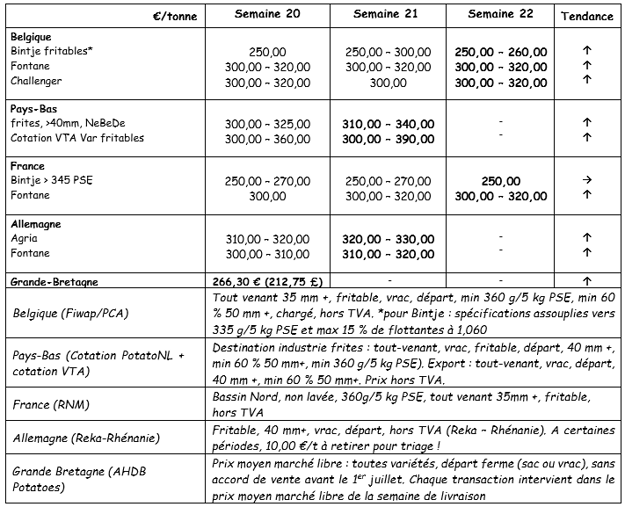

European physical markets

Summary of prices (source: NEPG) :

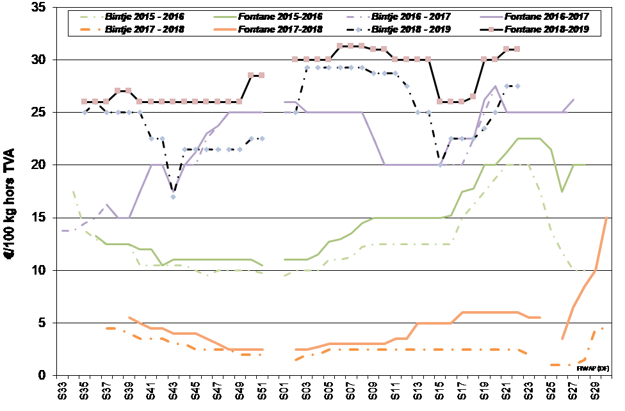

Belgium

Belgium

Message from the Fiwap / PCA markets :

Low stocks clearly limit free trade, which is shrinking more and more. Nevertheless, several manufacturers are still purchasing, faced with a variable offer in terms of quality, mainly in Bintje. There is still some export trade, especially in large size fried food

Fontane: 30.00 to 32.00 €/q, firm market;

Challenger: 30.00 to 32.00 €/q, firm market;

Bintje: firm market: "sinterable quality": max 15% floating at 1060 g/l and EPS min of 335 g/5 kg, sufficient size and good cooking colour: 25.00 to 26.00 €/q, for industry. The few batches that are still suitable for peeling still reach 30.00 €/q. However, many peelers switch to other varieties such as Fontane, Markies or Challenger. Imported early crops remain (very) expensive.

Prices in auction / veiling of Roeselare (source: REO via PCA): 27 May :

Weighted price (red and white) for hand-picked potatoes: 0.72 €/kg (90.00 €/q) excluding VAT. Supply: 17 tons.

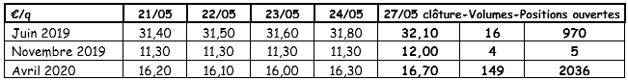

Futures market

EEX in Leipzig (€/q) Bintje, Agria and related transformer var., 40 mm+, min 60% 50 mm +:

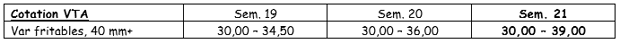

Netherlands

Netherlands

Prices strengthened further last week, but the volume affected by rising prices remained limited. Dutch industrialists preferred to use their contracted volumes and only paid the daily price for the extra tonnes delivered at the same time. The hunt for the last free volumes has therefore not yet begun. On the fresh produce markets, the supply of imported early fruit has expanded but without any real influence on prices, which remain high (0.60 to 0.81 €/kg). The preparers are therefore still interested in the latest stocks of old stock on the basis of 35 to 45 €/q. Exports continue to southern and eastern Europe, but also to Africa, on the basis of 32 to 36 €/q (sized in bags) for basic quality, with Scottish potatoes re-exported.

PotatoNL quotation: see also on www.potatonl.com

France

For industry, prices remain bullish with ranges in the order of 30 to 32 €/q in specific varieties (including Fontane), and 25 to 27 €/q in Bintje. The availability of goods is very low, and uncertainty remains as to the junction with new production. End of the year for exports and on the domestic fresh market, with almost no availability and last export shipments on the basis of 55 - 60 €/q (beautiful product sized in bags).

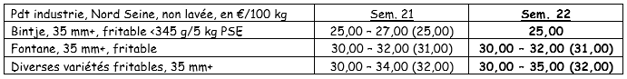

Unwashed industrial potato, bulk, departure, VAT excluded, Nord Seine, €/qt, min - max (average) (RNM) :

Increasing industrial activity (source: GIPT via UNPT): French factories have worked 1,033,000 tonnes since the beginning of July and until the end of April, representing an increase of 3% (+25,000 tonnes) compared to 2017/2018, and +90,000 € compared to 2016/2017. Contract supply represents 75% of the volumes worked.

Increasing industrial activity (source: GIPT via UNPT): French factories have worked 1,033,000 tonnes since the beginning of July and until the end of April, representing an increase of 3% (+25,000 tonnes) compared to 2017/2018, and +90,000 € compared to 2016/2017. Contract supply represents 75% of the volumes worked.

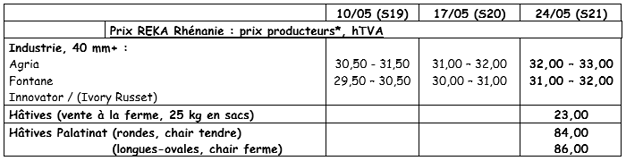

Germany

The early Palatinate was rated at 84 €/q for tender meat and 86 €/q for firm meat. In potatoes for industry (French fries), price increases again for sinterable potatoes: Agria between 32.00 and 33.00 €/q, Fontane between 31.00 and 32.00 €/q. In the West of the FRG (Rhineland-Westphalia, Palatinate), the North (Lower Saxony) and the Southwest (Baden-Württemberg) it rained reasonably (between 10 and 90 mm depending on the area), with optimal growth. The first defanking of production for the fresh produce market will soon take place to obtain "made skins" before harvesting. During the field start period, you must withdraw 1.00 €/q at these prices for sorting costs

During the field start period, you must withdraw 1.00 €/q at these prices for sorting costs

Great Britain

Average producer price (all markets combined) week 20: 26.63 €/q (compared to 25.55 €/q in week 19).

The rise in prices continues with the gradual exhaustion of supply in the face of continuing demand for processors (both in England and Scotland) and for wholesale markets (particularly in sinterable quality). The import from Spain is announced in the coming weeks in order to ease the markets. The industry is also buying. Export continues to Eastern Europe but with decreasing volumes and very high prices (from 18.75 to 31.25 €/qm to the producer).

For more information:

FIWAP

www.fiwap.be