European physical markets

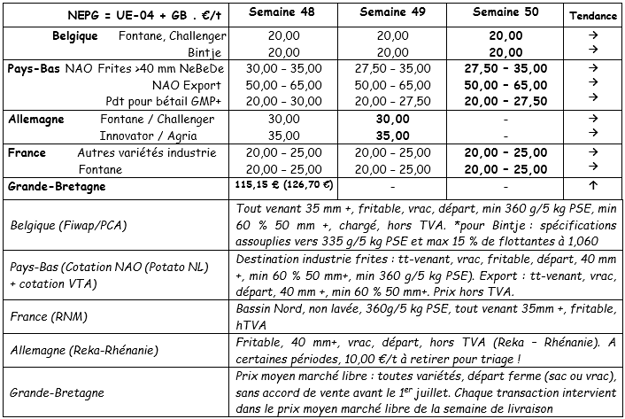

Price report (source: NEPG):

Belgium

Fiwap / PCA Markets Report:

Industrial potatoes: very little demand for free ones. Although many industrial agents are setting a purchase price, they are not actively seeking volumes. The transactions observed mainly concern surplus tons. The supply is also very scarce, even though batches with uncontrolled germination are also offered. The delivery of contracted volumes is generally done on time.

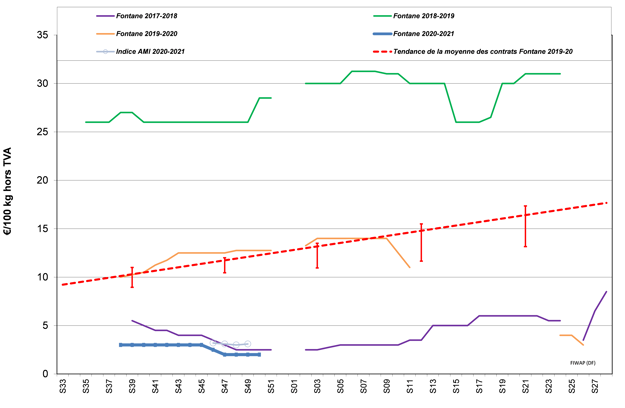

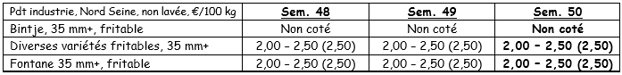

Fontane, Challenger, Bintje: between € 2.00 and 2.50 / q; most recurring price is € 2.00 / q.

For some varieties (Bintje, Markies, etc.) and higher quality batches (for industry or for frying), prices are (considerably) higher.

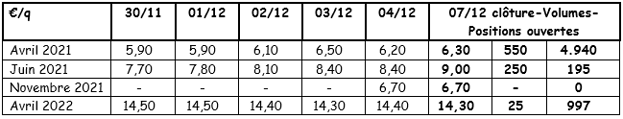

Futures market

EEX in Leipzig (€/q) Bintje, Agria and varieties for transformation, 40 mm+, min. 60% 50mm +:

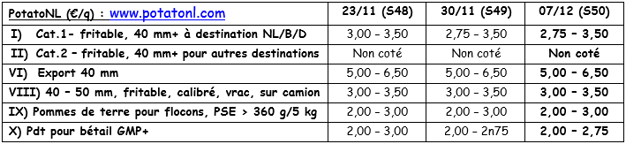

Netherlands

Unchanged trends and situation in the Dutch markets. December will remain (very) calm and the end of the year holidays will be used for the maintenance of equipment and production lines. Industrial activity should largely stop during weeks 52 and 53. The uncertainty persists in the new year. Will the vaccination campaigns have a real and immediate effect on the return to "normality" for the different markets? The reopening of hotels, restaurants, cafes and points of sale is of vital importance for the fresh potato chip market, as are the sales channels for frozen products (European retail and large export). In general, the contracts with the industries are coming to a close and the surplus tons are going to alternative markets (flakes and cattle) for between € 2.00 and € 3.00 / q. Things continue to go smoothly in the fresh produce markets. Exports are going better than expected, with shipments going to Africa combined with onions, and to the Caribbean, with producer prices ranging between € 5.00 and € 6.50 / q. The distribution of fresh potatoes is still going better than in "normal times". In the medium term, prices will also depend on an eventual forced supply, in case the germination hasn't been kept under control in the warehouses.

France

Industry: practically no purchases from industrial agents; prices stable at € 2.00 - 2.50 / q, depending on variety and quality, mainly for surplus tons from contracts. However, purchases have been made by intermediaries at higher prices (from € 4.00 to € 6.00 / q). Closing of lines in progress or planned for the end of the year. Some delays in the delivery of contracts have also been observed. Prices at € 3.00 / q for the Innovator and Russet. The fresh produce markets are extremely quiet. There are chances for the very high quality ones, but things are much more difficult for intermediate or low quality ones. The export is dominated by Spain, while Italy, Portugal and the eastern countries are backing down. Producer prices range between € 10.00 and € 13.00 / q for the yellow varieties and reach up to € 15.00 - € 17.00 / q for the red varieties.

Unwashed industrial potato, for export, excluding VAT, north of the Seine, € / qt, min. - max. (mean) (RNM):

Industrial activity (source: GIPT): French factories have worked with 381,000 tons of potatoes between July 1 and October 31; an 8.5% drop in terms of volume (36,000 tons) compared to 2019. 77% of this supply has been made through contracts.

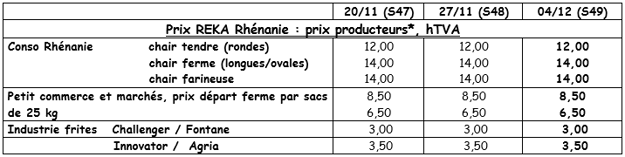

Germany

Fresh produce market (early and semi-early): prices for waxy potatoes unchanged: € 10.83 / q (€ 10.83 / q last week). This is also the case for starchy potatoes: € 10.17 / q (€ 10.17 / q last week). The demand is normal. Abundant defects detected; batches of medium to poor quality go directly to biogas, flakes or livestock. Peelers are less active, while farm sales are better. Quiet exports, except for those to distant destinations like Africa and Asia.

Processing market: stable and without changes. Contracts prioritized by the industry. Prices: € 3.50 / q for the Innovator / Agria and prices without changes for the Challenger / Fontane at € 3.00 / q. Stable prices for crisp / chip varieties. Between € 5 and € 8.00 / q. The production of flakes and chips / crisps is very active. In the potato chip market, there is a good demand for longer varieties (Innovator & Co) for fast food catering.

When potatoes are leaving the field, € 1.00 / q must be subtracted from the prices for the sorting expenses

Organic potatoes: producer prices unchanged at around 41.00 €/q (including all varieties and markets).

UK

Prices on the free markets (including all varieties): for the week ending 11/28: £ 11.52 / q; that is, € 12.67 / q.

For more information:

FIWAP

www.fiwap.be