Belgium

Fiwap/PCA Market Message:

Industrial varieties:

After the recent rise in prices, markets are globally calmer, with fewer buyers actively purchasing (temporization) and a less pressing demand. But the supply also remains (very) limited. Fewer transactions were observed this week.

Fontane: 30.00 to 32.50 €/q; sustained market, with most common price at 30.00 €/q;

Bintje: sustained market:

“Friable quality”: max 15% floating at 1060 g/l and PSE min 335 g/5 kg: 27.50 to 31.00 €/q, depending on the quality (PSE, cooking,…), on the caliber and the buyer. Highest prices for the nice regular lots of (very) good quality, mainly for fresh fries.

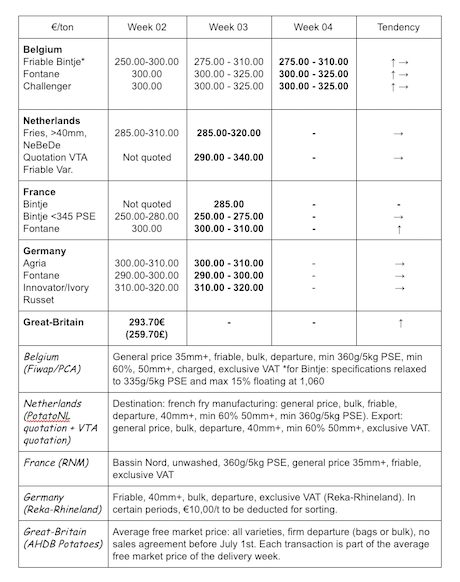

European physical markets

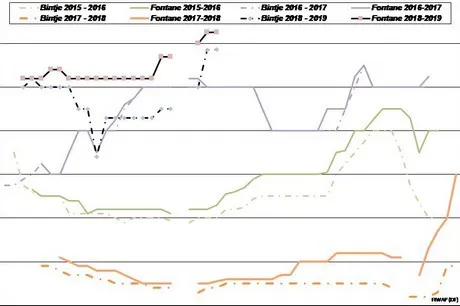

Price summary (source: NEPG):

Bintje plant: Dutch plant, class A, returned March 2019, by 5 tons, in bags, hTVA: firm markets and prices increasing and progressing (inquire very regularly):

Caliber 28 - 35 mm: 110 - 120.00 €/q

Caliber 35 – 45 mm: 84.00 - 90.00 €/q

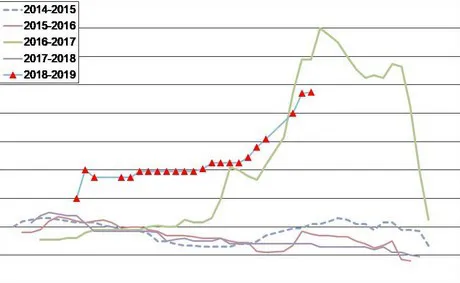

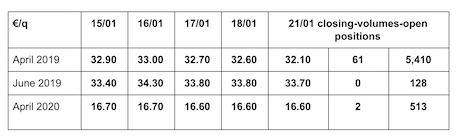

Forward market: EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60 % 50 mm +:

Forward market: EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60 % 50 mm +:

Netherlands

The markets are entering a new phase. The recent rise in prices has reflected the fact that the European harvest is insufficient compared to the needs of the industries, particularly in Belgium. The Dutch factories are less active on the free market than their Belgian competitors but they have had to keep up. Prices stabilized last week, and the question remains as to when the next “buying phase” will take place. Export remains slow towards Africa (the Senegalese importation quota have been reached). Eastern European countries are first served by France.

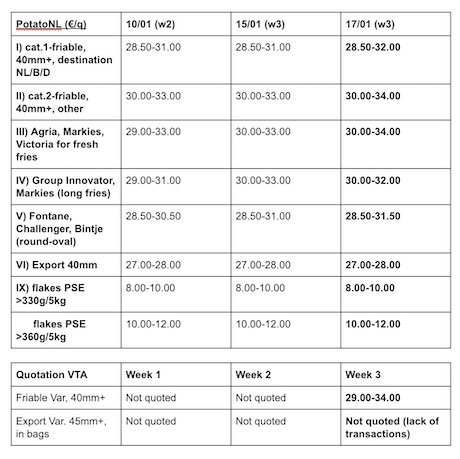

Quotation PotatoNL: also available on www.potatonl.com

France

Industry: very firm markets for all specific varieties (including Bintje), little offer in free. The purchase of dual-use varieties (Melody, Manitou…) continues on a basis of 27.50 €/q. The demand is thus sustained and the removal is often very fast. On specific outlets, prices can exceed 30.00 €/q. Rather active export for friable qualities towards Spain, but also for the red varieties towards Portugal. Eastern countries are present with regular but not abundant volumes.

From August to November, French export reached 478,588 tons, 10% more than last season (source: French Customs via UNPT).

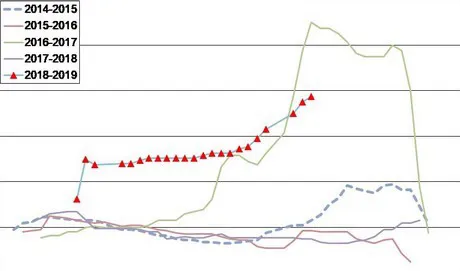

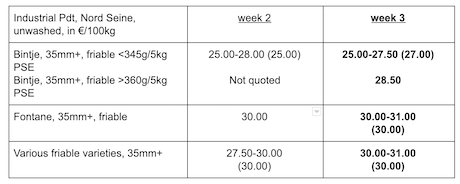

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min – max (moy) (RNM):

Germany

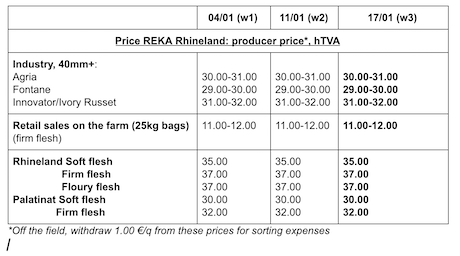

On the fresh market (Rhineland), on January 18th, prices were unchanged for the firm flesh at 37.00 €/q for the storage output refrigerated crates, and at 35.00 €/q for the storage output refrigerated crates for the soft flesh. For firm flesh on sale at the farm (Rhineland), prices ranged from 11.00 to 12.00 €/q per 25kg bag (unchanged).

Potatoes for industry (fries): prices are stable but firm! Agria between 30.00 and 31.00 €/q, Fontane between 29.00 and 30.00 €/q, Innovator between 31.00 and 32.00 €/q.

Great-Britain

Average producer price (all markets) week 2: 29.37 €/q.

For more information:

FIWAP