Brazilian grape exports to the United States fell sharply in the third quarter of 2025, down 70% compared to the same period last year, according to the Center for Advanced Studies in Applied Economics (Cepea). Export revenue also declined by 22%.

In total, Brazil exported 6,800 tonnes of grapes during the quarter. Shipments to the U.S. represented only 4% of total exports, one of the lowest shares recorded in Comex Stat's historical data. In the same period of 2024, the U.S. received 38% of all Brazilian grape exports.

The downturn follows a tariff increase imposed by the U.S. government two months earlier. It compounds an already weakened trend; grape exports had dropped 24% in 2024, with 58,900 tonnes shipped that year. Between January and September 2025, exports totaled 19,300 tonnes, representing about one-third of last year's total volume.

"The impact of the tariff hike was significant for the grape sector, especially for producers who depend on the U.S. market. But Brazilian agribusiness has a record of resilience. This is a time for restructuring, seeking new destinations, strengthening partnerships with countries that value the quality of Brazilian grapes, and investing in differentiation to reduce dependence on a few markets," said Ascenza Brasil's country director, Renato Francischelli.

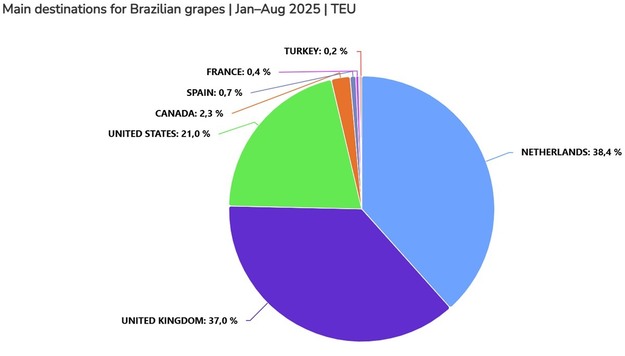

The São Francisco Valley, spanning Pernambuco and Bahia, remains Brazil's main table-grape-producing region. Cepea reported that the U.S. market is particularly important for premium varieties. With reduced U.S. demand, exporters redirected shipments to alternative destinations. Argentina absorbed over 50% of the quarter's volume, becoming the main market, while the United Kingdom and the Netherlands continued serving as entry points for European trade.

Latin American countries also expanded their share, though exports to these destinations occurred at lower average prices. Cepea noted that while these redirections helped prevent oversupply in the domestic market, they did not compensate for the revenue losses caused by reduced U.S. trade.

The average export price dropped from US$3.00 to US$2.40 per kilo in the third quarter, reflecting weaker competitiveness compared to Chile, Mexico, and Peru.

Domestically, between August and October 2025, grape supply remained under control, with stable prices supported by steady demand and the offseason in other producing regions.

Francischelli noted potential in developing markets. "There are important opportunities in Asia and the Middle East, markets that are expanding their consumption of fresh fruit," he said. He added that strengthening logistics and obtaining international certifications could help open new trade routes and stabilize exports.

Source: DatamarNews