Rabobank recently published their World Avocado Trade Map, charting global avocado production, consumption and trade. According to the bank, avocado trade will continue to grow in the next few years, but the market will be more competitive, forcing operators to be more efficient and increasingly sustainable.

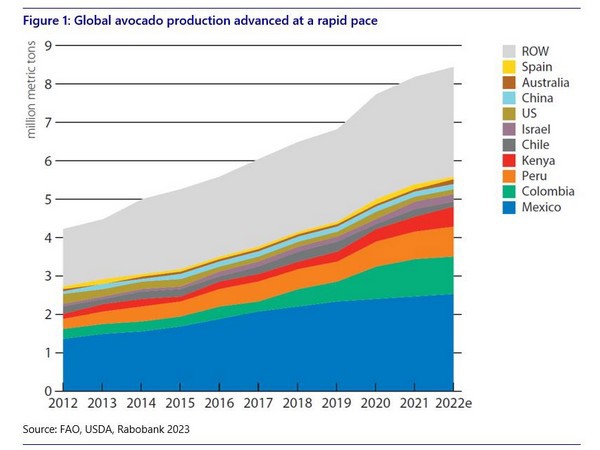

Avocado production is expanding globally, offering year-round supply to consumers. Global avocado production expanded by about 7 percent during the past decade. “Attractive prices and returns during that period were relevant drivers to expanding production in key regions,” said Cindy van Rijswick, global strategist – fresh produce, farm inputs at Rabobank. In Mexico, which currently accounts for 30 percent of global avocado output, production grew by about 6 percent during the past decade. In Colombia, Peru and Kenya, production increased roughly 15 percent, 12 percent and 11 percent during the same period, accounting for 12 percent, 9 percent and 6 percent of current global production, respectively. On the other hand, the U.S., which was still amongst the world’s largest avocado-producing countries in 2012, dropped a few places in the ranking and is no longer a top 10 producer.

Increased avocado production in countries with complementary harvesting seasons allows year-round availability in key markets, including the U.S., the EU and some markets in Asia. While production in Mexico extends year-round, it reaches a seasonal low in June and July, when production peaks in the U.S. (California) and Peru, providing steady supply to the U.S. market.

“With exports increasing at an average annual growth rate of around 8 percent over the past decade, Mexico reaffirmed its place as the largest avocado-exporting country in the world, surpassing 1 million metric tons in 2022,” said Van Rijswick. The primary destination is the U.S. where product versatility and promotional campaigns have helped to create demand for avocados. The U.S. remains the largest destination market, with imports increasing by about 8 percent from 2012 to 2022.

Exports from Peru, Spain and Kenya expanded by about 22 percent, 6 percent and 15 percent respectively between 2012 and 2022. These countries mainly supply Europe. From 2012 to 2022, imports increased in the Netherlands (up 14 percent), Spain (20 percent), France (8 percent), Germany (16 percent) and the UK (12 percent). Among the top 10 avocado-importing countries, imports to Chile grew the most.

The estimated global commercial market value of fresh avocados was around USD 18 billion in 2022.

In per capita avocado availability (used as an indicator of consumption), Mexico leads, with a global record of about 9kg of fresh avocados/person per year, followed by Chile with almost 8kg. Australia and the U.S. complete the list of countries with over 4kg per capita.

Sustainability concerns remain on the agenda for avocado producers, with water usage being the main issue discussed. Partly because of this, avocado growers have invested in advanced irrigation systems to improve water efficiency.

For more information:

For more information:

Melanie Bernds

Rabo AgriFinance

Melanie.Bernds.Smith@RaboAg.com

https://research.rabobank.com/