European physical markets

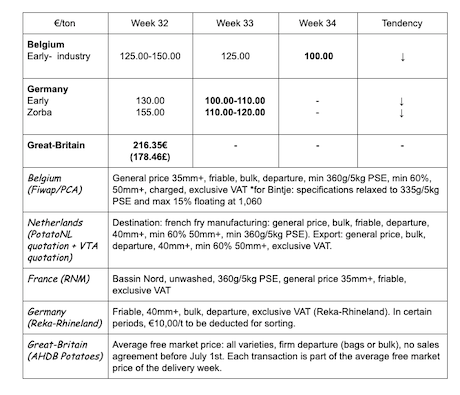

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Early industrial potatoes: calm market, with a low demand from factories, still working with their contracted volumes. Some export demand towards Eastern countries. The offer remains present, because of the surplus (from good yields) and the upcoming transition to other varieties (Bintje, Innovator) for some buyers.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery: mainly 10.00 €/q.

Prix in veiling/auction of Roulers (source: REO via PCA): August 19th: weighted price (red and white) for the hand-picked production: 0.33 €/kg excl. VAT. Approx: 27 tons.

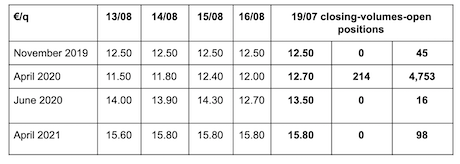

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm +:

Netherlands

Prices pressured down under the influence of the Belgian market and the wait-and-see policy of the Dutch buyers. The prices from last week for early industrial potatoes were between 13.00 and 15.00 €/q, depending on variety and destination. In export, there is a growing interest from Poland and Romania where the harvest is lacking (drought in Poland, excessive rains in Romania). The actual volumes remain nevertheless limited. The drop in prices could, however, boost the trade to these countries. Africa currently buys small volumes, on a basis of 18 to 23 €/q, prepared and packaged, depending on caliber and variety.

Intermediate samples show yields within the average of the previous years, with better yields in the west than in the east of the Netherlands.

Germany

The early potato season is nearly over. The last drops in prices were like the rainfall: significant. But globally, the season is ending with prices around 35.00 €/q last week (and 33.00 €/q for soft and mealy flesh). Trade is good for bags towards Eastern Europe, especially to Romania and Poland where the harvests have been very bad.

On the processing market, prices are down slightly with the early industrial potatoes between 10.00 and 11.00 €/q, and Zorba between 11.00 and 12.00 €/q.

Organic potatoes: the price of organic potatoes is higher than it was at the same time last year, and so is the demand. Last week, prices were around 75.00 €/q. At first glance, the yields are between “slightly lower than last year” and “equal to the average”. Sales are good, and the progress of organic potatoes in low-cost supermarkets (Lidl, Penny, Aldi) gave a boost to the consumption. Between 5 and 10% of all the potatoes sold in these stores are organic. Their quality is generally good, although there have been some reports of wireworm problems. In the southeast (Bavaria) and even more in Austria, where it rained more, some mildew problems have been reported.

Great Britain

Average price AHDB free markets week 32 (ending on August 9th): 21.64 €/q (all markets, all varieties).

The export trade to Poland slowed down last week. The importers are waiting, now that the offer develops in Germany and in France, and local harvests are about to start. The departure prices were between 12.00 and 18.00 €/q, depending on caliber and variety. The industry buys very little on the free market because it has contracted volumes. The indicative prices go from 14.50 to 15.75 €/q, and up to 22 €/q for the big calibers for peelers. The demand for the fresh domestic markets is considered “very low” and prices tend to go down.

Uprooting was interrupted in the northwest, in the regions where more than 25 mm fell in one day, mid-week.

Romania

Very bad harvest in sight (source: VTA). The months of May and June were exceptionally rainy, which compromised the crops. The observers predict a very mediocre harvest and a bad quality for storage. The areas have regularly decreased in recent years, before increasing slightly this year (+7,000 ha) for the first time since 2011 to reach 176,000 ha. The expected production is estimated at only 2.3 million tons, compared to 3 million tons in 2018. Already last year, Romania had had to import 200,000 tons because its own harvest was insufficient to cover the domestic needs. The import potential this year could reach 1 million tons.