In 2022, the organically farmed area in Germany continued to grow, increasing by 11.26 percent to a total of 1,869,227 ha. The number of producers and processing partners who are members of the associations (Naturland, Bioland, Demeter, to name but a few) is steadily growing. Sixty-four percent of the organic area is cultivated by producers who are members of one of the associations.

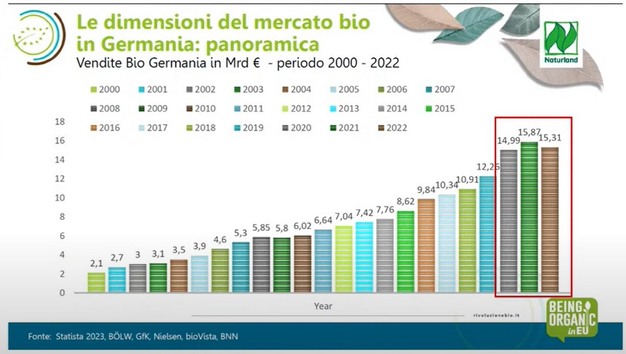

"The organic market in Germany has shown a more or less constant growth in sales from 2000 to 2021. The only exception was 2008-2009," said Massimo Valerio (pictured above), processing and trade area of Naturland (which works with FederBio at a European scale) during the second Bio Revolution session at Sana 2023.

"In 2022, German consumers purchased organic food and beverages valued at 15.3 billion euros. This number represents a decrease of 3.5 percent compared to the previous year."

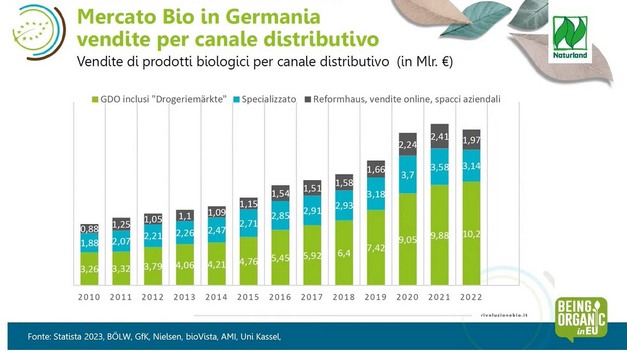

Sales by distribution channel

According to the data presented by Massimo Valerio, the large retail sector, including drugstores and discount retailers, recorded 10.2 billion euros in 2022, up from 9.88 billion in 2021 and 9.05 billion in 2020. The range of organic products offered by discount stores has increased significantly.

The specialized channel, with €3.14bn, is the most problematic, not only because of the decrease compared to 2021 (€3.58bn), but also because of the decrease compared to 2020 (€3.7bn).

"On the other hand, with 1.97 billion euros compared to the previous year, we are recording the largest loss in the sector represented by Reformhaus, online sales, company-owned stores and local stores. However, it is also true that this value should be considered in view of the abnormal growth, caused by the pandemic, between 2020 and 2021," emphasized Massimo Valerio.

The distributor’s brand is back on the rise, after a slight decline in 2021, with a 40.2 percent share, at the expense of the producer’s brand. As Valerio Massimo pointed out, "During 2022, organic products on average recorded more stable consumer prices and smaller increases compared to more conventional references. This is also a common fact in other countries and should be brought to the attention of the consumer. In terms of both volumes of marketed product and sales, they showed declines in almost all categories."

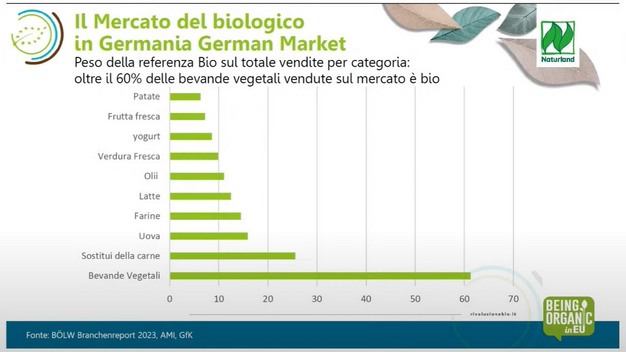

"More than 60 percent of plant-based beverages sold on the German market are organic. This is the most striking data, but also plant-based meat is showing positive results. All traditional products, including fresh fruits and vegetables and potatoes, saw quotas in line with previous years data."

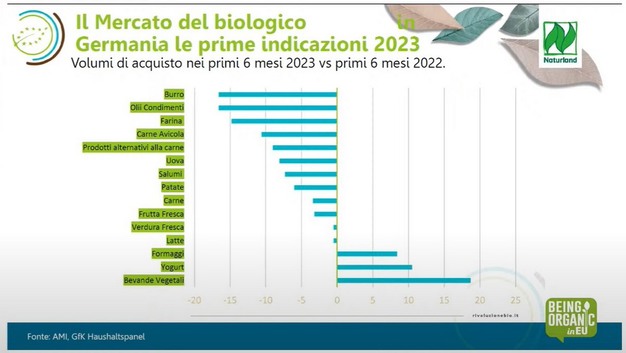

Comparison between the first 6 months of 2023 and 2022

"In terms of purchase volumes, the trend in vegetable beverages remains positive, and there is a significant increase in value in the cheese and yogurt categories, despite increases in consumer prices."

"Talking about purchased quantities, fresh fruits, vegetables and potatoes were also showing negative values in the first 6 months of 2023," concluded Valerio Massimo. "However, in this case, it is important to note that these products belong to the categories that have experienced substantial growth during the pandemic or that have faced market situations caused by the increase in the cost or unavailability of raw materials."