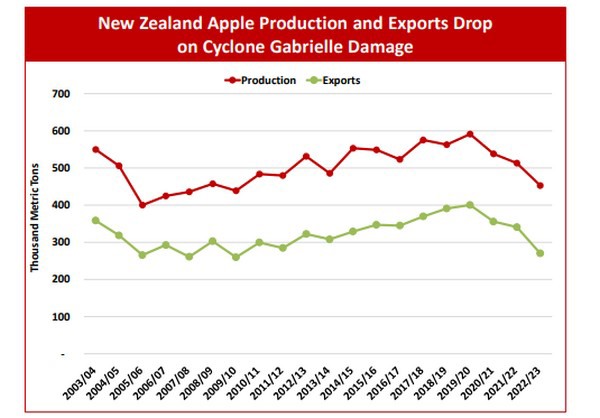

New Zealand’s apple production has suffered 3 consecutive years of decline after peaking in 2019/20. From 2020/21 through 2021/22, losses were mostly due to a COVID‐19‐related labor shortage. Immigration restrictions caused a severe shortage in seasonal labor, preventing orchards from being fully harvested. Successfully navigating those trials, growers were expecting a very good season in 2022/23 when New Zealand’s apple industry suffered catastrophic damage from Cyclone Gabrielle in February 2023, destroying years of investment to expand production.

Prior to 2020/21, New Zealand’s apple production had been on a long‐term upward trend, recovering from a two‐year period of damaging weather beginning in 2004/05 during which hail, heavy frosts, and persistent wet conditions significantly impacted production.

Production had slowly regained that lost output, reaching records in 2019/20 for both production (591,200 tons) and exports (400,400 tons), and accounting for 13 percent of Southern Hemisphere production. Planted area also expanded during this period, rising 9 of the last 10 years, increasing nearly 270 hectares per year on average. Major investments have been made in converting orchards to newer higher‐yield varieties preferred by consumers in overseas markets. New Zealand exports two‐thirds of its production and ships to over 60 countries. Shipments account for 5 percent of world exports and 20 percent of Southern Hemisphere exports on average. The top markets in 2021/22 were China, Vietnam, European Union, Taiwan, and the United States.

Despite the COVID‐19‐related declines the two years following 2019/20, acreage continued to expand though at a reduced rate, and investments continued with the ongoing replacement of older blocks of trees with new varieties. The past several years also saw significant investments in packhouses to improve efficiency with increased automation, including camera technology for grading and robotics for packing and stacking. The last 2 seasons were marked by lower supplies, but producers managed to sustain output of over 500,000 tons, which have now occurred 9 out of the last 10 years, and exports averaged 350,000 tons despite COVID‐19‐related logistical challenges.

After weathering those difficult seasons, 2022/23 started with high expectations and anticipation of a recovery of output to pre‐COVID‐19 levels. With the easing of COVID‐19 restrictions in New Zealand and worldwide, logistics were improving, and labor availability had improved for both orchards and pack houses. In addition, growing conditions had been ideal, and newer orchards were coming into full production.

These expectations were shattered in mid‐February when Cyclone Gabrielle hit New Zealand’s North Island at the start of the harvest, causing widespread destruction of orchards. The hardest hit areas were Hawke’s Bay and Gisborne which account for two‐thirds of New Zealand’s production. It is estimated that nearly half the trees have been impacted with nearly a quarter destroyed or expected to die as a result of being submerged under water or covered by deep silt. There was also substantial damage to infrastructure, including to irrigation on which most commercial orchards rely.

As a result, for marketing year 2022/23, production is forecast to fall 60,000 tons to 453,000 and exports to drop 70,000 tons to 270,000, both at their lowest levels since 2009/10. As producers restore orchards, the pace of previous years’ tree replacements is expected to accelerate, increasing acreage of higher‐yield varieties that generate greater returns, such as Rockit, Envy, and Pink Lady. However, it will likely take years for the apple industry to completely recover from the full extent of Gabrielle’s damage.

Click here to read the full report.

Source: apps.fas.usda.gov