European physical markets

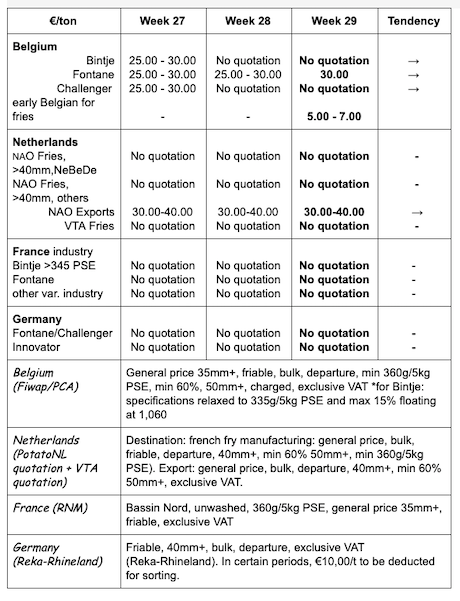

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Processed potatoes: some factories are closed, others have started again or will do so in 1 or 2 weeks. The current lines are using old and new potatoes, mostly from merchandise under contracts. The last transactions of old Fontane are around 3.00 €/q (sometimes 0.50 €/q more for better quality…). For early potatoes, prices are down, having lost more than half of their value within a week. There is simply no demand, or it is too low to maintain prices, which went from 10 to 12 €/q one week ago to 5 to 7 €/q today. Unfortunately, prices could drop even lower...

The quality of the early potatoes (Amora, Anosta, Première…) is good to very good (with some calibers missing nevertheless for some batches or varieties). Yields are average to good (25 to 35 t/ha), underwater weights are excellent (sometimes even too high), with proportions of 50% above 60-65% (for Amora). Some (new) Innovators contracted in Rhineland are processed in Belgium with good proportions for fries and perfect length...

Factories have resumed their activities, but the curb is gradually slowing down. The same goes for the sales of finished products. After the period of recovery and increase of activity levels and sales, the pace is now slowing down. The evolution of the pandemic overseas, especially in the countries we export to, is not very encouraging. Not to mention the current rebounds in Europe which are not looking good ... or the not so responsible behavior of some of our fellow citizens.

Fontane: end of quotations at 3.00 €/q, depending on the quality, buyer, volume and destination.

Bintje, Challenger: no quotation

Early Belgian potatoes: between 5 and 7.00 €/q, with the most practiced price at 5.00 €/q.

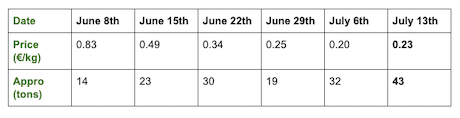

Weighted prices, (red and white varieties) at the Roeselare veiling (source: REO via PCA):

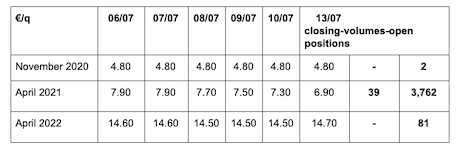

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

Netherlands

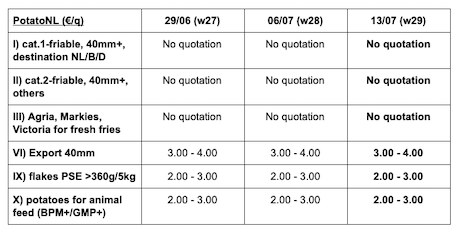

PotatoNL: also available on www.potatonl.com

The markets are in transition. Factories are still working with contracts for old potatoes. The free volumes go to livestock or flakes. Export is ending (still a little bit to Africa). Overall, transactions were between 2.00 and 4.00 €/q last week.

Dutch factories are still running at 70-80% of their capacity, and the markets for finished products seem to be recovering gradually. Early potatoes are between 15 and 40 €/qt, depending on variety and destination.

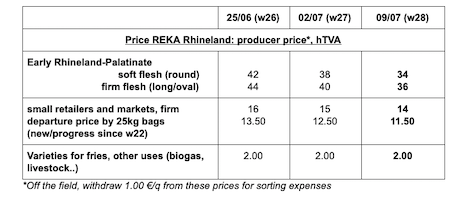

Germany

Fresh market for early native potatoes: most of the “covered” plots have been harvested and the harvest of the non-covered plots (early in the season) continues. Lower yields and the calibers are slightly larger than average. Very little free merchandise. Shipments to Belgian factories have started, mostly to fresh fries producers. No quotation. “Rhineland” 50 mm+ delivered to Belgian factories for 8.00 €/q...

Imported early potatoes: it is the end of the early potatoes imported from southern Europe...

Processing market

Fontane/Challenger: no quotation. Innovator: no quotation. Quotations for other uses (biogas, livestock feed…): 2.00 €/qt (2.00 €/q last week).

Organic potatoes: the first “peaux faites” are sold in supermarkets. With most of the German population staying in Germany because of the pandemic, the consumption of fresh potatoes is maintained, especially for organic potatoes. Producer prices at 83.00 €/q on average.

The plots with organic potatoes are increasing in Germany, covering 2,666 ha. The volumes have not necessarily increased, because tuberization rates are generally low, calibers are large and plots tend to be topkilled early. In Austria, the plots with organic potatoes for consumption have also increased, to 2,289 ha. 1 ha out of 5 in potatoes for consumption is now organic in Austria!

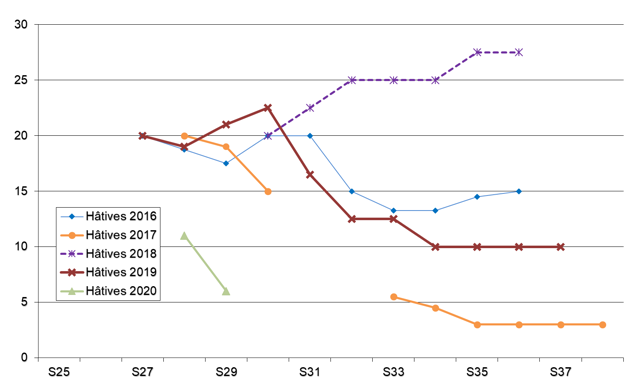

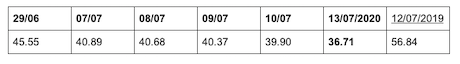

Native early potatoes, weighted average prices, for all Länder, €/t

United States

According to VTA, the decrease of north-american surface areas is confirmed, at the lowest level in the past 20 years. Some processing plants are actively looking for free potatoes from the old harvest. Exports were up 6.6% in May compared to April 2020, but down 27% compared to May 2019.

For more information:

FIWAP

www.fiwap.be