European physical markets

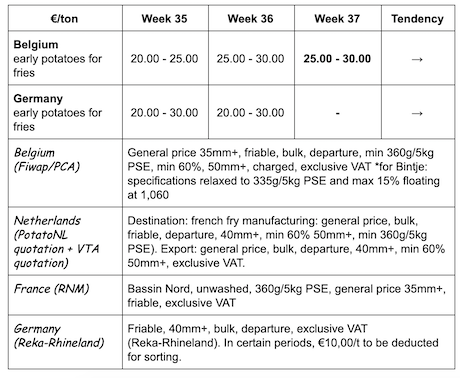

Price summary €/t (source: NEPG):

Belgium

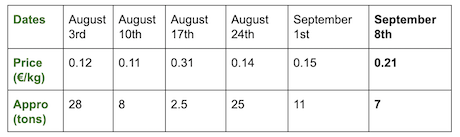

Fiwap/PCA market message:

Early processed potatoes: the season is ending, which limits the global supply. Demand is also low because the contracts remain the basis for factory supply.

Early Belgian potatoes: 2.50 to 3.00 €/q, stable market.

Some first (small) volumes (ripe and indurated lots) are observed for export to Africa.

No quotation yet for the later varieties (due to lack of transactions).

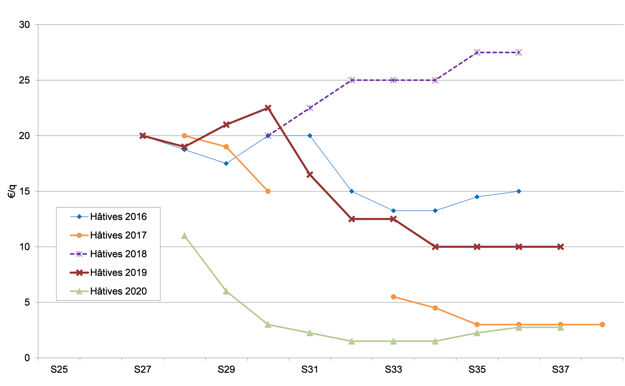

Weighted prices, (red and white varieties) at the Roeselare veiling (source: REO via PCA):

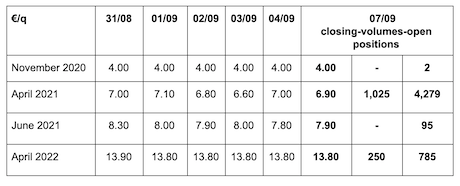

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

Netherlands

No additional activity from factories, but prices remain the same. The increasingly dry soils make harvesting difficult (except for the irrigated plots, of course). Prices remain “firm”, around 2.50 and 3.00 €/q. The factories work at about 80-90% of their capacity, and some are taking excess tons, while others limit themselves strictly to the contracted volumes. The early potatoes are ending this week or the next. The activity on the fresh markets is normal, with prices between 10.00 and 17.00 €/q. Export is looking for a balanced price, between 10.00 and 13.00 €/q (calibrated departure big-bags), as observed last week, with some demand for Africa.

Germany

Fresh market (early and semi-early): prices are down again, both for firm flesh: 12.25 €/q (14.83 €/q last week), and for soft/mealy flesh: 11.08 €/q (13.50 €/q last week). Prices are decreasing, the supply being higher than the demand, especially because of the early potatoes weighing on the market and the almost non-existent export market. The very low consumption during the 1-2 weeks of very hot weather did not help either.

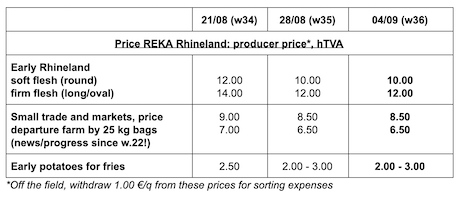

In Rhineland, prices have stopped declining, stabilizing at 10 to 12.00 €/q.

Processing market (early and semi-early): 2.00 to 3.00 €/q (2.00 - 3.00 €/q last week).

Organic potatoes: producer prices between 55.00 and 58.00 €/q (all varieties and markets combined).

Great Britain

On the wholesale markets, trade is still slow, although we feel a slight improvement of the demand. Some observers estimate that the demand from restaurants is only at 50% of its pre-crisis level in big cities, and 70% in less populated areas.

Factories and peelers have showed little interest for the free volumes last week, and prices are between 4.50 and 5.50 €/q for the batches of lesser quality, and up to 7.70-8.80 €/q for the good batches of Sagitta or Maris Piper, or even 15.50 €/q for the high quality calibrated Agria.

In the fields, the harvests continued smoothly last week, except in the west and northwest where the heavy rains interrupted the work. In the east and southeast, irrigation is still used before harvest. Some batches were refused due to excessive damage, as well as mole and slug damage. In the potato chip sector, dry matter contents have decreased and yields are said to be average.

For more information:

FIWAP

www.fiwap.be