European physical markets

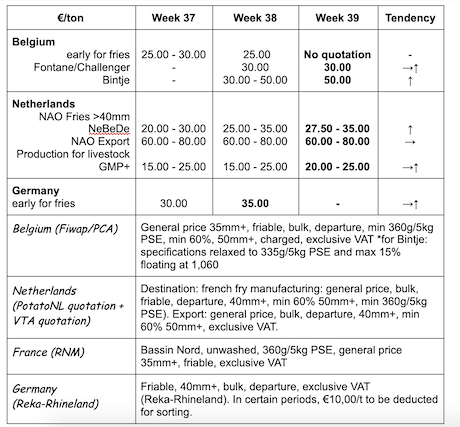

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Early potatoes for processing: no quotation, end of season. Some last volumes reported at 2.50 €/q.

Storage varieties: demand from factories is still very low outside of contract deliveries, and export is also slow. Very few transactions observed, besides some excess volumes. The offer is very limited because of the low prices and also because of the harvesting difficulties following the drought.

Early Belgian potatoes: no quotation.

Fontane Challenger: 3.00 €/q, sustained market;

Bintje: 5.00 €/q; we observe a good demand from peelers. The top-quality batches (especially the larger calibers) are given exceptionally high prices (up to 7.00 €/q), on a firm market.

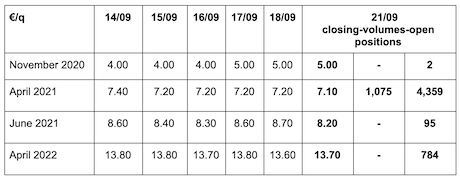

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

Netherlands

The harvest of early potatoes is coming to an end. However, the uprooting of storage varieties has not advanced at all due to the persistent drought. The alternative markets (livestock, biogas…) remain active and form a firm base for prices. The factories are easily satisfied with their contracts and show no real interest in the free market. Overall, the Dutch market is considered to be sustained, with prices ranging from 2.00 to 3.50 €/q for the industry (excess tons), from 8.00 to 12.00 €/q for fresh to soft flesh varieties, and up to 18.00 - 22.00 €/q for firm flesh varieties. Export is quite good, especially to Senegal and Ivory Coast, but also to the Caribbean and the Middle East, with prices around 11.00 to 16.00 €/q, calibrated, departure in big-bags, depending on caliber and variety.

Good industrial activity in August (source: NAO): Dutch factories worked 278,700 tons in August, which is 9,100 tons (5%) more than in July. The activity has not returned yet to its level from before the crisis, but it has improved considerably in the past months. However, there is no guarantee that it will be maintained throughout the season. In total, 3.46 million tons have been worked over the past 12 months, compared to 3.85 million tons during the 12 previous months.

France

The markets seem to be recovering somewhat, with yields that should ultimately be lower than expected. Manufacturers are covered by their contracts, but some volumes are bought between 2.50 and 3.00 €/q depending on the variety. Very little trade on the fresh market.

In the fields of the Hauts-de-France, topkilling is progressing fast and some storage is underway depending on the irrigation possibilities from before the harvest. The dry matter levels are very high. In the Centre-Beauce, uprooting is coming to an end, yields are very heterogeneous, germination is already beginning on some refrigerated batches, the first anti-germination treatment being applied nearly 3 weeks early.

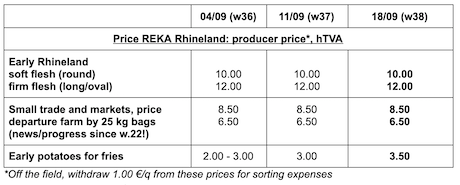

Germany

Fresh market (early and semi-early): stable prices for the firm flesh: 11.67 €/q (11.67 €/q last week), and slight decline for the soft/mealy flesh: 10.54 €/q (10.71 €/q last week). The harvest is in full swing, especially in the sandy soils of Lower Saxony, and the offer remains higher than the demand, due to the declining prices. The market is ruthless in terms of quality. The slightest defect brings prices below 10.00 €/q (even going down to 8.00 €/q in the east). Part of the surplus from the fresh market goes to livestock, biogas or the starch industry.

In Rhineland, prices have stopped going down, stabilizing around 10.00 to 12.00 €/q. The processing market (early and semi-early) is a little more firm: 3.50 €/q (3.00 €/q last week). The industry is mainly focused on contracts, but the atmosphere is improving, with a slight increase of 0.50 €/q. Part of the free volumes, finding no buyers from the french fry industry, go to flakes, potato granules, starch production or livestock..

Organic potatoes: producer prices between 41.00 and 43.00 €/q (all varieties and markets combined).

For more information:

FIWAP

www.fiwap.be