European physical markets

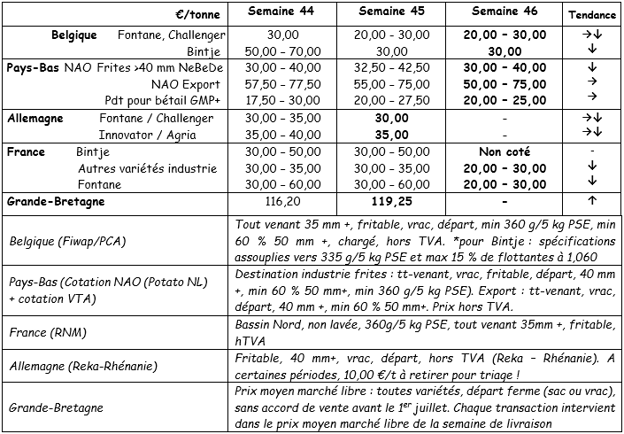

Prices overview (source: NEPG):

Belgium

Market report Fiwap / PCA:

Industrial potatoes: the markets are weak, without changes in the prices, but, apart from a few batches of contract surpluses, there are very few transactions. The industry is not interested in rare varieties and, with the exception of a few limited shipments to Africa, exports are virtually non-existent. The supply is generally small, but when the harvesting activities were completed, a number of batches were still available.

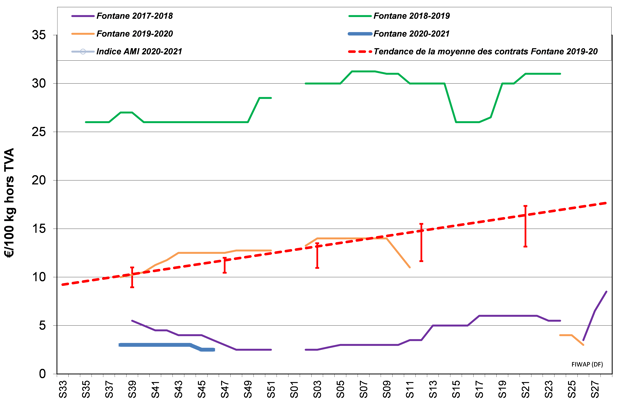

Fontane, Challenger: prices between 2.00 and 3.00 € / kilo; weak market; very few transactions in an inactive market due to lack of demand.

Bintje: prices at around 3.00 € / kilo. The supply is greater than the demand.

Bintje planting: little trade, buyers and sellers waiting... Dutch plantings, class A, delivered in March 2021, per 10 tons, in big bags excl.

Size 28 - 35 mm: 66.00 - 68.00 € / kilo

Size 35 - 45 mm: 43.00 - 45.00 € / kilo

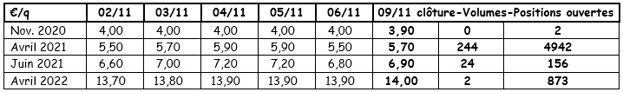

Futures market

EEX in Leipzig (€ / kilo) Bintje, Agria and related industrial varieties, 40 mm, min 60% 50 mm:

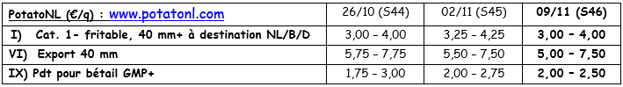

The Netherlands

The slow progress in the harvesting in the main regions last week has not put much pressure on the markets. According to the VTA, between 5 and 10% remains to be harvested in the entire country and up to 25% in the Dutch coastal areas. The partial lockdown has led to a further slowdown in industrial activity. On the one hand, this means that the fresh chip lines have largely come to a standstill, but on the other, the production activity for frozen products is almost normal.

A positive consequence of the partial lockdown is that the activity on the fresh markets is very good. The export activity, on the other hand, remains limited. Only the overseas destinations remain, with normal volumes and prices ranging between 5.00 and 7.50 € / kilo for the producer and 8.50 and 11.00 € / kilo for potatoes sorted according to size and quality.

France

Industry: Last week, prices stood consistently between 3.00 and 4.00 € / kilo, depending on the variety, with certain manufacturers and dealers always buying for immediate delivery at prices close to or higher than the prices set, especially for sensitive varieties. The downward trend was confirmed this week, with prices falling to between 2.00 and 3.00 € / kilo.

Exporting remains difficult, but some shipments are going to Spain and Portugal. The Eastern European countries and Italy have a very small presence. Grower prices range between 13.00 and 16.00 € / kilo for the basic quality. Prices are slightly higher for the red varieties, with around 18.00 € / kilo, and the top quality Agata potatoes reach 20.00 € / kilo.

The harvesting is being completed under slightly better conditions. However, there are problems in the crop's preservation related to the moist storage conditions and/or early germination.

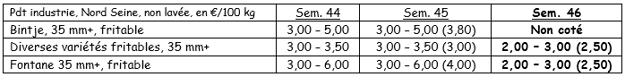

Industrial varieties, bulk, export, excl. VAT, Nord Seine, € / kilo, min - max (average) (RNM):

Germany

Fresh market: the demand is good. Due to the closure of restaurants and canteens, consumption by households is increasing. In the Rhineland, buyers have to pay 2 € / kilo extra for storage potatoes. A reduction has been reported in the purchase of potatoes for peeling and of all products normally demanded by the Horeca and company canteens / restaurants.

The industrial market: the harvest is well underway and will likely be completed soon. The industry is mainly focused on contracts. The demand for rare varieties is weak after the resurgence of the coronavirus. The activities of chips manufacturers are going very well. This is also reflected in rising prices (1 to 2 € / kilo). The same goes for the manufacturers of potato slices (although this is not reflected in the prices).

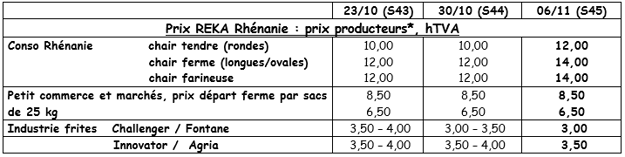

* If no work is done on the fields, 1 € / kilo in sorting costs must be deducted from the price

Fresh market (early and semi-early potatoes): the price of firm-fleshed potatoes remains unchanged: € 10.83 / kilo (€ 10.83 / kilo last week) and that of floury / floury potatoes has changed only slightly, with € 10.17 / kilo (10.08 € / kilo last week). Sales in supermarkets are good thanks to the coronavirus. A surcharge of 2.00 € / q applies for the potatoes that are taken from storage.

Industry market (storage potatoes): Less robust market. Prices at around 3.50 € / kilo for Inno / Agria (between 3.50 and 4.00 € / kilo last week), and slightly lower for the Challenger / Fontane, with around € 3.00 / kilo (between € 3.50 and € 4.00 / kilo last week). The industry is mainly focused on the contracts.

Organic potatoes: grower prices at around 41.00 € / kilo (all varieties and markets together). Prices are negotiable.

UK

Prices in the rare varieties market (all varieties together) stand at around 11.93 € / kilo. The impact of the second wave of the coronavirus is clearly noticeable in the supply of fresh products, with volume increases of up to 20% in certain segments. Top quality potatoes are scarce. The demand for baked potatoes (including that from Fish & Chips stores) is almost non-existent. The growers have been trying to identify the batches that couldn't be properly stored. Grower prices for peelers remain at around £ 5 / kilo for bagged potatoes, and between € 13.00 and € 14.00 / kilo for sorted Marquis and Agria potatoes.

For more information:

FIWAP

www.fiwap.be