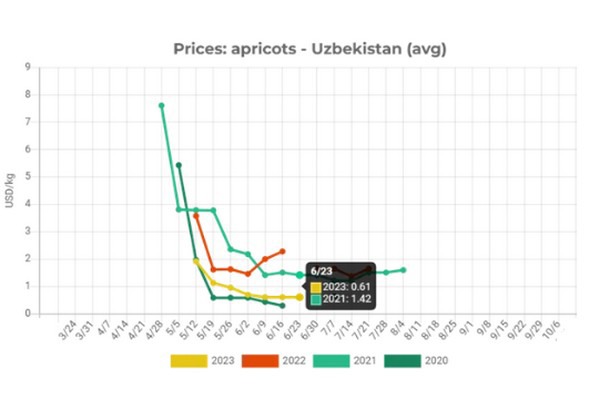

According to EastFruit analysts, Uzbekistan is likely to harvest a record apricot crop in 2023, which will contribute to higher exports and return of this country to the top positions in global ranking of leading exporters. Currently, apricot prices in Uzbekistan are at historically low levels – they were lower only in 2020, when exports were temporarily blocked due to the coronavirus pandemic.

Interestingly, on Saturday, June 24, prices for apricots in Uzbekistan decreased even more against the backdrop of the outbreak of the civil war in Russia. However, prices are expected to recover somewhat in the coming days, but they will certainly remain at very low levels.

We estimated that during the first two months of the season, Uzbekistan was able to repeat the record for apricot exports, selling about 40 thousand tons of fresh apricots to foreign markets, which is 5.4 times more than in the same period of 2022.

Why do we think that this will allow Uzbekistan to become the second largest exporter of fresh apricots in 2023?

First of all, because the apricot harvest in Italy and Spain in 2023 was lower than expected and below averages in recent years. At the same time, Uzbekistan has already exported more apricots than Italy exports on average for the entire season. And the season in Italy, we recall, lasts much longer than in Uzbekistan.

The second reason is the very competitive price, while in Europe apricot prices remain relatively high, which also “pulls up” apricot prices in Turkey.

The third reason is economic problems and a decrease in the income of the Russian population, which leads to an increase in demand for cheap products. Accordingly, a cheap apricot in this market will be in higher demand than more expensive types of fruits and berries.

We forecast that during the season Uzbekistan will be able to export at least 65-70 thousand tons of fresh apricots, although, under certain conditions, exports may even exceed 75 thousand tons. At the same time, Spain, most likely, will export no more than 60 thousand tons of apricots this year, and Italy – about 45 thousand tons.

Exports of fresh apricots from Turkey may for the first time exceed 100 thousand tons. Turkey will be able to buy a lot of cheap dried apricots in Tajikistan and Uzbekistan, so a larger part of the products will be sent to the fresh markets where prices are good. This is also fueled by devaluation of the Turkish lira.

Tajikistan also has a record harvest of apricots this year, which has already led to a collapse in prices for dried fruits from this country. We predict that Uzbekistan will also increase the production of dried apricot fruits and will also put pressure on this market throughout the season.

For more information: east-fruit.com