The 2024/25 U.S. pecan marketing year closed with an average harvest but a noticeably tighter supply environment due to reduced imports and declining inventories. The balance between supply and demand differed from previous years, setting up possible shifts for the upcoming season.

Supply dynamics

Production for the 2024/25 season was near average, yet the overall supply was constrained by weaker import volumes. U.S. pecan imports declined for a second consecutive year, particularly from Mexico, which narrowed total availability despite stable domestic production.

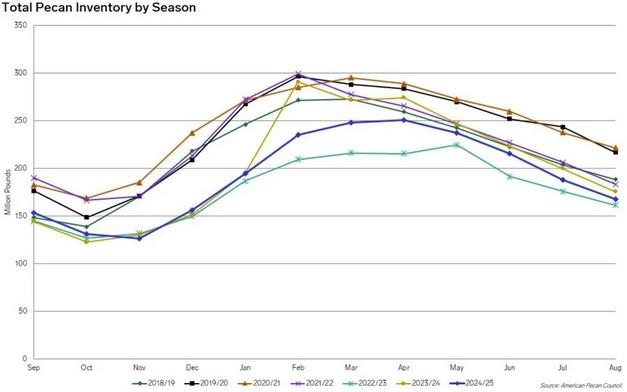

Cold storage data showed that shelled pecan inventories were higher than in the previous two seasons, but much of that product was already committed. Shelled commitments ended the season about 10 million pounds (4,535 tons) higher than the prior year, meaning uncommitted inventory available to buyers was below 2023/24 levels. This reduced accessible supply despite higher total storage figures.

In-shell pecan inventories entered the new marketing year at their lowest level in six years, according to USDA data, further tightening supply conditions.

Demand balance

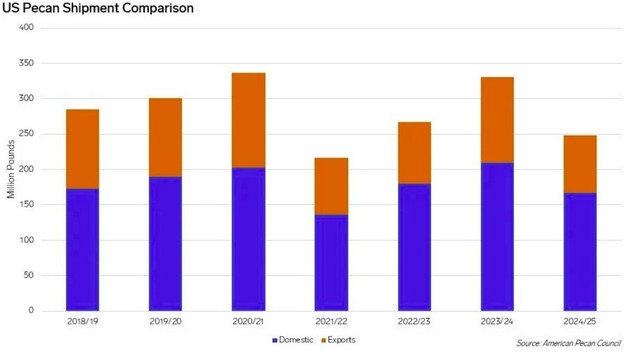

Domestic consumption remained steady and continued to absorb available product, while exports faced more difficulty. U.S. pecan exports are projected to finish the 2024/25 season well below last year's levels.

Shelled exports primarily went to Canada (6.8 million pounds or 3,084 tons), Israel (5.5 million pounds or 2,495 tons), and the Netherlands (4.5 million pounds or 2,041 tons). However, exports to China declined sharply. Inshell shipments to China totaled only 6.0 million pounds (2,722 tons), equivalent to 3.0 million pounds (1,361 tons) shelled, down from 48.0 million pounds (21,772 tons) inshell, or 24.0 million pounds (10,886 tons) shelled-equivalent, the previous year.

The drop in Chinese demand, combined with lower imports and limited inventory, created an unusual supply-demand structure, suggesting that broader trade or competitive factors influenced international flows.

Outlook

The U.S. pecan sector enters the 2025/26 marketing year with smaller inventories than in recent seasons. Average production, reduced imports, steady domestic utilization, and weaker exports have reshaped the market balance. Early expectations indicate potential price strength ahead, with projections of smaller crops from both the U.S. and Mexico. However, uncertainty remains around the new harvest and the global trade environment.

Source: Mintec/Expana