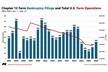

Chapter 12 farm bankruptcies increased for the second consecutive year in 2025, reflecting continued financial pressure across the U.S. farm sector.

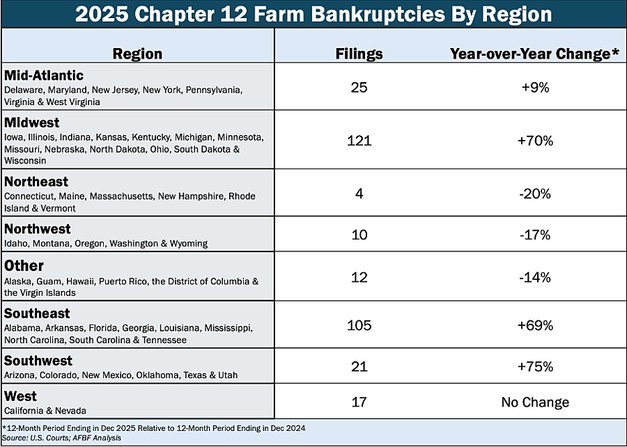

According to U.S. Courts data, 315 Chapter 12 bankruptcies were filed in calendar year 2025, a 46% increase compared with 2024. Although filings remain below earlier historical peaks, the rise marks a second year of growth and points to ongoing strain in agriculture. Chapter 12 filings represent a last-resort option for family farms seeking debt restructuring and do not fully capture broader trends in farm closures.

© American Farm Bureau Federation

© American Farm Bureau Federation

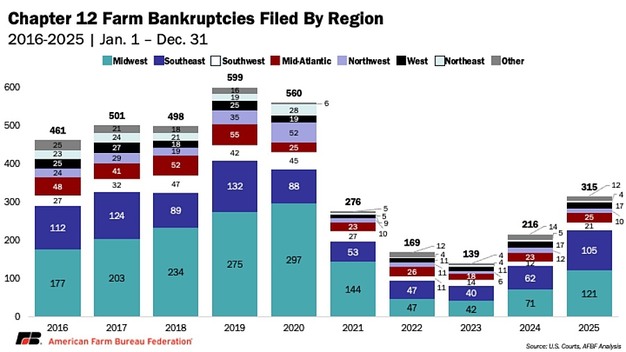

The Midwest and Southeast accounted for the majority of filings, with 121 and 105 cases, respectively. These regions were impacted by continued losses across major crops, combined with rising input costs and declining farm receipts. Filings in the Midwest rose 70% year on year, while the Southeast recorded a 69% increase.

Arkansas recorded the highest number of Chapter 12 cases in 2025 with 33 filings, more than double the previous year. Georgia followed with 27 filings, reflecting losses in principal row crops and limited support for specialty crop production. Other Southeast states with notable increases included Texas and Louisiana, with 12 filings each, and Florida, which rose to 16 filings.

© American Farm Bureau Federation

© American Farm Bureau Federation

In the Midwest, increases were reported in Iowa with 18 cases, Nebraska with 17, Missouri and Wisconsin with 16 each, Minnesota with 13, and Kansas with 11. Several of these states also faced pressure from weakened dairy, hog, and poultry markets. Outside these regions, Montana and Pennsylvania also recorded large year-on-year increases, while California reported 17 filings, unchanged from 2024.

Farm bankruptcies tend to lag underlying financial conditions. Data from the Federal Reserve Bank of Kansas City indicate that farmers are taking on larger operating loans and requiring more time to repay them. USDA projects total farm debt to rise 5.2% to $624.7 billion in 2026. In 2025, nearly 40% more new farm operating loans were opened than the previous year, with average loan sizes increasing by 30%. Interest expenses across the sector are expected to reach $33 billion in 2026.

© American Farm Bureau Federation

© American Farm Bureau Federation

Not all farms qualify for Chapter 12 protection. Many operations rely on off-farm income to support household expenses and maintain production during downturns. However, farms earning the majority of income off-farm are excluded from Chapter 12 eligibility. As a result, some families may face land sales, reduced production, or farm closure. More than 160,000 farms closed in the U.S. between 2017 and 2024.

The increase in Chapter 12 filings highlights continued economic pressure in agriculture and signals ongoing challenges for farm financial stability.

© American Farm Bureau FederationFor more information:

© American Farm Bureau FederationFor more information:

American Farm Bureau Federation

Tel: +1 202 406 3600

Email: [email protected]

www.fb.org