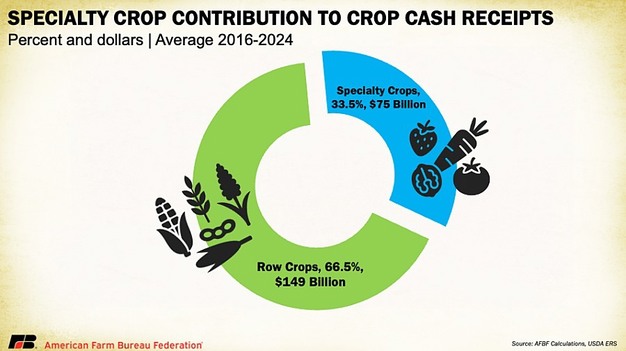

Specialty crop farmers in the United States face growing financial pressures in 2025 as production expenses continue to outpace prices and trade uncertainties add further risk. Despite contributing more than US$75 billion in farm-gate value, specialty crop producers have fewer safety-net options than row crop growers.

© American Farm Bureau Federation

© American Farm Bureau Federation

Specialty crops include more than 350 commodities and account for one-fifth of U.S. agricultural cash receipts across 220,000 farms. The diversity of crops increases exposure to weather, pests, regulatory requirements, and perishable supply chains. Many crops lack price transparency, making hedging difficult. Imports of fruits, vegetables, and nuts add further pressure, while limited access to insurance or futures markets leaves growers exposed.

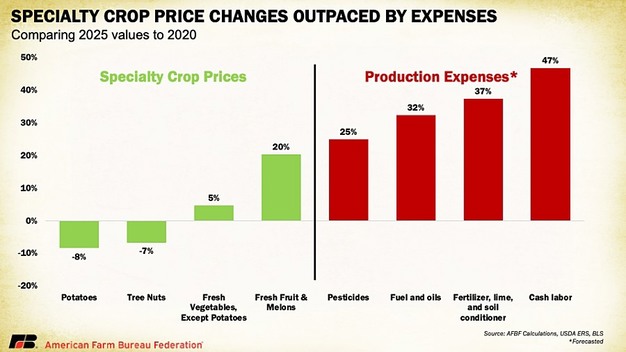

Between 2020 and 2025, producer price indices show potato prices declined by 8% and tree nuts by 7%. Fresh vegetables rose only 5% and fruit and melons by 20%. Over the same period, pesticide costs increased by 25%, fuel by 31%, fertilizer by 37% and labor by nearly 50%. USDA data show specialty crop farms averaged more than US$466,000 in cash expenses in 2023, up 47% from 2021.

Several commodities illustrate these challenges. Almonds generated US$5.6 billion in 2024, but average prices declined to US$1.81 per pound, down from US$3.05 in 2014–2018. UC studies show net returns shifted from a gain of US$205 per acre in 2019 to a US$4,280 loss in 2024. About 66,000 acres of orchards were removed as growers exited production. Walnut growers faced costs near US$8,000 per acre against revenues of about US$3,000, creating losses of more than US$5,000 per acre.

© American Farm Bureau Federation

© American Farm Bureau Federation

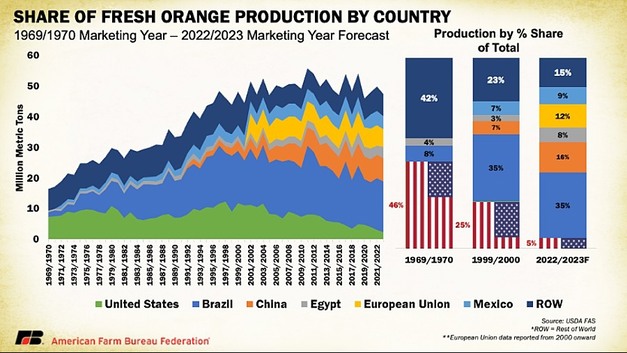

Apples also show losses. Washington State University budgets for Honeycrisp indicated net losses of roughly US$12,000 per acre, with returns of about US$38,000 against costs exceeding US$50,000. Blueberry producers reported expenses above US$10,400 per acre, with management income of just US$240. UC Davis studies put strawberry costs at US$113,000 per acre, with projected losses of more than US$14,000. Citrus production costs rose from US$1,555 per acre in 2005 to US$4,215 in 2025.

Vegetable growers also report challenges. Romaine lettuce prices in 2025 dropped to US$14.55 per carton, while per-acre costs remained near US$17,000. Florida tomato growers face costs around US$37,000 per hectare (about US$15,000 per acre), with growers receiving only a third of the retail price.

© American Farm Bureau Federation

© American Farm Bureau Federation

The Federal Crop Insurance Program provides limited coverage for specialty crops. More than 43% of fruit and nut acreage and 47% of vegetable and melon acreage remain uninsured. Specialty crops are largely excluded from Title I programs, leaving them outside farm bill safety nets. USDA relief programs have also been delayed for these growers due to limited standardized data.

© American Farm Bureau FederationFor more information:

© American Farm Bureau FederationFor more information:

American Farm Bureau Federation

Tel: +1 202 406 3600

Email: [email protected]

www.fb.org