With the Red Sea ceasefire in effect and more container vessels returning to the Suez Canal, breakbulk operators are preparing for shifting market dynamics. Increased container traffic is expected to heighten competition, which may place mild downward pressure on General Cargo day rates and reduce tonne-mile demand for Project Carriers on this route. Shorter Suez transits will release vessel capacity and reduce tonne-miles, although ongoing demolitions of older ships and limited newbuilds are likely to balance supply. Despite improved conditions, operators remain cautious, noting that Suez traffic is still below pre-crisis levels. Forecasts suggest that breakbulk trade lanes could stabilise fully by the end of the first half of 2026.

A stronger return of container vessels will directly affect breakbulk carriers. If container traffic rises sharply, ports may face congestion before trade flows normalise. Shippers may also weigh higher insurance premiums and canal tolls for the Suez route against elevated bunker costs when sailing via the Cape of Good Hope.

© Drewry

© Drewry

A recovery in container services is expected to influence the breakbulk sector in several ways. Container lines may take over portions of general cargo traditionally handled by breakbulk carriers, especially where commodities can be containerised. Cargo categories likely to face greater contestability include steel coils and plate, bagged commodities such as cement, fertilisers, and wood pulp, and palletised machinery, pipe bundles, or smaller modules. General Cargo vessels will continue to handle freight better suited to dry cargo ships, but improved transit times via the Suez Canal could increase overall competition.

In project cargo, container lines may also contest volumes when they have available slot capacity. A common practice is securing a large single project piece mid-ship on multiple flatracks. Similar crossover activity is seen in the dry bulk sector, where carriers such as Handy and Supramax vessels are used to transport lighter project cargo on open decks.

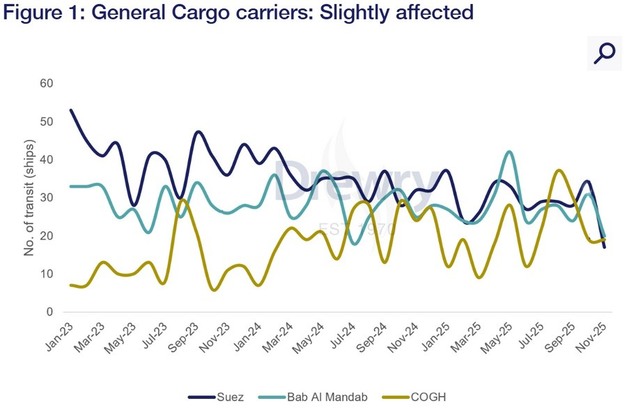

General Cargo ships were less affected by the Red Sea crisis that began in November 2023, as fewer of their routes relied heavily on the region. A full reopening of the Suez Canal will shorten voyages and may reduce transport costs, prompting carriers to review service structures, port rotations, and schedules to regain pre-crisis efficiency.

© Drewry

© Drewry

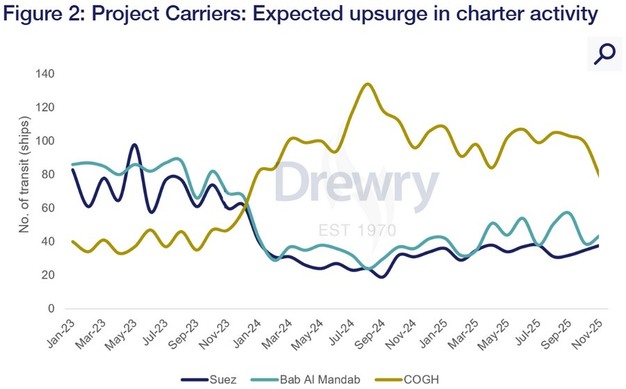

Project Carriers experienced greater disruption due to high-value and time-sensitive cargoes requiring extensive rerouting. If Suez access fully returns, the capacity freed by shorter voyages is expected to be absorbed by ongoing demand from infrastructure and energy projects. Although the initial easing of utilisation could pressure charter rates, sustained demand for heavy-lift cargo is likely to support rate stability over time.

© DrewryFor more information:

© DrewryFor more information:

Drewry

Tel: +44 (0) 207 538 0191

Email: [email protected]

www.drewry.co.uk