairman Christian Senft was satisfied with the development of premiums, which had grown by 8.8 % to a total volume of 110.7 million euros in 2022. Especially in Italy, Switzerland and in the indirect business with Vereinigte Hagelversicherung, new business increased significantly, even adjusted for inflation. Foreign business now accounts for 46 %. "It is not a matter of course that we were able to increase the premium volume through new members in a difficult economic environment," Christian Senft emphasised.

"The horticultural businesses in Europe rely on us in difficult times, and they can," Senft continues. Because every membership fee is also an acknowledgement of the competent advice and service provided by the professional staff, he added. "Word of our fast, fair and personal claims settlement gets around again and again, especially after major loss events - and now in six languages in eight countries." In 2022, contracts were underwritten for the first time in the neighbouring country of Poland, where Gartenbau-Versicherung is involved as one of three partners of AgroRisk Polska.

Gross claims ratio again above ten-year average

Senft cited the constant adaptation of risk management, especially to climate change, as a challenge. "We are constantly examining how we can continue to provide sufficient security at affordable prices in the future. This includes, for example, that weather hazards in particularly stressed regions will be reflected even more strongly in the tariffs in the future or that we will have to make higher demands on the construction of plants there. In this regard, we are already providing preventive advice on site."

In the 2022 financial year, the gross loss ratio in European direct business was again above the average of the last ten years at 69.4%. This was mainly due to weather extremes in France, Italy and the Netherlands. In the previous year, however, high losses in Germany had ensured an exceptional result at the same level. "Internationalisation and broad risk diversification therefore remain our recipe for success in protecting horticulture," Senft continued.

Financial year closes with a clear minus

Looking specifically at the balance sheet, CFO Dr. Dietmar Kohlruss explained that not every euro paid out had the same impact on the annual financial statement. In addition to the amount of damage, the type, cause or location of the damage also made a difference. In the 2022 business year, for example, a particularly high number of smaller claims could not be claimed from the reinsurance partners. In addition, most of the damaged businesses were located abroad, so that taxes of 1.7 million euros were due in Germany despite the high claims payments.

The high proportion of storm claims also had a negative impact on the annual result, as these could not be offset by the equalisation reserves for this class, which were already burdened from previous years. The greatest effect, however, was caused by the good development of the indirect business, as the favourable relation between premiums and claims led to the legal obligation to allocate 6.6 million euros to the equalisation reserve for this class. In total, these special circumstances, together with higher pension provisions from the collective agreement and other increased costs, therefore led to an extraordinary net loss for the year of 8.8 million euros. However, a total of 7.7 million euros of this amount remains in the company as a reserve via the obligatory equalisation reserves.

"This special situation therefore has no influence on the sustainable security of our financial and business policy - on the contrary, it increases our reserve cushion for future excess loss years," Dr. Dietmar Kohlruss emphasised.

New elections and confirmation in office

In the regular elections, the Supervisory Board members Beate Schönges, Hermann Berchtenbreiter and Lothar Dahs were confirmed in their offices. The terms of office of numerous member representatives were also renewed by the 40-member assembly. Philipp Schwab (photo centre), owner of a nursery in Ingolstadt, and Inga Balke, owner of a nursery in Nützen (Schleswig-Holstein) and managing director of a plant trading company, were newly elected as member representatives. Fruit tree nurseryman Johannes Schmitt (photo right) from Poxdorf in Bavaria and Jessica Mayer, managing director of two adventure garden centres in the Stuttgart area, successfully stood as deputy member representatives.

Frank Werner (photo left), Chairman of the Supervisory Board, expressed his sincere thanks to all retiring member representatives for their many years of trustful cooperation. He expressed his personal thanks to Dr. Hans-Hermann Buchwald and Hermann Haage, both of whom were present and who, at their own request, did not stand for re-election after 20 years as member representatives.

Images: Gartenbau-Versicherung

Further informatio:

www.gartenbau-versicherung.de