European physical markets

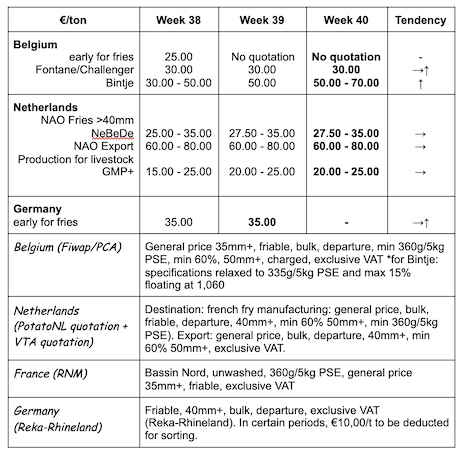

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Processed potatoes

Fontane Challenger: 3.00 €/q, stable market; very little offer (given the difficult harvesting conditions and the very low prices) and very low industrial demand (the factories work between 80 and 90% and are satisfied with the field output contracts). Very few transactions, except for some volumes of excess tons accepted by some buyers.

Bintje: 5.00 to 7.00 €/q, depending on quality (caliber, mostly). Because of the uprooting difficulties, higher prices are observed for immediate harvest and delivery.

Fresh markets: few transactions on the market which are dominated by the contracted supply. Trade to large retailers is described as very quiet, while export is almost inactive at the moment (except for some small volumes to Africa). Competition can be felt from the German production.

Soft flesh varieties (Melody, Alegria, Artemis, Bintje…): 8.00 to 12.50 €/q.

Firm flesh varieties:

- Nicola, Franceline type: 13.00 to 17.00 €/q. The Nicola availability is particularly reduced by the Yntn virus problems.

- Charlotte, Annabelle, Jazzy type: 16.00 to 20.00 €/q.

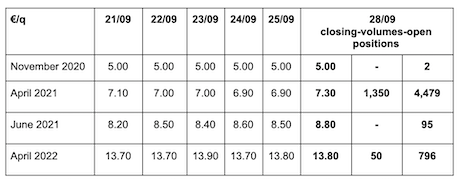

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

Netherlands

Overall, the markets remained unchanged last week. Prices are defined by the alternative outlets (livestock, biogas, starch). Factories keep their supply exclusively under contract, except for some excess tons paid between 2.00 and 3.50 €/q. Several promotional actions are underway in the supermarkets, which boosts the volumes on the fresh markets, but prices tend to flatten out: 10.00 to 12.00 €/q at the producer for soft flesh varieties, 18.00 to 22.00 €/q for firm flesh varieties. Export is more calm, most shipments going to Africa at 9.50 - 12.50 €/q (sorted, calibrated, departure big-bags).

The rains that have fallen since the end of last week will allow the harvest to take place in much better conditions...if the rain stops, of course!

France

Factories are mostly covered by contracts, but there seems to be some buyers on the free market again (actual yields below estimates and complicated uprooting conditions), with prices around 3.00 €/q for storage varieties. Export is quite static, with departure prices at 10.00 - 13.00 €/q for the basic quality, and up to 15.00 - 17.00 €/qt for the higher quality going to Spain. Very little demand at the moment from Italy, a little bit of trade to Portugal and some encouraging prospects to the Czech Republic.

Industrial activity (source: GIPT): 178,00 tons worked in French factories in July and August, which is barely 3.3% less than last year (-6,000 t).

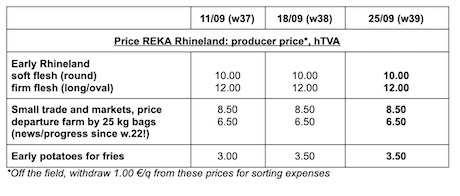

Germany

The “Bundesminsterium für Ernährung und Landwirtschaft” (Federal Ministry of Food and Agriculture) announces a harvest of 11.55 million tons, which is almost 1 million tons more than the 2019 harvest (and a 8.9% increase). Between 2019 and 2020, surface areas increased by 3,300 ha (+1.2%), going from 271,600 ha to 274,900 ha.

Fresh market (early and semi-early): firm flesh prices are down: 10.83 €/q (11.67 €/q last week) and also a slight decline for the soft/mealy flesh: 10.08 €/q (10.54 €/q last week). The harvest of the varieties for the fresh market is often over. We note many problems related to moles.

In Rhineland, prices have stopped declining and are now stable (10.00 to 12.00 €/q). Processing market (early and semi-early): stable but firm: 3.50 €/q (3.50 €/q last week). Factories focus mostly on their contracts, but the overall atmosphere is improving. Not finding any buyers among fry manufacturers, part of the free volumes go to flakes, potato granules, starch production or livestock...Uprooting will resume or start, as soon as the weather conditions allow it.

Organic potatoes: producer prices between 41.00 and 43.00 €/q (all varieties and markets combined).

For more information:

FIWAP

www.fiwap.be