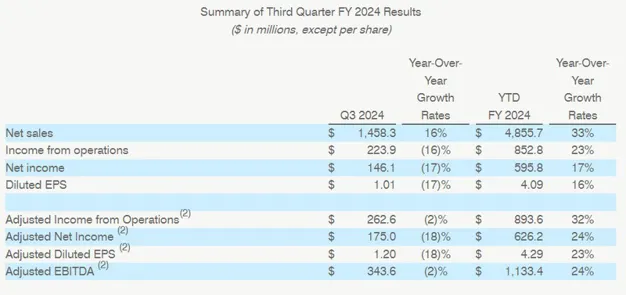

Lamb Weston Holdings, Inc. has announced its results for the third quarter of fiscal 2024 and updated its full year earnings targets for fiscal 2024.

"The transition to a new enterprise resource planning (ERP) system in North America negatively impacted our financial results in the quarter by more than we expected," said Tom Werner, President and CEO. "The ERP transition temporarily reduced the visibility of finished goods inventories located at distribution centers, which affected our ability to fill customer orders. In turn, this pressured sales volume and margin performance. While we are disappointed with the magnitude of the ERP transition's effect on the quarter, after implementing systems adjustments and modifying processes, we believe the impact is behind us as our order fulfillment rates have normalized."

"As a result of the ERP transition's impact and soft near-term restaurant traffic trends, we have reduced our annual sales and earnings guidance for the year. We remain confident in the underlying performance of the business, the health of the global frozen potato category and our ability to deliver sustainable, profitable growth over the long term."

Q3 results of operations

Net sales increased $204.7 million to $1,458.3 million, up 16 percent versus the prior year quarter, with the current year quarter including $356.7 million of incremental sales attributable to the consolidation of the financial results of Lamb-Weston/Meijer v.o.f., the Company's former joint venture in Europe, following the completion of the Company's acquisition in February 2023 of the remaining interest in LW EMEA.

Net sales, excluding the incremental sales attributable to the LW EMEA Acquisition, were down $152.0 million, or 12 percent versus the prior year quarter, with approximately $135 million of the decline attributable to the ERP transition. Volume declined 16 percent, with approximately 8 percentage points of the decline related to unfilled customer orders resulting from the Company's transition to a new ERP system in North America. The other half of the volume decline largely reflects soft restaurant traffic trends in North America and other key international markets, as well as the carryover effect of the Company's decision to exit certain lower-priced and lower-margin business in the prior year to strategically manage customer and product mix.

Gross profit increased $5.9 million versus the prior year quarter to $403.7 million, and included a $23.3 million ($17.3 million after-tax, or $0.12 per share) unrealized loss related to mark-to-market adjustments associated with commodity hedging contracts. The prior year quarter included a $5.1 million ($3.8 million after-tax, or $0.03 per share impact) unrealized loss related to mark-to-market adjustments associated with commodity hedging contracts.

For more information:

Shelby Stoolman

Lamb Weston Holdings, Inc.

Tel.: +1 208-424-5461

Email: shelby.stoolman@lambweston.com