HMRC have now released trade data covering up to the end of February 2021. In January, after the end of the transition period to leave the European Union (EU), we saw some teething issues in exports. Did these continue into February?

Well in February, ware exports for both processed and fresh sectors increased from January’s figures, though still lag previous years February figures. Whereas overall seed exports and ware imports fell substantially January to February.

As Alex mentioned in last month’s January round-up, HMRC’s data collection method changed from January 21 onwards. The method now collects monthly volumes by customs declaration. Previously, data was collected on physical movement and so when comparing to previous monthly trade figures, this should be considered.

Exports

Fresh exports to the EU totalled 9.3Kt in February, up from 6.9Kt in January. Spain, Belgium, and the Irish Republic were the main destinations. Despite a rise in fresh exports from January to February, the volume exported is well below the average monthly fresh EU exports before the end of the transition period (July-December 2020). It also lags well behind previous years indicating that there could be continued issues with exports. .

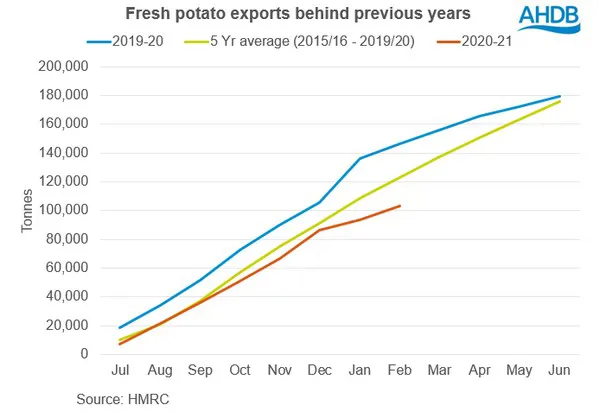

Combined total fresh exports (EU and non-EU) totalled 9.6Kt for February, bringing the total season-to-date figures to 103.0Kt; behind the 5-year average for July-February by 19.8Kt.

Processed exports increased from January to February too. The largest actual increase was felt by the frozen sector, exporting 614t* more (58%) to total 1.7Kt*. This is however, lower than previous years. The Irish Republic remains the key destination for frozen exports. Though even these fall well behind the February 5-year average by 1.3Kt* (61%).

Crisp, canned and dried exports also increased from January to February, but lag behind the 5-year average for February by 38%, 28% and 2% respectively.

Imports

Both fresh and processed imports fell, January to February. Frozen imports reduced the most from January to February, falling by 6.7Kt*. Compared to the 5-year average for frozen imports, February 2021 is down 41% at 30.1Kt*. Starch, dried, crisped and canned imports are also behind the 5-year average for February figures too.

Fresh imports totalled 3.1Kt in February 2021 with the most prominent origin, Cyprus. This is down 48% from January and 68% from the February 5-year average (2015/16-2019/20). Season-to-date (Jul-Feb), fresh imports total 57.9Kt. This sits 8.8Kt below the 5-year average.

For more information: ahdb.org.uk