Supermarkets and fresh produce retailers say the key to surviving and thriving through the pandemic has been the ability to be agile and keep up with the constantly changing environment.

Produce Marketing Association Australia-New Zealand released its State of the Industry report at Hort Connections. It included a panel discussion involving three key members of the horticulture industry; Head of Produce at Woolworths Supermarkets Paul Turner joined Hort Innovation's Chief Executive Officer, Matt Brand and Harris Farm CEO Tristan Harris.

Mr. Harris explains that the thing with innovation is that it is tied to pace, and some parts of the industry have kept up and others have not.

"You cannot separate innovation and speed," he said. "What we saw through COVID-19 was a massive agility dividend; if you do things quickly, you survived and you thrived. If you did things slowly, it was really, really painful. Smaller organisations like ours have a huge advantage in that situation because we can turn on a dime. That plays out across all of the industry because your ability to turn, even if you weren't being particularly innovative, just doing something in a new way but very quickly – that was the answer to last year. I have never seen a team more enthused (than ours) because they thought that they were winning and our culture came together. We have been persistent in driving flexibility to the team. We feel that our mental health levels in the business actually skyrocketed because we were one of the companies that had a benefit during COVID."

Harris Farms is an independent retailer, which started off as fruit and vegetable shops, and has expanded its range to cover more categories of fresh produce. It is based in Sydney and has around 25 stores nationwide.

At the other end of the scale in terms of company size is supermarket Woolworths, and Mr. Turner told the panel that while the "ship was larger to turn around", he feels that the challenges of the pandemic made the whole company more "laser-focused".

"Our teams were able to focus purely on how do we deliver to customers when you have around 1,000 stores around the country," Mr. Turner said. "You really have to work well through your whole supply chain, and I cannot compliment the growers enough on how they came to the party for us to be able to deliver stock to our stores through that period. It was an amazing effort from everybody. Getting everyone focused on a crisis situation isn't difficult to do because you have no other option. To maintain that focus and to make sure that you don't work in crisis mode all the time and end up with fatigue was the hardest thing. We had trouble pulling them back, so I am amazed at the productivity."

Mr. Turner also revealed Woolworths has a number of trends that have amplified and continued since the outbreak of the pandemic, where online sales have grown exponentially and the company accelerated three years of planned growth in the space of three months.

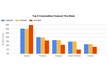

"There was also a growth in localisation," he said. "We saw people leaving the CBD, so localised neighbourhood centres became more frequently shopped. We also saw the independents like IGA and other local stores picking up a lot of market share, and that trend has continued in more recent times. I think the other thing we saw was scratch cooking became more of a focus during lockdown periods, and that has continued. Around 75 percent of people are now cooking a home meal once a week, which is a significant increase in pre-COVID times. What we are seeing is people are starting to buy back into categories that were in decline and hard vegetables such as potatoes are a good example. The category had been in decline for about 20 years in consumption, but what we have seen is uptake and people learning how to cook and prepare potatoes."

While trends relating to holistic well-being also came into focus during the pandemic, Mr. Turner points out that they had been emerging for many years now.

"It started in the higher socioeconomic population, with people with more expendable income but we are seeing it spread down into mainstream society," Mr. Turner said. "People are buying into organics or just healthier options. We have seen that growth and seen it consistently for years. So, it is not necessarily a COVID impact. From the data about restaurants, we can see that they are on the increase again. They are up considerably, so people have gone back to being social and getting out and about. People are much more comfortable here than in other countries."

Matt Brand from Hort Innovation notes that the erratic consumer demand that occurred at the height of COVID has settled down a bit, while at an industry level, research and development are still continuing strongly.

"We saw that snacking as a consumer behaviour increase, and we saw the emergence of the 'home economy'," he said. "People were trying to be a master chef at home, but I think for our industries that were exporting there was an enormous amount of uncertainty. That will be an ongoing challenge, but ultimately consumers need to be fed, and you can't turn a tree off. In some categories, we have seen a drop in production, but we have seen value going up. From a Hort Innovation perspective, we still have 460 projects that are alive, but our challenge is how to monitor and evaluate their success with the lockdowns. We have seen a phenomenon of people wanting to support farmers, and we want to ride that and keep driving it."

He also says the pandemic has also forced growers to become more entrepreneurial and multi-skill, where office workers were having to drive tractors and do manual work in a packing shed. While, he agrees that automation in the field will be the next frontier in the horticulture industry, on the back of technological advancements in food safety and traceability.

But one of the biggest challenges for the whole industry is the labour shortage, largely due to the Australian government closing the borders during the pandemic, meaning farmers and growers cannot access foreign workers, mostly backpackers.

"We have worked with the industry since COVID hit to identify what was the gap," he said. "It has become quite political, which we're not allowed to be, but what we do is provide the industry with data so it can advocate. We have just done another wave of that research and trying to quantify the future; there's no point looking back, as COVID has already hit. We are now in the peaks and trough, so we are looking forward to what are the challenges across different commodities in different states. We know that the next summer there will be significant challenges. Sure, there are opportunities with automation and robotics, and they are being invested in, but the here and now is identifying gaps so they can be filled."