JSE-listed KAL Group has stated that new U.S. tariffs may create challenges for niche agricultural sectors, but are unlikely to significantly affect South Africa's overall agricultural recovery. Instead, they could accelerate diversification into other markets.

KAL Group CEO Sean Walsh said global trade flows are shifting in ways that may benefit South African producers. "The disruption is accelerating a shift towards new opportunities. Trade flows are starting to realign, and long-planned diversification into Asia, Africa, and Europe is gaining momentum, supported by better logistics and stronger trade partnerships," he said.

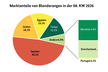

Walsh noted that while the U.S. is an important overall trading partner, it is not dominant in agriculture. "This is supported by trade data from a recent Agbiz research report, which shows that in the first quarter of 2025, SADC markets accounted for roughly 39% of South Africa's agricultural exports, followed by the European Union with around 25%. Other major destinations include the United Kingdom, China, and regional African markets (SACU). The United States accounted for only 4-6.5% of total agricultural exports over recent years."

South Africa's citrus industry has been central to the tariff debate, but it is on track for a record 2025 season. "Data suggests that around 4% of South Africa's citrus exports were destined for the U.S. in 2024, amounting to 6.58 million cartons. Within the U.S. market for Southern Hemisphere citrus, South Africa held a share of about 13.9%, behind Chile, Peru, and Argentina." Walsh added that most shipments were completed before the 30% tariff took effect. Production in 2025 is forecast at 180 million 15kg cartons, compared to 164.6 million cartons in 2024.

Walsh said the real effects of tariffs will likely be felt from 2026. "Importers will naturally compare tariffs across suppliers, and while some South American and EU competitors may look more attractive in the U.S., that creates openings for South Africa in other markets currently served by those suppliers."

He added that diversification into Asia, Africa, and Europe is advancing. "Asia represents a rapidly expanding opportunity. Citrus exports to Vietnam, avocados to China, Japan, and India, and premium wine to Asian markets, combined with logistics upgrades, are already reshaping South Africa's trade profile."

Wandile Sihlobo, chief economist of the Agricultural Business Chamber of South Africa (Agbiz), said the EU accounted for 22% of agricultural exports in the second quarter of 2025. "Citrus, apples and pears, dates, pineapples, avocados, guavas, mangos, wine, grapes, and nuts were amongst the primary agricultural products South Africa exported to the EU," he said. The Americas accounted for 7%, with citrus, juices, wine, nuts, apricots, apples, pears, and grapes the main exports.

Sihlobo added that although the U.S. share is around 4%, it remains important for specific industries directly linked to that market.

Source: IOL