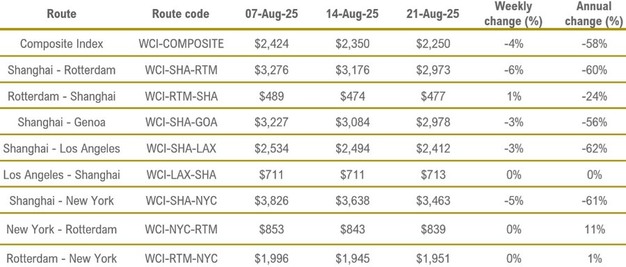

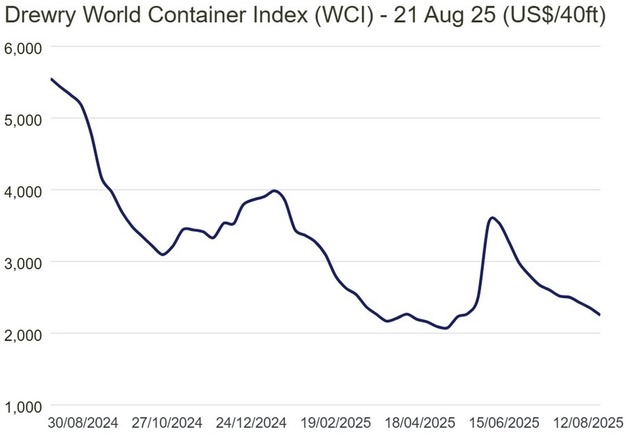

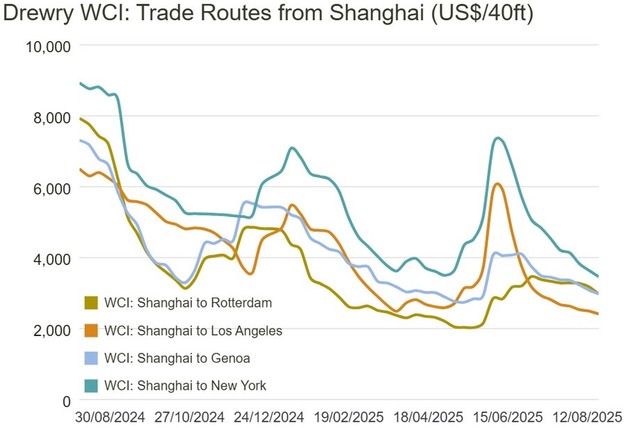

Drewry's World Container Index (WCI) declined for the tenth consecutive week, continuing to stabilize after a volatile period. The instability began after US tariffs were announced in April, which caused rates to surge from May through early June. This was followed by a sharp decline until mid-July, after which the downward trend slowed.

© Drewry

© Drewry

On the transpacific, spot rates decreased this week. Shanghai–Los Angeles fell 3% to US$2,412/feu, while Shanghai–New York dropped 5% to US$3,463/feu. The phase of accelerated purchasing by US retailers, which created an early peak season, has ended. With a slowing US economy and higher tariff costs, retailers are now scaling back procurement. Drewry expects spot rates on these lanes to be less volatile in the coming weeks.

© Drewry

© Drewry

Asia–Europe spot rates also fell. Shanghai–Rotterdam declined 6% to US$2,973/feu, while Shanghai–Genoa dropped 3% to US$2,978/feu. Despite firm demand and port delays in Europe, surplus vessel capacity continues to push down spot rates. Drewry expects further decreases in the coming weeks.

Looking ahead, Drewry's Container Forecaster projects that the supply-demand balance will weaken again in the second half of 2025, which will lead to further spot rate contraction. The extent and timing of rate changes will depend on future US tariff measures and on capacity adjustments linked to possible penalties on Chinese ships, both of which remain uncertain.

© DrewryFor more information:

© DrewryFor more information:

Drewry

Tel: +44 (0)207 538 0191

Email: [email protected]

www.drewry.co.uk