European physical markets

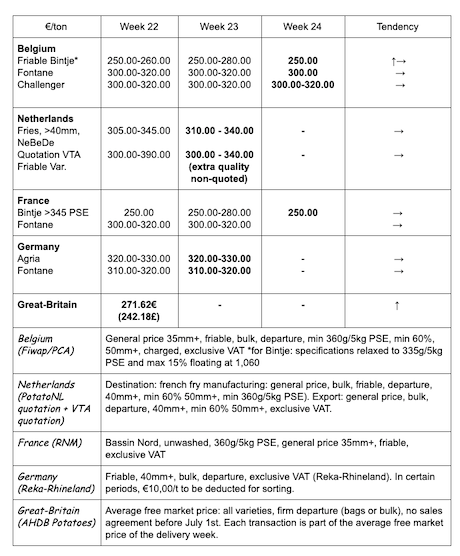

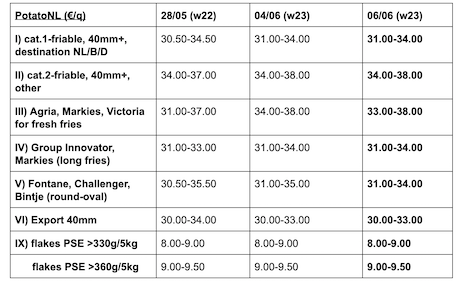

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

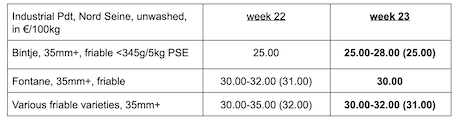

Several industrials are still buying, mostly Fontane and Challenger, and some Bintje (depending on the quality). Other industrials stopped buying, their planning being set until the arrival of the early potatoes. The offer is getting rare due to the low stocks.

Fontane and Challenger: 30.00 to 32.00 €/q, firm market;

Bintje: sustained market: “friable quality”: max 15% floating at 1,060 g/l and PSE min 335g/5kg, sufficient caliber and good cooking color: 25.00 to 28.00 €/q, for the industry. Most practiced price at 25.00 €/q. Fewer buyers, including among peelers, some of them having turned to other varieties.

Auction prices/REO veiling (source: REO via PCA): June 10th: weighted price (red and white) for hand-picked potatoes: 0.25 €/kg (90.00 €/q) excluding VAT. Appro: 31t.

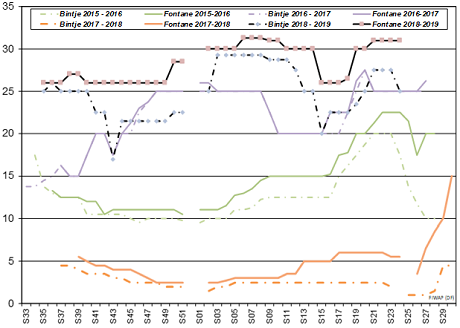

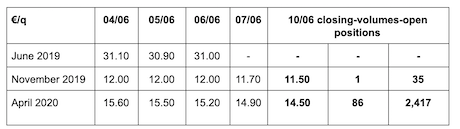

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for conversion, 40 mm+, min 60% 50 mm+:

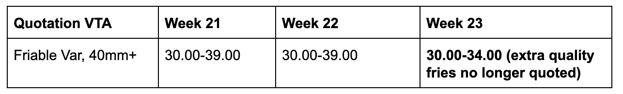

Netherlands

For the industry, there are almost no free potatoes left, while there are still at least 5 weeks to go with the old harvest. The factories are working under contracts, complemented by the (few) remaining extras. 75% of the domestic fresh markets have turned to the new potatoes. What remains of the old harvest is still finding some buyers due to the rather high prices of the imported early potatoes (55 to 70 €/q). Export is coming to an end, with only a few shipments to Poland at 32 to 38 €/q calibrated, departure in big-bags. In the fields, the rains brought 25 to 60 mm in the northwest of the Netherlands, significantly improving the growing conditions. But in the southeast of the country, several “waterschappen” limit irrigation and other uses from ditches because the drought remains very real.

Quotation PotatoNL: also available on www.potatonl.com

France

Very few transactions observed. Warehouses and fridges are almost empty in all regions. The demand is also very low, so the last tons available are even sometimes difficult to place. This raises many questions as to the transition to the new harvest and the need for rain in the fields, despite the few storms that have occurred in recent weeks. Irrigation is under way in the main regions.

Unwashed industrial potatoes, bulk, departure, hTVA, Nord-Seine, €/qt, min–max (average)(RNM):

Germany

The Rhineland-Palatinate early potatoes were quoted at 73 €/q for the soft flesh/round varieties, and at 75 €/q for the firm flesh/salad varieties. The cooler temperatures and clouds are somewhat delaying the crops. In some sub-regions, it was necessary to irrigate last week. As for the potatoes for the industry (fries), quotations are stable but firm and unchanged for the friable qualities:

Agria between 32.00 and 33.00 €/q

Fontane between 31.00 and 32.00 €/q.

Great Britain

Average producer price (all markets) week 22: 27.16 €/q (compared to 26.29 €/q in week 21).

The domestic demand remains firm. The early potatoes occupy their place, and the first local crops are almost depleted (Cornwall, Channel Islands). Supply is becoming difficult for the friable quality. The old harvest is no longer of good quality, which slows down the wholesale trade. The new friable potatoes are expected in the coming weeks. Average prices continue to go up, given the reduced offer for the old harvest and the high prices of the imported early potatoes. The industry gets their supply mainly by contract. The export is slowing down, with some shipments to the Czech Republic, Ireland, the Netherlands and Poland. In the fields, the state of the crops is generally good, but more rains would be welcome. Irrigation is under way to fight common scab.

Exportation record in March: with more than 20,000 tons exported last March, the record for this month was beaten. Belgium is the first destination, followed by Poland, the Netherlands and the Czech Republic.