European physical markets

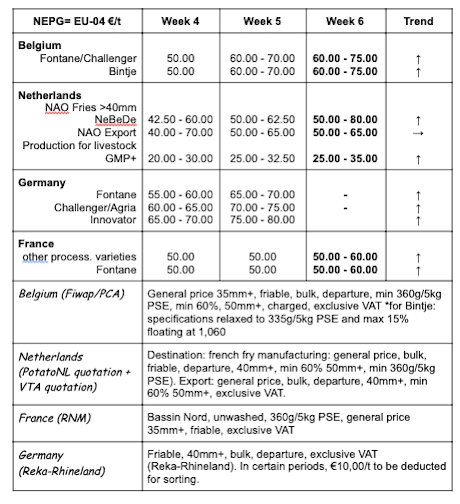

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: several factories are still buying to cover the limited needs, but the markets are mostly driven by the demand for potatoes to complete the shortage of volumes under contract, especially through intermediate trade. The offer is (very) low due to the low temperatures and higher prices.

Bintje, Fontane, Challenger: 6.00 to 7.50 €/q, with the highest prices charged to complete the contracts. Firm markets.

Bintje plant: little trade, but prices are firm. The small calibers are difficult to find (almost no offer). Dutch/French/Belgian plants, class A, returned March 2021, by 10 tons, in big-bags, excl.VAT:

Caliber 28 - 35 mm: momentarily no quotation due to lack of offer;

Caliber 35 - 45 mm: 52.00 to 54.00 €/q, firm prices.

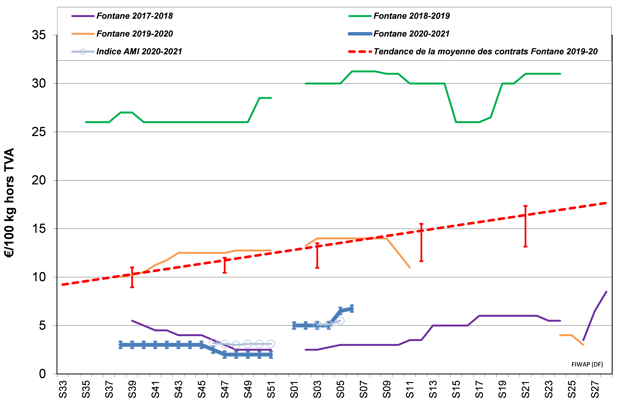

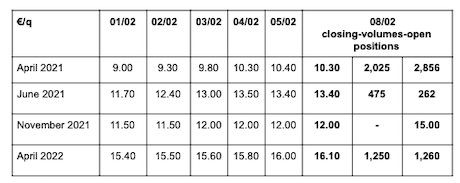

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

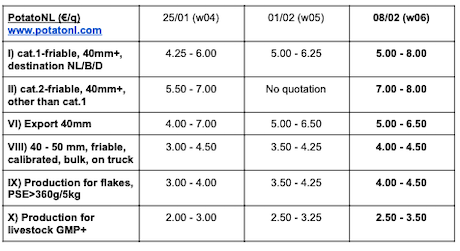

Netherlands

Markets remain firm and prices are still up, following the trend in Belgium and Germany. The offer at the prices charged before the New Year was almost non-existent. The factory activity picking up again at the beginning of January and the need to complete the shortage of volumes under contract (for both producers and intermediate trade) have boosted the demand and pushed prices up. Planned offers (tenders) have recently been made at 7.00 €/q for immediate delivery, and up to 12.00 €/q for June. For the industry, prices are currently between 5.00 and 8.00 €/q, depending on the variety. The domestic fresh markets have not evolved as much, and prices remain between 9.00 and 14.00 €/q for the soft flesh varieties, and up to 16.00 €/q for the firm flesh varieties. Export is not yet back to its activity level from before Christmas, trade remains sluggish and prices are under pressure at 5.00 - 6.50 €/q at the producer.

France

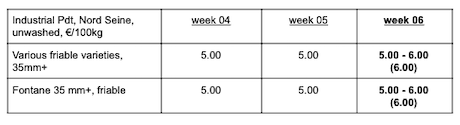

Processing market: mostly driven by purchases to replace the shortage of volumes under contract (between producers and through intermediate trade). The industry is buying very little (prices still around 5.00 €/q), using its contracts with no or very little delay. For export, trade remains complicated for the non-washable varieties, but the demand for red varieties is still good. Italy and Spain are buying, with slightly lower prices for Italy, and stable prices for Spain. Eastern countries are not very present.

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

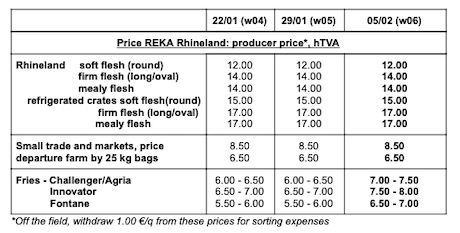

Fresh market (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q, before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.25 €/q, before last quotation). Except for the merchandise from refrigerated crates-pallets with a 3€ higher validation (see REKA prices in table below!).

Processing market: firm market and prices are up again: 7.50 - 8.00 €/q for Innovator (6.50 - 7.00 € last week), 7.00 - 7.50 €/q for Challenger/Agria (6.00 - 6.50 €/q last week), and 6.50 - 7.00 €/q for Fontane (5.50 - 6.00 €/q last week). Firm prices for the crisps varieties between 7.00 and 11.00 €/q.

*Organic potatoes: unchanged producer prices around 41.00 €/q (all varieties and markets combined), returned trade. Expected increase...

The lockdown stimulates the consumption of potato products

In 2020, the household consumption of frozen fries increased by 19% compared to 2019. Consumers paid 1.65 €/kg for fries on average, which is 7 euro cents less than a year earlier, but 10 euro cents more than in 2018. The consumption of croquettes increased by 16%, while the consumption of chips/crisps increased by 15%. The crisps (chips) cost 6.79 €/kg on average (3 euro cents less) for the consumer. As for organic products, the consumption of fries increased by 46%, with an average price of 6.63 €/kg (4 times more than conventional fries) and the organic chips cost 15.72 €/kg on average.

Great Britain

Average price free markets for the week ending on January 30th (week 3): 13.53 £/q [14.89 €/q]. Lower by 2.4% (3.31 £/q).

With the lockdown, the packaging sector remains the main source of demand for potatoes. On the wholesale markets, although the traded volumes vary significantly, Maris Piper gets a premium over the white varieties, both in the packaging and processing sectors. Peeling and processing are still faced with the closure of most of the hotel industry. Prices have remained stable, but the volumes are still disappointing.

For more information:

FIWAP

www.fiwap.be