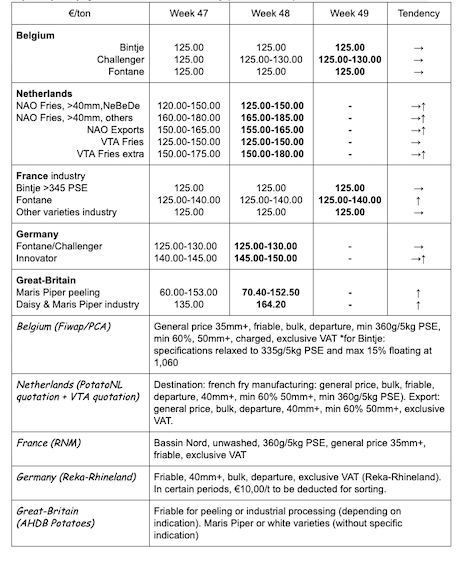

European physical markets

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message: industrial potatoes: the market is somewhat disrupted by an offer of potatoes that do not keep well (mainly Challenger with rotting problems). Problematic contracts and lots help to supply the demand from the processing industry. It is the main reason preventing prices from going up. Some producers managed to sell larger lots immediately or at a later date at better prices. Besides, some bad frying indexes have been reported: late potato harvests at colder temperatures. In the Netherlands and Germany, prices are more firm, mainly for Innovator and other “high-end/fast-food” varieties.

Most markets remain stable, with some higher prices for the good quality potatoes or on more specific markets. Shipments to Eastern Europe have slowed down but continue actively to Great Britain (especially for the “fish & chips” trade).

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery:

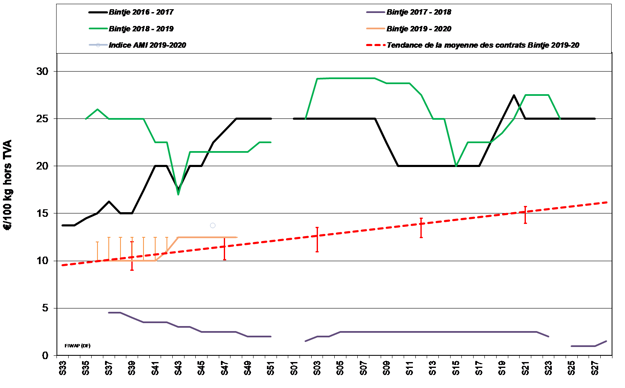

Bintje: around 12.50 €/q, stable market;

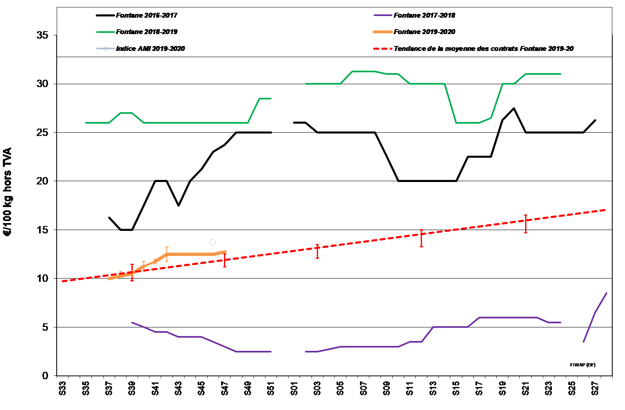

Fontane: 12.50-13.00 €/q, stable market;

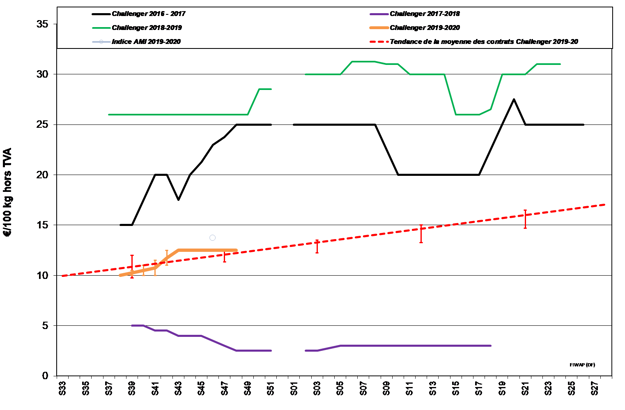

Challenger: around 12.50 €/q, stable market;

Challenger: around 12.50 €/q, stable market;

Innovator: 13.00–14.00 €/q, sustained market.

Innovator: 13.00–14.00 €/q, sustained market.

Bintje plant: very little trade, low demand. Indicative prices. Dutch plant, class A, returned March 2020, by 10 tons, in big-bags excl.VAT:

Caliber 28-35 mm: 59.00-61.00 €/q

Caliber 35–45 mm: 39.00-41.00 €/q

Seedling market: yields, harvests and tuberizations were better than in 2018, but the seedling market (especially in the Netherlands) seem to be “stuck” because of the importance of downgrading due to virosis. It is getting difficult to find (besides Bintje) various common fries varieties (either from the early or the main harvest) on the free market. Prices are firm, and speculators on the other side of the Moerdijk expect, like last year, for uncertainty to settle and prices to rise…

Netherlands

Some dozens or hundreds of ha remain to be harvested, especially in the clay soils of North Holland. Producers “keep” their potatoes dry and healthy. For the industry, most prices are slightly up, between 12.50 and 15.50 €/q, up to 18.50 €/q for specific industrial varieties (cat 2) which are a little “better”. On the domestic fresh markets, price levels are easily maintained and preparers have “a lot of work”. The offer of dry lots is lower. Prices are between 18 and 30 €/q.

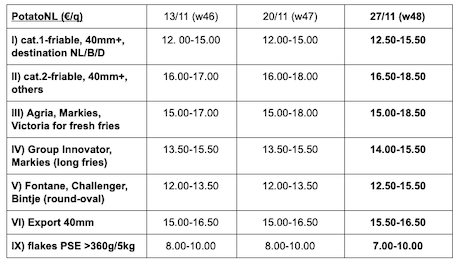

Quotation PotatoNL: also available on www.potatonl.com

France

For the industry: stable markets for all varieties between 12.50 and 14.00 €/q, and a little more for Innovator as always, between 13.50 and 14.00 €/q.

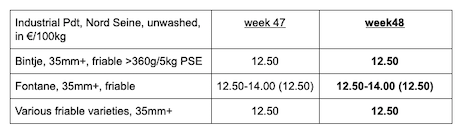

Unwashed industrial potato, bulk, departure, excl.VAT, Nord Seine, €/q, min-max (average)(RNM):

Germany

Fresh market, increase for the firm flesh at 22.83 €/q (compared to 22.33 €/q last week), and increase for the soft and mealy flesh at 21.08 €/q (compared to 20.83 €/q). Producers “let go” of their lots, especially the best ones, only after a lot of persuasion. But the lots with wireworms or silver scurf problems go more easily. Besides, the shipments to Poland continue and are good. Will the volumes exported to the East influence prices in the coming weeks/months? This is a source of debate on the other side of the Fagne. Sales at the farm and on the markets is also better, while there is a slight decline of sales in supermarkets (-4.4% between October 2018 and October 2019).

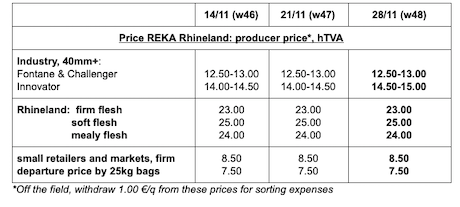

Processing market: unchanged quotations for Fontane/Challenger at 12.50-13.00 €/q; increase for Innovator at 14.50-15.00 €/q (compared to 14.00-14.50 €/q).

Great Britain

Thousands of hectares still remain to be harvested, especially in the north of England: Yorkshire, Midlands... Average AHDB prices of the industrial free markets are up in week 48:

- Maris Piper for peeling: 7.04 to 15.25 €/q depending on quality/caliber;

- Daisy, Ramos, Performer for fries industry: around 16.42 €/q.

For more information:

For more information:

FIWAP

www.fiwap.be