It is common for European tomato prices to fall in November. There are usually overlaps during the switch from local crops to imports, which depresses prices. This year, however, that price dip was far more severe than normal. And thus, the tomato market's more extreme peaks and troughs continue. A development that started in the summer of 2021.

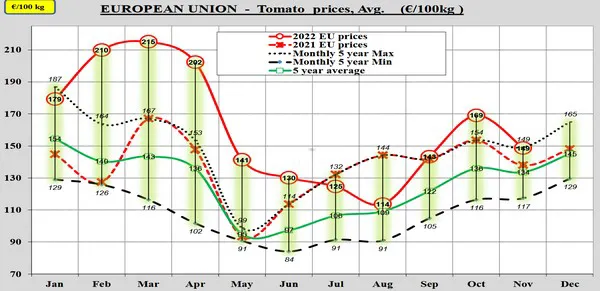

Across the board, according to the European Commission's tomato dashboard, a kilo of tomatoes costs €1.49 in the European Union. That price is at a five-year maximum and above the five-year average.

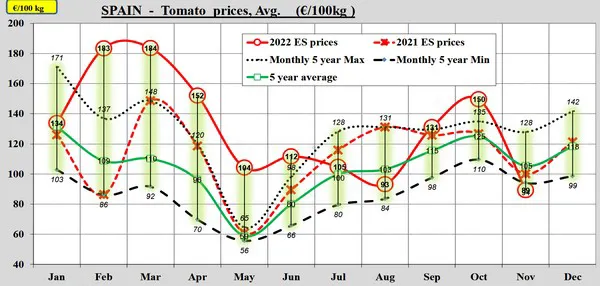

That is the case in three of the four countries on that board, with only Spain dipping below that five-year average.

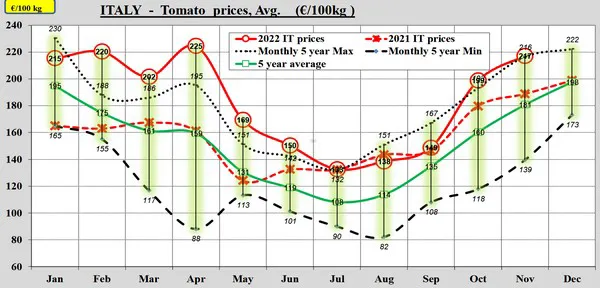

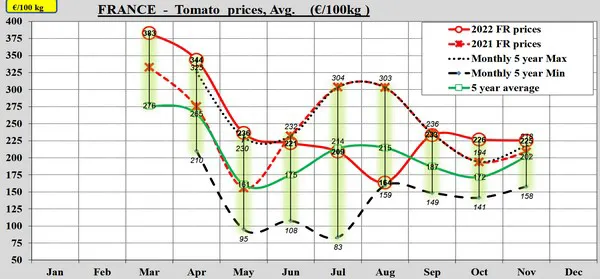

From October to November, prices in all the markets decreased. That is not unusual in Spain and the Netherlands, but it happened in Italy and France this year too.

On the contrary, both those countries had seen their prices climb in recent years. In France by 18% and by 13% in Italy.

Average kilo prices in France and Italy are still well above the European average, though. People in those countries have to pay €2 more per kg of tomatoes. In the Netherlands, a kilogram costs €1.16, and in Spain, €0.89.

December prices lagging too

The tomato market's first weeks of December can also be considered difficult, perhaps even bad. Some Dutch and Belgian tomato growers had a fall crop and had hoped to benefit from lower supplies of tomatoes grown under lights counting on slightly higher kilogram prices. Given the summer's market noises, the Spaniards, meanwhile, were surprised that Northwest European tomato supplies remained as high as they did for as long as they did.

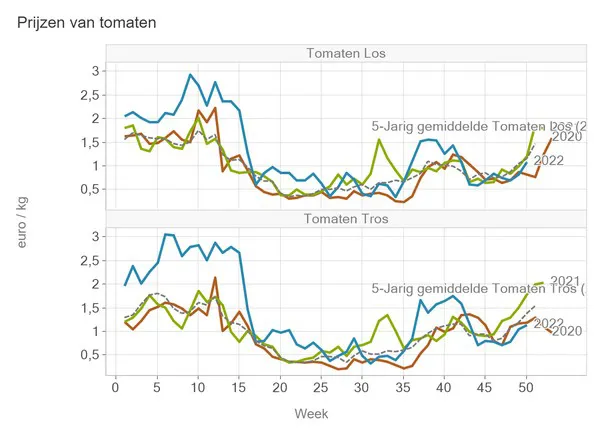

Belgium is not included on the EC tomato dashboard. However, the graph below shows that, in November, tomato prices fell below the five-year average and stayed there. The Belgian Horticulture Cooperative Association (VBT) supplied these figures.

VBT figures up to week 50 from the Flemish Department of Agriculture and Fisheries' agricultural figures.

Even less local supply in January

As with the fall tomato crop, lower supplies are expected in January, dropping even lower in February. Despite increased tomato acreage in Spain, tomato cultivation in Morocco, and tomatoes from countries like Turkey, prices are set to rise. Here, the fact that it is usually hard to get good quality TOVs to northwestern Europe, given the distances, also plays a role. Those tomatoes could become particularly scarce later this winter.