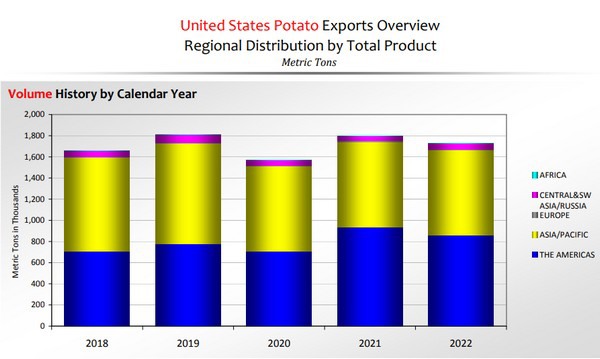

In 2022, U.S. potato exports reached a record $2.1 billion in sales. Compared to 2021, volume sales declined -4.2% but were higher than 2018 and 2020 (fresh weight equivalent). The value of U.S. potato exports rose across all potato types (frozen, fresh, dehydrated, seed, and chips), resulting in an 11% increase from the previous year. Global price hikes and inflation can be attributed to this growth.

Demand for U.S. potato products remained strong throughout 2022, showing that the slight decrease in export volume resulted from the tight supply. Over the year, the top export markets for U.S. potatoes were Mexico, Canada, Japan, South Korea, and the Philippines, in descending order.

The value of U.S. frozen potato exports rose by 13.8%, reaching $1.34 billion, while volume decreased -2.5% compared to 2021. The top destinations for U.S. frozen potatoes were Japan, Mexico, South Korea, and the Philippines. In 2022, U.S. frozen shipment volumes to Japan and South Korea increased, while shipments to Mexico and the Philippines decreased slightly compared to 2021.

U.S. fresh potato sales rose 9% to $287 million, however shipment volume, including both table-stock and chipping potatoes for processing, decreased by -9.7%. Canada, Mexico, Japan, and Taiwan were the top export markets for U.S. fresh potatoes. While fresh shipments to most markets decreased, expanding market access for U.S. fresh potatoes beyond Mexico’s border region led to an increase in fresh shipments to Mexico of nearly 10%.

In 2022, the value of dehydrated potatoes increased by 1.1%, reaching $217.6 million for the year. However, the volume of U.S. dehydrated potato shipments declined -3.2%. Canada, Mexico, Japan, and the United Kingdom were the top markets for U.S. dehydrated potatoes in 2022. Dehydrated potato shipments to Canada and the UK were up from 2021, while shipments to Mexico and Japan decreased in 2022.

Although representing smaller portions of U.S. potato exports, the shipment volume of seed potatoes and finished chips in 2022 increased by 28.8% and 2.2%, respectively, compared to 2021. The export value in 2022 amounted to $16.3 million for seed potatoes and $211.6 million for potato chips.

Throughout the year, maintaining a consistent supply of U.S. potato products was a significant challenge for exports. By year-end, the U.S. potato supply stabilized in some export markets, including South Korea and Myanmar. Despite inflation-driven price increases of U.S. products, global demand for U.S. potatoes remained strong. Importers, foodservice operators, and retailers in key markets reported their preference for U.S. potatoes over competitor products, and several buyers returned to purchasing U.S. potatoes when supply became available again.

For details on U.S. potato exports, click here.

For more information:

Potatoes USA

[email protected]