Dutch data-analysis company, A-INSIGHTS, does not believe intuition and experience are enough to make the correct strategic decisions. You need reliable insights. That is why this company analyzed around 400 European fruit and vegetables companies' financial data. They are in four chain links: breeding, cultivation, trading, and processing. They did so for 2016-2019. They also mapped out the most important developments within the sector. This is all in a trend report which drew a few noteworthy conclusions.

Added value equals more sales

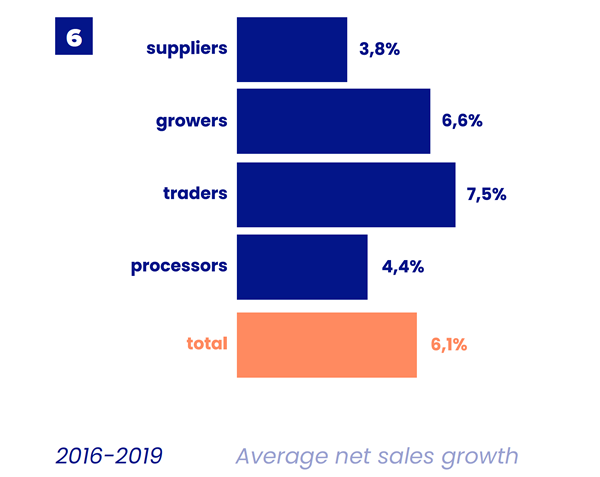

Added value is key for the survival of fruit and vegetable segment players. Traders realized the highest growth rate within the value chain. That averaged 7.5% and is in addition to volume growth. They did so by:

- Expanding with more exclusive fruit and vegetables, like exotics.

- Adding smart process steps like ripening avocadoes and mangoes.

- Creating concepts such as meal packs with extra added value.

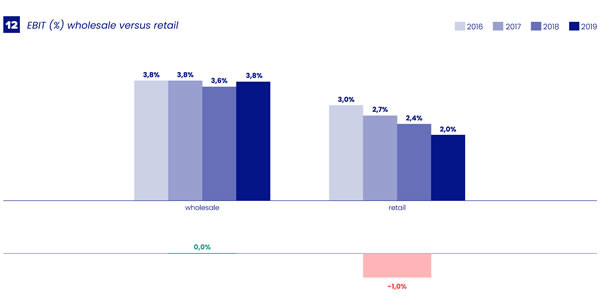

More profitable to focus on wholesale than retail

In the years examined, retail suppliers' margins were under great pressure. Increased legislation and regulations drive that. But also, (contract) prices do not compensate for the higher level of service required. Increased labor costs relative to sales is particularly striking. A-INSIGHTS did not see this development in the wholesale segment. That fuels the idea that many suppliers are becoming more interested in that sector.

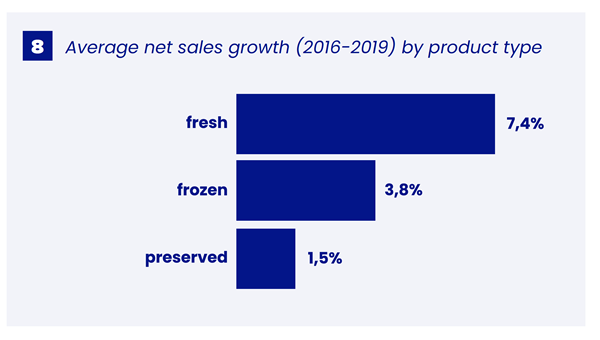

Fresh sector companies grew 5 x faster than those in the canning sector

Fruit and vegetable companies demonstrated healthy growth in the specific period. That was a yearly average of 6.1%. Consumers increasingly prefer fresh fruits and vegetables (7.4% growth). That is rather than frozen (3.8% growth) and canned (1.5% growth) products. These are considered less healthy. Within the fresh fruit category, businesses focusing on more exclusive fruits such as exotics and soft fruits are expanding most.

You can download the report, for free, via this link. It also delves further into:

Which chain links performed best in the 2020 COVID-19 year.

Which chain links performed best in the 2020 COVID-19 year.- Which chain links are most profitable. But why there, too, margins are still under pressure.

- Why processors should watch their returns closely.

For more information:

Miriam van der Waal

A-INSIGHTS

Email: miriam.van.der.waal@a-insights.eu