In Turkey, MY 2022/23 citrus production decreased for all citrus fruits except tangerines due to freezing weather conditions reaching -7 C during the beginning of the orange blossoming period in March 2022.

In MY 2022/23, citrus exports slightly decreased compared to the previous year due to lower foreign demand, political instability due to the Russia-Ukraine war and transportation and logistics problems. Notably, citrus exporters were severely affected by the earthquake in southeastern Turkey in March 2023 since roads were closed and cold storage was reallocated for humanitarian assistance. The earthquake region accounts for 57.5 percent of citrus production in Turkey, while the hard-hit province of Hatay realizes 20.8 percent of this production alone; lemons were especially affected. Russia, Ukraine, Iraq, Poland, and Romania are the main export markets for Turkey.

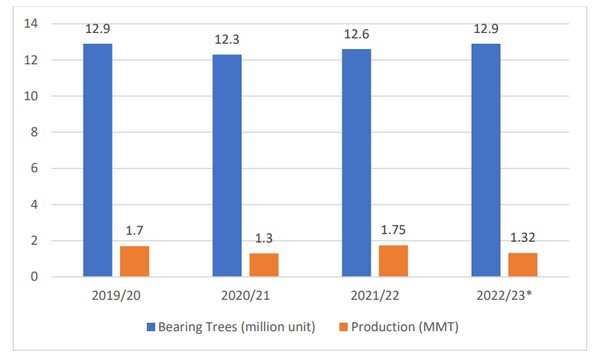

Turkey orange production (MMT) vs bearing trees (million units), MY 2019/20- MY 2020/21- MY 2021/22 and MY 2022/23 Comparison

Turkey orange production (MMT) vs bearing trees (million units), MY 2019/20- MY 2020/21- MY 2021/22 and MY 2022/23 Comparison

Consumption

In MY 2022/23, orange consumption is expected to decrease to 1.06 MMT due to lower production and high market prices as a result of low yields. The MY 2021/22 orange consumption was realized at 1.3 MMT. The MY 2020/21 consumption totaled 1.02 MMT.

The average retail price for oranges increased 141.7 percent in 2022 when compared with the previous year. Moreover, the retail prices are about three times more than the farm selling prices due to middlemen and transportation costs marking up the prices as the product makes its way to retail shelves. Other citrus fruits also face large price differences in the domestic supply chain between farm gate and retail prices for the same reason.

Click here to read the full report.

Source: fas.usda.gov