European physical markets

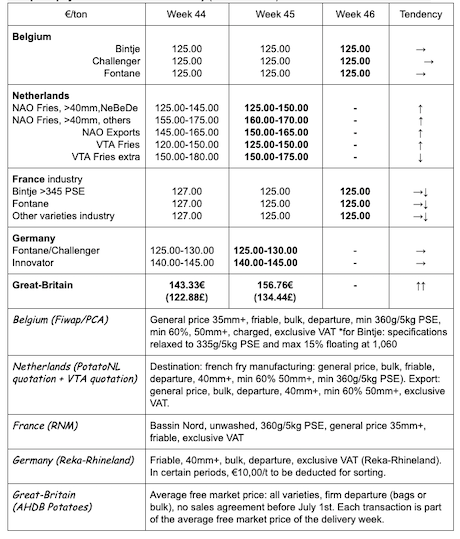

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Globally unchanged markets and static prices, with moderate and balanced supply and demand. The industry easily takes the offered lots. Supply includes the last lots out of the fields as well as precarious storage and lots whose storage is not ideal. Export remains calm but present towards Southern and Eastern Europe.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

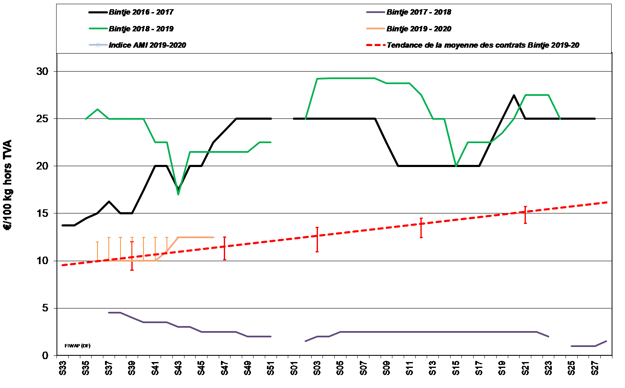

Bintje: around 12.50 €/q, depending on caliber and destination; stable market;

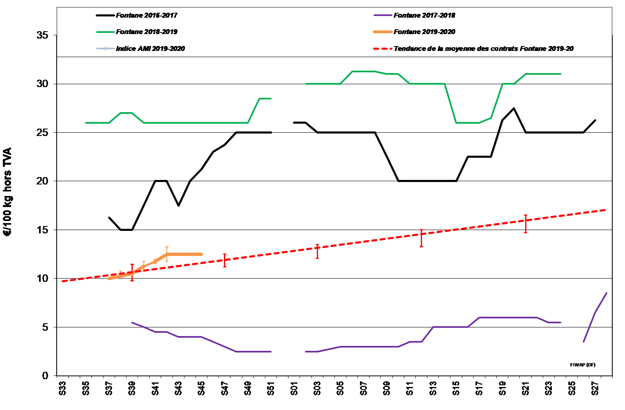

Fontane: around 12.50 €/q, stable market;

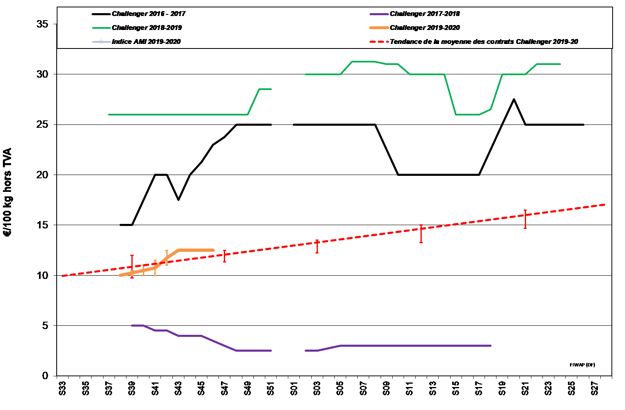

Challenger: around 12.50 €/q, stable market.

Innovator: between 13.00 and 14.00 €/q, firm market.

Bintje plant: very little trade, low demand. Indicative prices. Dutch plant, class A, returned March 2020, by 5 tons, in bags hTVA:

Caliber 28-35 mm: 60.00 - 62.00 €/q

Caliber 35-45 mm: 40.00 - 42.00 €/q

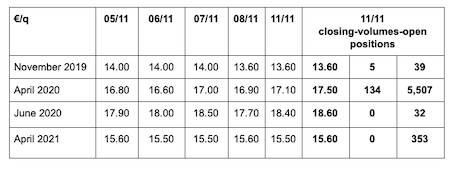

Forward market:

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

Netherlands

Little could be done last week in the fields because of the continuous rains. There should be 10% left to harvest. The west of the country has had a lot of rain in the past 48 hours, with 35 to 65 mm (particularly in the Noord-Oost Polder) so there won’t be much grubbing in the coming days. Anxiety grows… With the difficulties of the harvest, we see piles of potatoes on the edge of the fields, and temporary storage which will have to be taken quickly to the factories. Despite all these problems, prices for the industry have not changed much, and are slightly up in a firm context. For export, interest is growing again and we can export to all the classic distant destinations. Eastern European countries are also buying (Poland, Romania, Czech Republic…) on the basis of 14 to 16 € at the producer.

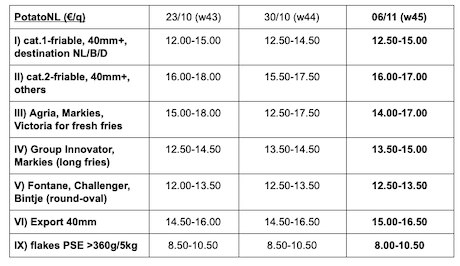

Quotation PotatoNL: also available on www.potatonl.com

France

Grubbing is not complete yet (95-97%), conditions remain very complicated on the coast of Calais-Dunkirk and in Normandy. Few free purchases for the industry, with firm prices. Export shows renewed interest and stable volumes, with the presence of Spain, Italy, Portugal and Eastern countries. Firm market, prices slightly up, especially for the “fresh export” varieties, with producer prices between 25 and 31 €/q.

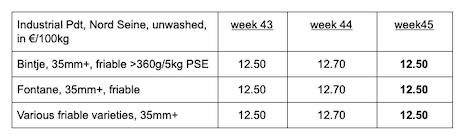

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min–max (moy)(RNM):

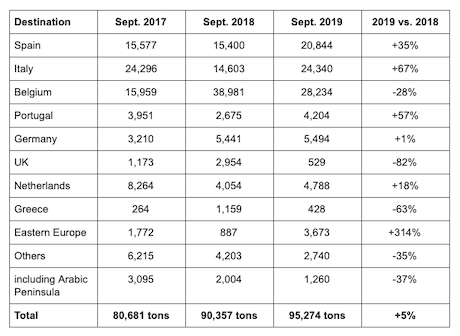

French export statistics (sources: Customs via CNIPT): France exported more than 95,000 tons of potatoes last September, which is 5% more than last year. The main increase in trade comes from Southern and Eastern Europe. On the other hand, Belgium and the United Kingdom introduced fewer French potatoes.

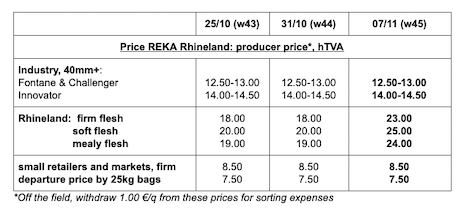

Germany

Grubbing is almost complete. Fresh market, again more firm at 22.17 €/q (compared to 21.17 €/q) last week for firm flesh, and 20.42 €/q (compared to 19.42 €/q) for soft and mealy flesh. Good qualities but calibers are often too small for the non-irrigated, and too big for the irrigated! High increase in Rhineland for the consumption varieties (+5 €/q), output warehouse, for the 3 categories (soft, firm and mealy).

Processing market: unchanged quotations for Fontane/Challenger at 12.50-13.00 €/q; same for Innovator between 14.00 and 14.50 €/q. Grubbing almost complete.

Organic potatoes: prices renewed around 65.00-67.00 €/q.

Great Britain

Average AHDB price free markets week 45 (ending on November 9th): 15.68 €/q (compared to 14.33 €/q), all varieties all markets, in week 44.

The rains don’t seem to want to stop in England, where last week was still very wet. Short-term weather forecasts predict cold and rain, with a high risk of snow and frost in the central and northern parts of the country. It is now very likely that a significant part of the remaining areas will not be harvested before New Year. Depending on the counties, the proportions still remaining to be grubbing vary from 5 to 35%.

The quality of the lots grubbed in the past weeks is disappointing, especially for the fresh market, with 20% of tare, and rejections due to blue spots. Export to the Canaries is dynamic, and Poland is still buying (large caliber plants). Prices for the friable quality are up with Maris Piper and Sagitta from 15.20 €/q, Markies and Agria from 16.20€, or even 17.20 €/q.

For more information:

FIWAP

www.fiwap.be