At the end of last week, Poland quite unexpectedly introduced a temporary ban on the imports and transit of Ukrainian agricultural products, and Hungary and Slovakia joined it a few days later. Similar measures are also being discussed in Romania and Bulgaria. Naturally, it was the restrictions on grain imports as the leading category of Ukrainian exports that got into the media’s focus.

However, EastFruit notes that many other types of agricultural products have also been banned, including fresh and processed vegetables and fruits. Although the transit ban was introduced only by Poland and was almost immediately lifted, import restrictions until June 30 are still in effect.

Let’s analyze how these measures by the neighbors of Ukraine will affect the Ukrainian fruit and vegetable market in months when the ban remains in force.

The exports of fresh vegetables, fruits, and most of their processed products, brought Ukraine a total revenue of $566 million last year, which, although less than in 2021 ($616 million), still remains one of the highest figures in the last decade.

The Top-8 products, which accounted for about 83% of Ukraine’s total export revenue in 2022, included apple concentrate (nearly a third of total revenue), various types of frozen berries (almost a third in total), walnuts (14%), tomato paste, fresh apples and fresh blueberries (8% in total).

At the same time, Ukrainian vegetables and fruits (fresh or processed) were exported mainly to the EU markets (the total share is almost two-thirds of the total revenue), as well as the USA (13%), while the share of other destinations was much lower.

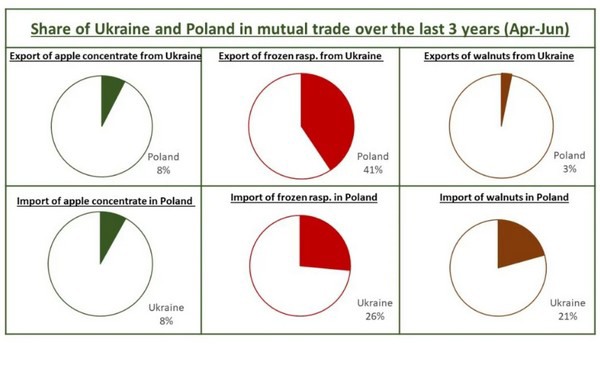

It should be noted that Poland provided almost a third of Ukraine’s foreign exchange earnings from exports in the fruit and vegetable segment in 2022. It is the import ban imposed by this country that will have the greatest negative effect on the Ukrainian industry because the total share of Romania, Bulgaria, Hungary, and Slovakia in exports from Ukraine last year was only a little over 3%.

We would like to draw your attention to the fact that, since the import ban is in effect from mid-April to the end of June, not all segments of Ukrainian exports will be affected by it. For example, exports of Ukrainian fresh blueberries peak in July-September, and the supply of frozen blueberries is also active from July. The exports of frozen strawberries will suffer from the ban, but it will almost not be reflected in the overall picture of the Ukrainian fruit and vegetable market due to the small volumes.

Ukraine will suffer the greatest damage from the ban imposed by Poland on the fruit and vegetable market in the segment of frozen raspberries. On average, Poland provided over 40% of all proceeds of Ukrainian exporters from frozen raspberry exports in April-June over the last three years.

For more information: east-fruit.com