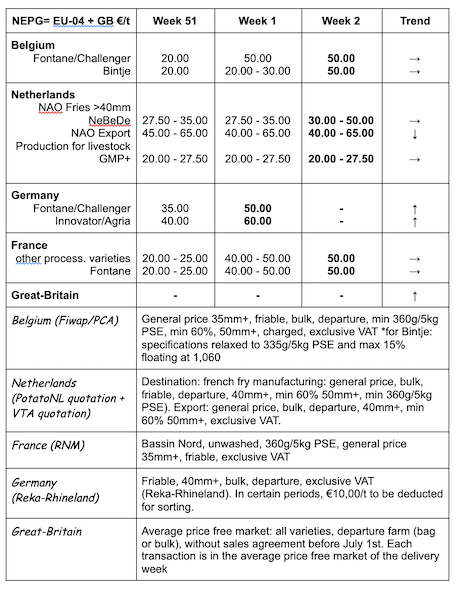

European physical markets

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: since the beginning of the year, several factories are buying on the market. The offer remains limited despite the recent price increase.

Bintje: 5.00 €/q for the normal qualities/excess tons.

Fontane, Challenger: 5.00 €/q.

For the 3 varieties, some formal offers for purchase at higher prices are still observed, both for direct and delayed deliveries (until June).

Bintje plant: little trade, but firm prices. The small calibers are difficult to find (almost no offer). Dutch/French/Belgian plant, class A, returned March 2021, by 10 tons, in big-bags excl.VAT:

Caliber 28-35 mm: 68.00 - 69.00 €/q

Caliber 35 - 45 mm: 42.00 - 45.00 €/q

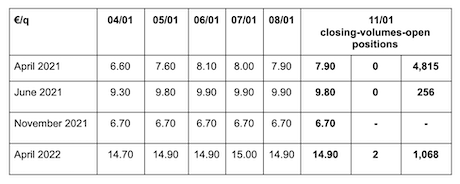

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

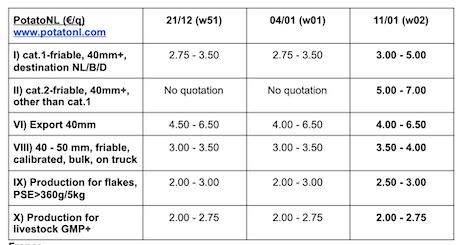

Netherlands

For the industry, the markets recovered quite strongly last week, at prices varying from 5.00 - 6.00 €/q (direct delivery) to 8.00 - 9.00 €/q (April - May). The better mood is due to the new optimism found in the fight against Covid-19. The large-scale vaccination makes it possible to imagine the reopening of restaurants and their related markets, which will improve the sales possibilities for the factories. But there is also some pressure related to signing contracts for 2021/2022: lower prices and explosive costs for germination control are making producers reluctant to sign. Export did not really start yet last week. The domestic fresh markets are considered to be “normally active” with producer prices around 10.00 - 15.00 €/q for soft flesh varieties, and 18.00 - 20.00 €/q for the firm flesh.

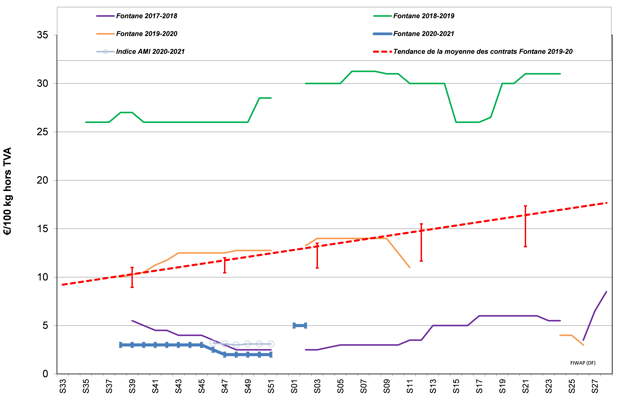

France

Processing market: against all expectations, factories were buying again before and after the New Year, resuming their activities after the holidays. However, the general lockdown (Netherlands, Germany, United Kingdom) is once again clouding the immediate prospects for recovery. The transactions observed at around 5.00 €/q, but the volumes concerned remain limited in a context where there is sometimes a lack of offer on some contracted varieties. We still note some purchases through intermediate trade at higher prices (6.00 €/q). On the fresh markets, prices are sustained for the red varieties (requested in Romania and Portugal) on a basis of 16 to 18 €/q, more debated for the white varieties at 13-15 €/q, up to 18-20 €/q for Agata. The demand for the very nice quality is maintained. No demand for out-of-home catering, so only the supermarkets remain, alongside the short circuits. Export is turned to Spain, Portugal and Italy. Romania is quite present among the Eastern countries.

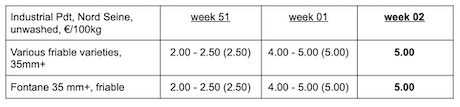

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

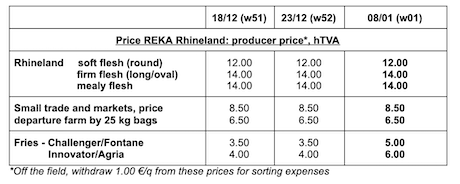

Germany

Fresh market (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.17 €/q before last quotation).

Processing market: firm and rising market. Prices: 6.00 €/q for Innovator/Agria (4.00 €/q last week), as well as for Challenger/Fontane at 5.00 €/q (3.50 €/q last week). Firm prices (with widening of the range upwards) on the varieties for crisps. Between 5 and 9.00 €/q.

Development of the consumption: the consumption of fresh potatoes by households has increased in the past months. Compared to October and November 2019, there was a progress of 12 and 6.9% respectively in 2020. For the first 11 months of 2020, there was a 12% increase compared to the first 11 months of 2019.

The increase in purchase is particularly noticeable in supermarkets (excluding low-cost chains), sales at the farm and via the internet.

Organic potatoes: unchanged producer prices around 41.00 €/q (all varieties and markets combined), returned trade. We also note some progress in consumption for organic potatoes, with a 22% increase in November 2020, compared to November 2019. On an annual basis, this should translate to a 4% increase. Organic potatoes represent 6.9% of the potatoes purchased by consumers.

Great Britain

Fresh markets: trade after Christmas was described as slow in most sectors. Packers were still very busy last week, although most of their needs are covered by supply contracts. Most are waiting to see what impact the latest lockdown measures - introduced last Tuesday - will have on the demand. Fish&chips shops are better prepared than during the first lockdown and could stay open, but their business will still be hampered by the travel restrictions. Processing market: usually, additional orders are expected after the Christmas rush. But it is not the case this year. The closure of schools early last week has consequences: some clients now have too much in stock, having prepared for the return of the students. The complete closure of all restaurants further reduces the sales opportunities for finished products. Like in the first lockdown, the demand in supermarkets will probably be sustained, but this will only marginally make up for the loss resulting from the closure of restaurants. Many locations selling food are now better equipped to offer take-away options, which makes it possible to maintain some trade.

Spain and Portugal

Source: VTA Nederland: in Spain, the 2020 surfaces are expected to decrease significantly. The reason behind this are the low prices in western Europe combined with the lack of tourism. The surface decrease in Castilla y León could reach 20%. In the south of the country, the early potatoes in the Cartagena region are planted. The region of Seville, however, has fallen behind because of the winter weather conditions, and 20% of the surfaces still remain to be planted. In Portugal, surfaces are also expected to decrease from 10 to 15% in the north of the country (late harvest), while the planting of the early potatoes is also delayed.

For more information:

FIWAP

www.fiwap.be