We are nearing the end of the 22-23 apple season and EastFruit analysts look at Georgia’s trade statistics. Apple export volumes and prices in US Dollars are quite similar to numbers from the previous season. This is not necessarily an underperformance – on the contrary, the 21-22 season was quite good in terms of volumes and prices. Meanwhile, apple import volumes are unusually low, which should not be surprising.

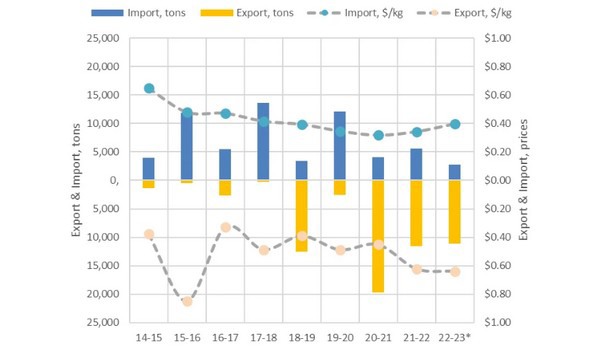

Georgia’s trade with apples by seasons, volumes, and prices

Data source: Ministry of Finance of Georgia.

Data source: Ministry of Finance of Georgia.

*Does not include data for June and July 2023. This should not be an issue as the exports in these months are usually very low.

So far in this apple season, which ends in July, Georgia has exported a bit over 11 thousand tons of fresh apples. According to the official trade data, the average export price for the season amounted to $0.64/kg. Both volumes and prices from the 22-23 season are almost identical to the 21-22 season.

As for the imports, Georgia imported only 2.7 thousand tons of apples – the lowest amount in at least nine seasons. This can be attributed to reduced demand for foreign apples due to the growth of local supply. The latter in turn is mainly driven by the governmental support program “Plant the Future”. Since the start of the program in 2015, more than 1,700 hectares of new orchards have been established with governmental co-financing.

Interestingly, trade partners do not change much in recent seasons.

The main country where the Georgian apples are exported is Russia. For six consecutive seasons, Russia has had a share of 90% or more. The 22-23 season is no different in this regard. 98% of Georgia’s exported apples were bought by Russia.

Key apple exporter countries to Georgia in the 22-23 season are Turkey and Ukraine. Turkey has a share of 70%, the remaining 30% is almost totally covered by Ukraine. Generally, country-wise, imports are more diverse than exports, which focuses on Russia. Since 2014, major exporters to Georgia are Turkey, Iran, Ukraine, and Poland. Turkey usually dominates the shares, imports from the rest are not systematic.

For more information: east-fruit.com