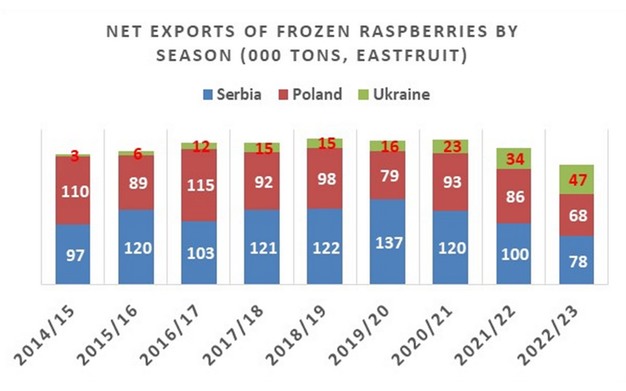

According to EastFruit analysts, Ukraine has recently taken a huge step towards becoming the world leader in exports of frozen raspberries, which is amazing as it is happening despite the Russian aggression in Ukraine. Over the past five seasons, the volume of frozen raspberry exports from Ukraine has grown by 3.1 times. During the same period, the global leader Serbia reduced its net exports of frozen raspberries by 35%, and Poland by 26%. Basically, each year Ukraine has been boosting exports by 40-45%, taking part of the market share away from Poland and Serbia.

“Ten years ago, Ukraine exported hardly any frozen raspberries. In Europe and worldwide, there were essentially two countries that dominated the market – Serbia and Poland. Ukraine accounted for less than 1% of what Serbia and Poland exported, basically having no impact on the market. However, in 2018, Ukraine got noticed, even though its export volumes were not comparable to those of the leaders – only about 5% of their total volume. However, at the end of the 2022/23 season, raspberry exports from Ukraine exceeded 50% of what Serbia exported and 43% of Poland’s total frozen raspberry exports. I emphasize the word ‘total’ because nearly 37% of raspberry exports from Poland were re-exports, predominantly of Ukrainian raspberries. Therefore, if we consider net exports, Ukraine has come quite close to Poland in terms of export volume,” says Andriy Yarmak, an economist at the Food and Agriculture Organization (FAO) Investment Centre.

He notes that these figures also include exports of frozen blackberries, but its volume is relatively small. Also, according to Andriy Yarmak, Serbia, like Poland, trying to maintain its position in the global frozen raspberry market, also increased imports of this berry from other countries, including from Ukraine, for further re-exports. True, the rate of increase in Serbia’s raspberry imports was lower than that of Poland and re-exports accounted for only about 13% of all external sales. At the same time, Ukraine did not import frozen raspberries at all.

As we can see in the graph, net exports of raspberries from Serbia have been declining for three seasons in a row, and from Poland – for four seasons in a row. At the same time, raspberry exports from Ukraine are growing every year, even in years when prices are not too high, and demand remains weak.

For more information: east-fruit.com